TOGETHER WITH

Howdy Fam!

Dealers are the only people we know who give away more cars than that Oprah GIF.

Before we get into today’s news, I wanted to share an interesting dealer collaboration.

The folks at Bannister Chevrolet and Kia Penticton are putting a car on the line to support local food security programs. Each ticket sold is a chance to get the keys to a new ride, with ticket sales going to the charities.

We love stories like this. They’re one of the unique perks of working in an industry that truly loves people more than it loves cars.

We’ll be watching how this one plays out and will report back once there’s a winner and a total to share.

Keep Pushing Back,

-Chris with Paul, Kyle & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 5 min and 11 sec

Customer Experience is Key

In our upcoming ASOTU Edge webinar, we’re chatting with Elisabeth Marietti about updates to Urban Science’s SalesAlert, a defection survey designed to capture direct customer feedback from buyers who ultimately chose to purchase elsewhere.

This new survey capability, developed in collaboration with dealer advisory board members, provides that missing context by gathering feedback on key aspects of the experience, including sales approach, website usability and fundamental service touch-points.

Join us on Wednesday, January 21st at 2pm EST to discover how this tool delivers successful sales coaching, customer experience improvements and performance tracking.

THE NEWS

Alright, here’s what’s on the radar for dealers today: flexibility is the strategy, credit is the hinge, and inventory discipline is the edge.

Toyota: Flexibility, Not One Big Bet

giphy

Toyota is getting a little meta with it.

Dealer leadership is reframing affordability as value. Toyota National Dealer Advisory Council chair George Haddad says the 2026 goal is not to chase the lowest sticker, but to keep offering vehicles that fit customers’ real-world needs.

You can see that thinking in Toyota’s product posture. The brand stayed committed to sedans like Corolla and Camry while plenty of competitors walked away from the segment. That gives dealers dependable, accessible options for first-time buyers and payment-sensitive shoppers.

Then there’s the truck proof point.

Toyota’s own 2025 sales release called out the redesigned Tacoma as a key driver of momentum. Industry coverage puts Tacoma at roughly 275,000 sales in 2025, a record.

The bet is flexibility. Gas, hybrid, EV, sedans, trucks. Toyota is positioning for a fragmented market, not a single clean trend line.

Auto Market Snapshot: The Credit Valve Is Opening

giphy

If Toyota’s betting on flexibility, credit is the hinge that makes that bet realistic. The latest Dealertrack read says financing got meaningfully easier in December, even if buyers are still doing some gymnastics to make payments pencil.

Cox’s Dealertrack Credit Availability Index rose to 99.6, the strongest level since October 2022. The biggest headline: approvals improved, and pricing on loans eased a touch, which helps explain why transactions keep moving even with new-vehicle prices still sitting high.

What improved in December

Credit availability: 99.6 (best since Oct 2022)

Approval rate: 73.7%, up month over month

Average contract rate: 10.3% (down modestly)

What’s still telling the affordability story

72+ month terms: 27.3% of loans

Negative equity: 52.9% of borrowers

Lenders are opening the gate wider, but a lot of customers are still stretching to reach their monthly payments.

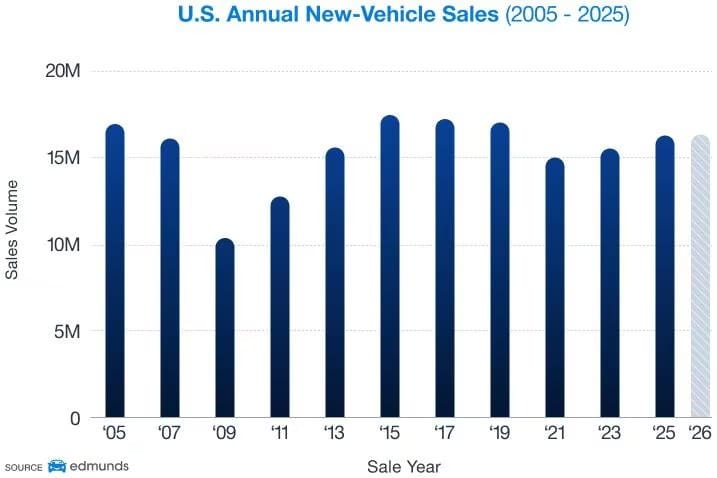

See also: Cox’s weekly summary shows December sales rose 13.8% vs. November but finished 2.3% below last year, with SAAR at 16.0M and fleet share up to 17.2%, while ATP pushed above $50K and incentives climbed to 7.5%.

Edmunds: A Market That’s Splitting Instead of Stalling

This is why the conversation is shifting from “can people afford cars” to “which people are buying which cars.”

December projection from Edmunds shows the U.S. market to hold near 16M new-vehicle sales in 2026, with affordability continuing to sort buyers into different lanes and off-lease supply helping used availability.

One useful note that fits this thread.

According to Fortune, early January consumer-sentiment readings ticked up slightly overall, but economists are still flagging job-market concerns and uneven confidence.

The market isn’t frozen. It’s sorting itself. And strategy matters more when buyers diverge.

Lexus: Inventory Discipline Turns Chaos Into Confidence

giphy

If Edmunds is right about the split, Lexus is a clean example of what disciplined operations can do inside an uneven market.

Lexus dealer council chair John Iacono told Auto News that tight inventory has been a strategic advantage, not a constraint. Low days’ supply reduces carrying costs, protects margin, and keeps the transaction cleaner because dealers are not forced into constant discounting.

This aligns with what inventory management folks have been saying for months.

Success is increasingly about managing turn rate, pricing precision, and mix. One industry benchmark cited recently put average used days-to-turn around 37 days in late October.

In a selective market, Lexus is basically saying: stay disciplined on supply, stay clear with the customer, and you can keep the experience calm even when the macro picture is not.

AROUND THE ASOTU-VERSE

Dealer Conferences and Industry Events (2026)

January 22: Public Policy Day, D.C. Auto Show, DC

February 3-6: NADA Show 2026, Las Vegas, NV (Looking for a party?)

May 12-15: ASOTU CON 2026, Hanover, MD

Quick Hits

🛒 Retail: Everyone’s least favorite Easter candy is getting a new flavor line-up for 2026.

🌔 Space: A company called GRU Space has announced its intent to construct a hotel on the Moon.

🧪 Science: Ravioli ravioli, LabCoatz cracked the formuoli. A YouTuber claims to have successfully replicated Coca-Cola’s secret recipe.

Today in History: January 14

1690: The clarinet is invented in Nuremberg, Germany. 🎶

1914: Henry Ford opened his assembly-line Model-T factory. 🏭

1954: The Hudson Motor Car Company merged with Nash-Kelvinator Corporation forming the American Motors Corporation. 🤝

Thanks for reading, Friend. We check this poll each day to guide our writing, so please let us know.