TOGETHER WITH

Howdy Fam,

Today, we’re looking at a few upstream moves, the kind that turn into dealership opportunities or dealership obligations.

But if anyone can turn lemons into something the whole community can use, it’s dealers.

We made a whole show proving it, and Season 2 is coming soon.

Watch More than Cars: The Truth about Car Dealers season 1 on Tubi, Amazon Prime, or YouTube.

Keep Pushing Back,

-Chris with Paul, Kyle & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 5 min and 07 sec

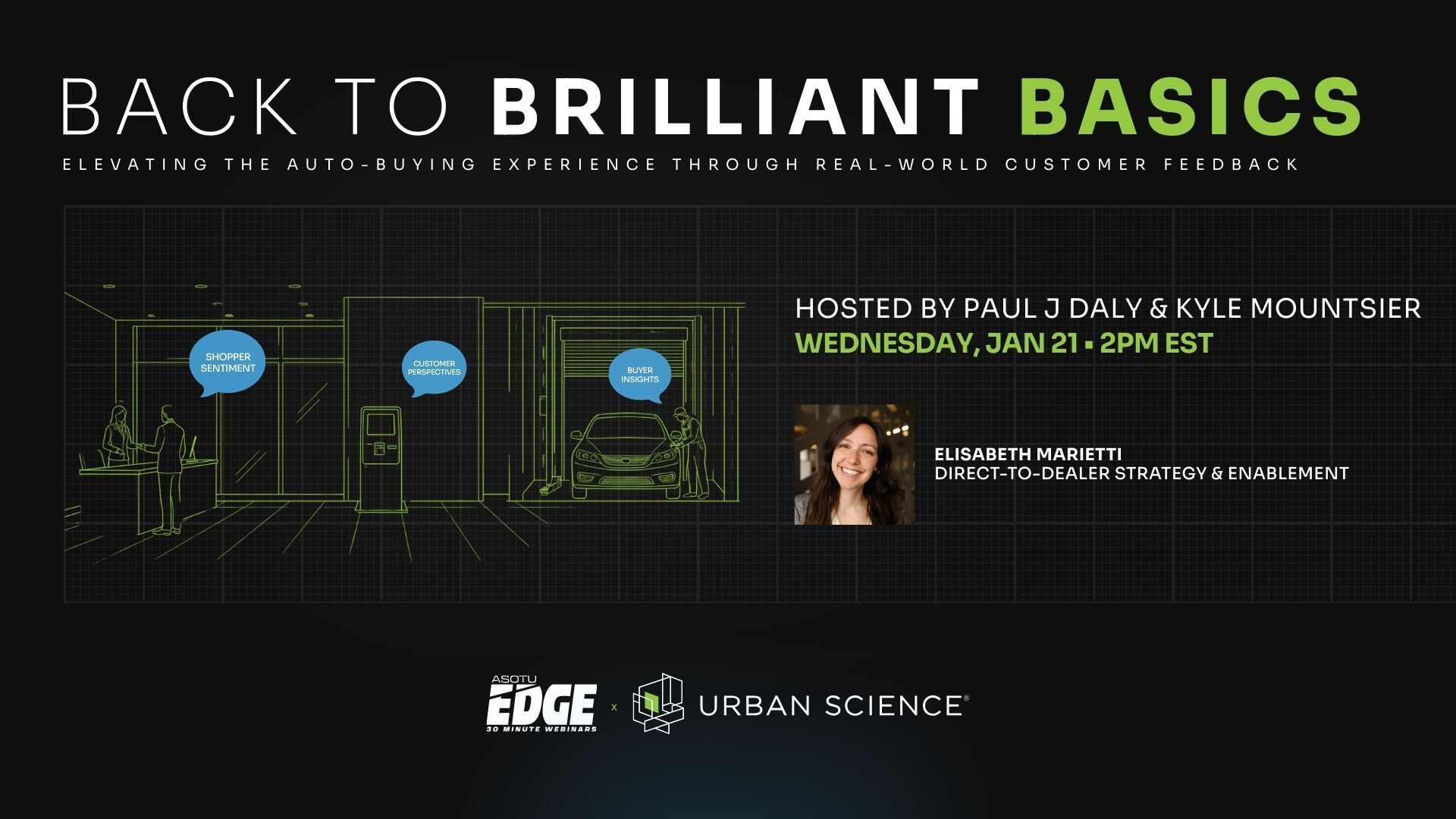

Real Feedback Leads to Real Fixes

On January 21st, find out what your walkaways were really thinking.

Back to Brilliant Basics is our upcoming webinar with Elisabeth Marietti of Urban Science who will introduce us to their latest enhancement to SalesAlert. This new defection survey captures direct feedback from customers who went elsewhere.

You’ll get clarity into the exact points where the experience broke down, from sales conversations to website performance to in-store interactions.

Save your seat to get closer to the insights you’ve been missing.

THE NEWS

Today’s picks give us the clearest three-angle read on the business.

Used cars show what customers are actually doing right now. Manufacturing tells us what’s shifting underneath pricing and supply. And the OEM pivots to storage, software, and Level 3 show where revenue is heading next.

Put together, it’s the most useful thread to pull today.

Used Market Starts 2026 With Unexpected Momentum

giphy

Cox Automotive says retail used-vehicle sales hit 1.34 million in December, up 3% year over year and 2% month over month, even though December usually cools off. Days’ supply landed at 49, basically flat year over year.

Cox’s takeaway is the part to underline

2025 beat expectations, but 2026 could soften modestly as economic pressure and constrained supply from prior lower production continue to weigh on the market.

Therefore, the near-term opportunity is timing, because Cox also flags Q1 as a potential bright spot if tax refunds come in stronger than expected and keep shoppers active.

Manufacturing Looks “Up,” But The Auto Signal Is Still Mixed

giphy

Meanwhile, zooming out to the macro picture, Reuters reports U.S. manufacturing production rose 0.2% in December, helped by a surge in primary metals that offset a fourth straight monthly decline in motor vehicle output.

Input costs and parts availability can move even when vehicle assembly is not accelerating.

So it makes sense that executives and economists are still talking about tariff uncertainty and fragile business confidence, because the story is less “manufacturing is back,” and more “specific categories are carrying the totals.”

In other words, the average goes up even if some things go down.

Automakers Hunt New Revenue Streams Beyond Straight EV Growth

giphy

That sets up the OEM pivot.

CNBC laid out how Ford and GM are pushing into energy storage to repurpose battery investments as EV demand cools.

At the same time, Automotive News says the autonomy conversation is shifting from robotaxi hype to Level 3 eyes-off systems aimed at subscription revenue, with Ford and GM targeting 2028 launches.

Automakers want recurring revenue that is less dependent on the monthly retail EV mix. Dealers should expect more “attach” conversations, subscriptions, service plans, home energy tie-ins, and new training requirements as these offerings get productized.

What To Do This Week: Message, Mix, and Incentives

giphy

Now bring it back to the showroom. This report highlights multiple brands setting U.S. sales records in 2025, with luxury and trucks doing a lot of the heavy lifting, while Car and Driver’s sales rundown reinforces that pickups and SUVs still dominate the bestseller list.

Meanwhile, incentives are getting more tactical: Electrek notes $5,000 customer cash on the Chevy Equinox EV, but competitive lease math still matters because rivals can undercut the payment even when the range story is strong.

So it makes sense that the best near-term play is a two-track narrative: lead with used and CPO value while the supply picture stays tight, and keep EV offers simple and comparable on payments, not just rebates, especially as shoppers stay cautious and rate-sensitive.

So, be ready. If customers hear “manufacturing is weird” it may translate to “there are no more cars.” And if they hear “automakers want to sell subscriptions” they may believe “dealers want to upsell me a house battery.”

It’s a confusing time. Clarity is kindness.

AROUND THE ASOTU-VERSE

Dealer Conferences and Industry Events (2026)

January 22: Public Policy Day, D.C. Auto Show, DC

February 3-6: NADA Show 2026, Las Vegas, NV (Looking for a party?)

May 12-15: ASOTU CON 2026, Hanover, MD

Quick Hits from the Automotive State of the Union

🛒 Retail: Paul and Kyle’s read: Honda’s wider H is not a cosmetic tweak; it is a dealership-level alignment move. One mark across ICE, hybrid, EV, and motorsports makes the in-store story easier to tell and harder to dilute.

💾 Tech: Their execution takeaway from Tesla: the refinery is the headline, but the method is the lesson. Design, studies, and build running in parallel is how you compress timelines and control cost, not by waiting for perfect certainty.

☕ Economy: A note for managers: “job hugging” is not disengagement; it is caution. Treat stability as earned, not assumed. Invest in upskilling, clearer paths, and local innovation, so your best people do not become quietly available later.

Today in History: January 19

1937: Howard Hughes flew the Hughes H-1 Racer nonstop from Los Angeles to Newark, New Jersey, covering about 2,490 miles in 7:28:25 and averaging roughly 332 mph.

1954: General Motors announced a $1 billion investment to expand its auto operations across brands like Chevrolet, Buick, and Cadillac, fueling growth and helping inspire enduring models such as the Tri-Five Chevrolets.

1978: The last VW Beetle (Type 1) rolled off a German assembly line. Beetle production continued abroad until July 30, 2003, when the final car left Puebla, Mexico.

Happy Monday, Friend. If you see something cool out and about, send it my way. I’ll write about it, or at least send you a GIF.