Stock market volatility continues as Trump’s tariff announcement and Nvidia’s earnings shake up investor sentiment. Meanwhile, economic data suggests a shift in consumer confidence.

Tariffs Incoming: A 25% tariff on Canada and Mexico takes effect March 4, while China faces an additional 10% levy. If trade costs rise, vehicle pricing and supply chains could feel the impact.

Consumer Concerns: Jobless claims jumped to 242K, adding to a string of weaker economic reports, including soft retail sales and declining consumer confidence—factors that could influence buyer behavior in showrooms.

Nvidia’s Dip: AI-driven optimism took a hit as Nvidia’s earnings raised concerns about future growth. While not directly tied to auto, dealership technology investments—especially AI-driven tools—may be influenced by broader tech market trends.

The return of Trump’s proposed tariffs could send shockwaves through the industry, raising prices, disrupting supply chains, and squeezing the dealers caught in the middle. Unlike his first term, when similar tariffs were floated but never implemented, this time, there’s little indication of a pullback.

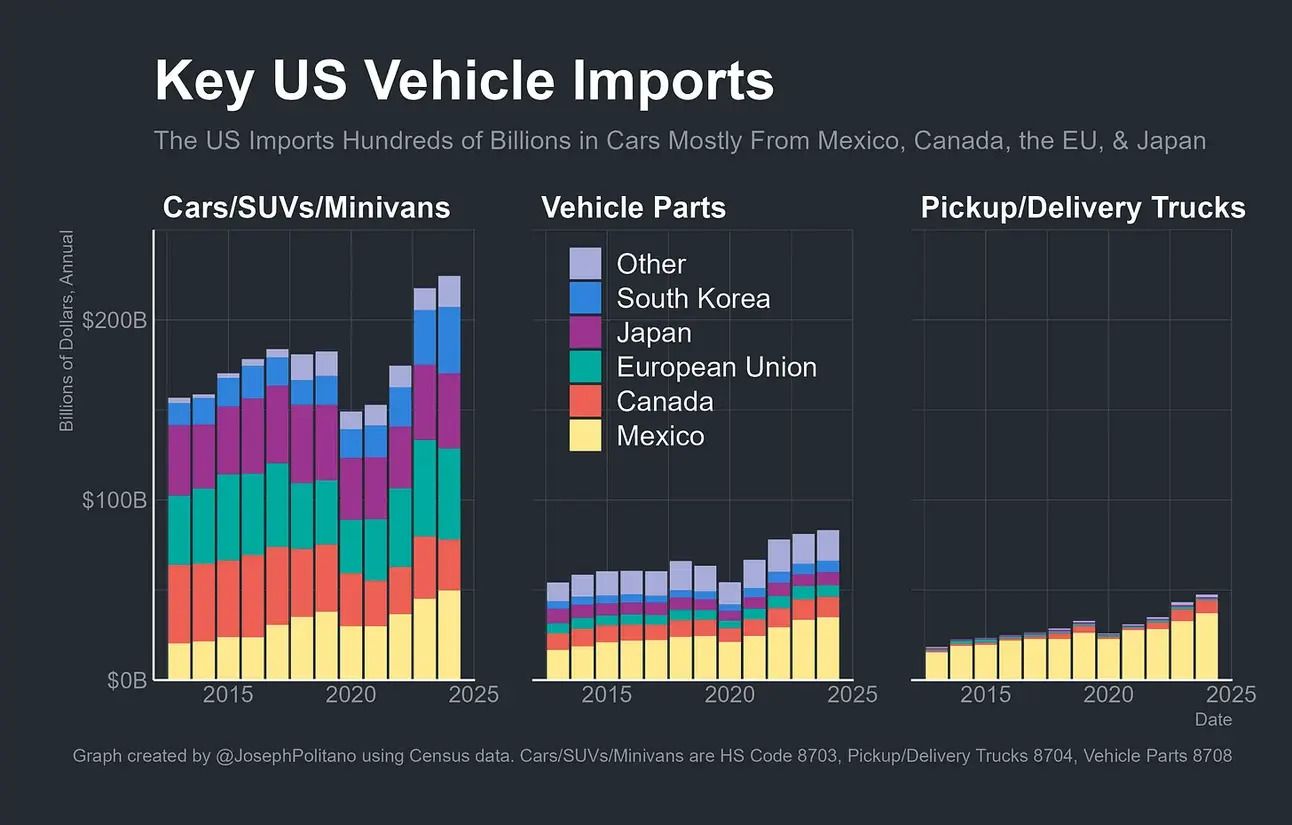

Major Supply Chain Disruptions: The U.S. auto market relies heavily on imports from Canada, Mexico, Japan, South Korea, and the EU. Parts and vehicles frequently cross borders multiple times before reaching consumers, meaning tariffs could significantly raise costs at every stage.

Dealers Brace for Higher Prices: With vehicle affordability already stretched, additional tariffs could make things even worse. Prices on new and used cars remain high, and U.S. vehicle manufacturing jobs have already declined by 30,000 in the past year.

No Easy Workarounds: Unlike tariffs on China, automakers have few alternative sourcing options. Most U.S. imports come from long-established trade partners, making it nearly impossible to shift production without massive cost increases.

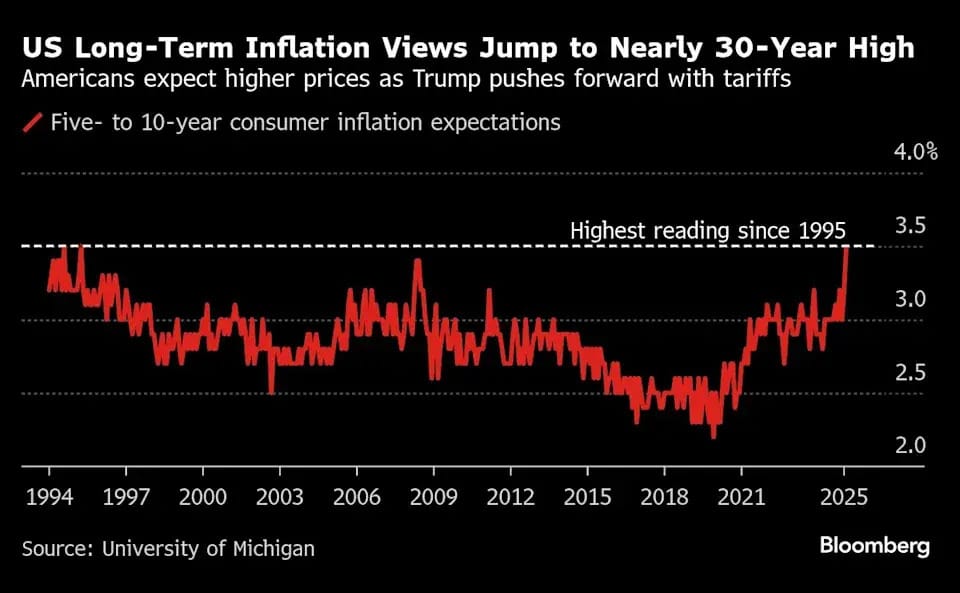

Rising costs across the board are keeping inflation stubbornly high, and the auto industry isn’t immune. Supply chain costs, wages, and tariffs are all adding pressure, which could influence pricing and consumer demand in the months ahead.

Higher Input Costs: Steel and other raw materials are climbing again, with manufacturers reporting the highest price pressures since 2022. Vehicle production costs could rise, impacting dealer pricing and margins.

Wage Pressures Return: Compensation is trending higher, adding cost burdens for suppliers, automakers, and dealerships managing payroll.

As inflation worries continue to grow, consumer confidence is taking a tumble. The latest data shows a sharp decline in consumer sentiment, with worries about inflation, tariffs, and job security looming.

Jobless Claims Jump: First-time unemployment claims rose by 22K mid-February, surpassing expectations and marking the highest level since late 2024.

Spending Pullback: Retail sales fell 0.9% in January, the biggest drop in a year.

Confidence Hits a Low: The Conference Board’s index fell to 98.3 from 105.3, well below expectations. A reading under 80 has historically signaled a recession risk.

Amid concerns about inflation and economic uncertainty, fears of rising tariffs are actually driving some consumers to buy now rather than later.

Buying Before the Hike: Consumers snapped up vehicles late last year, anticipating higher prices due to looming tariffs. That momentum is still carrying over, keeping demand steady.

Strategy Shift: Many retailers are adjusting pricing and inventory to capitalize on both tariff fears and tax refund season. Some are leaning into promotions and flexible financing to turn urgency into sales, while others are stocking up on in-demand models before potential cost increases hit.

After a sluggish January, new-vehicle sales have picked up in February, with the SAAR expected to hit 16.3M. That’s up from January’s 15.6M pace and marks the sixth straight month of YOY sales growth.

Volume Holds Steady: Sales are projected to reach 1.25M units this month, down just 0.3% from last year despite having one fewer selling day.

Cautious Optimism for 2025: The forecast calls for total new-vehicle sales to reach 16.3M this year.

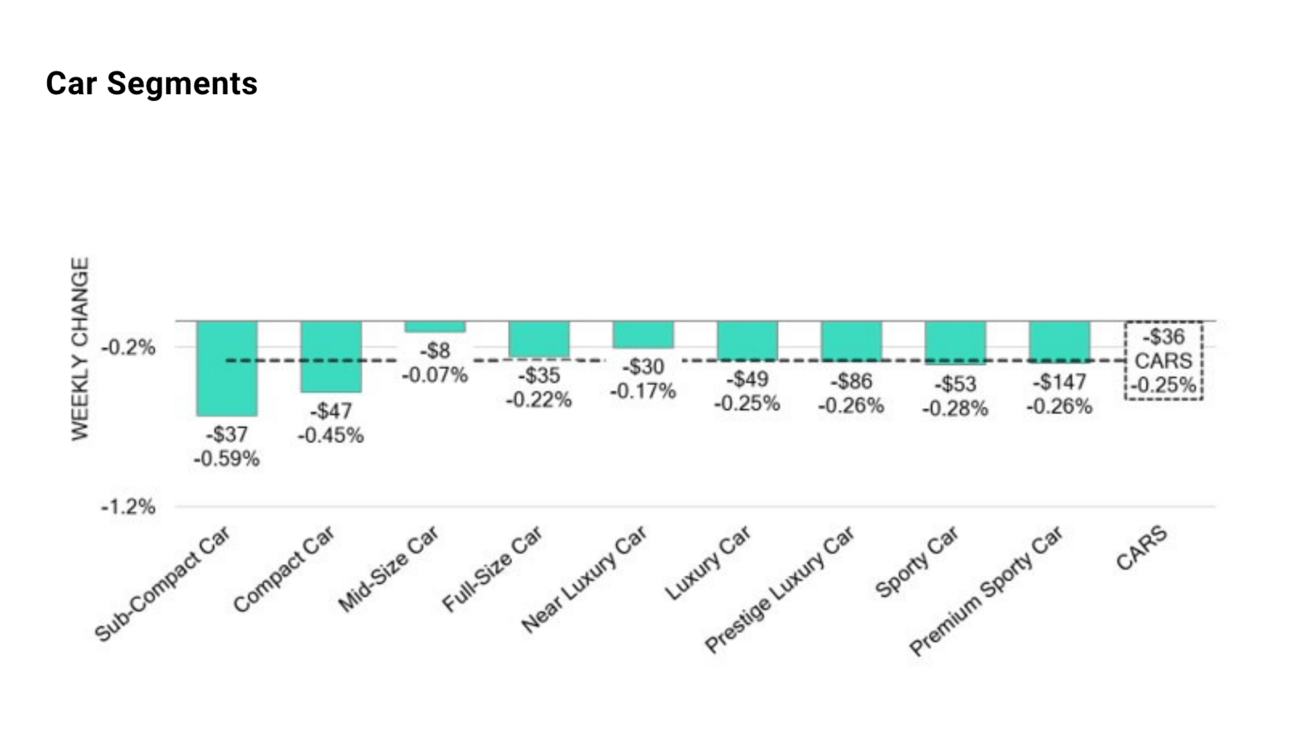

While used car prices continue their gradual decline, last week’s data suggests depreciation is easing across most segments. Sub-Compact Cars remain the exception, facing the steepest drops.

Car Values Stabilizing: Overall, the Car segment declined just 0.25% last week, a notable slowdown from the previous week’s 0.43% drop.

Newer Models Holding Value: 0-to-2-year-old cars saw only a slight dip of 0.02%, nearing positive territory—much earlier than last year’s rebound in mid-March.

Older Cars Face More Pressure: 8-to-16-year-old models declined 0.64%, reflecting ongoing depreciation in higher-mileage inventory.

Mid-Size Models Stand Out: Among newer used cars, Mid-Size vehicles posted the strongest performance, rising 0.51%.

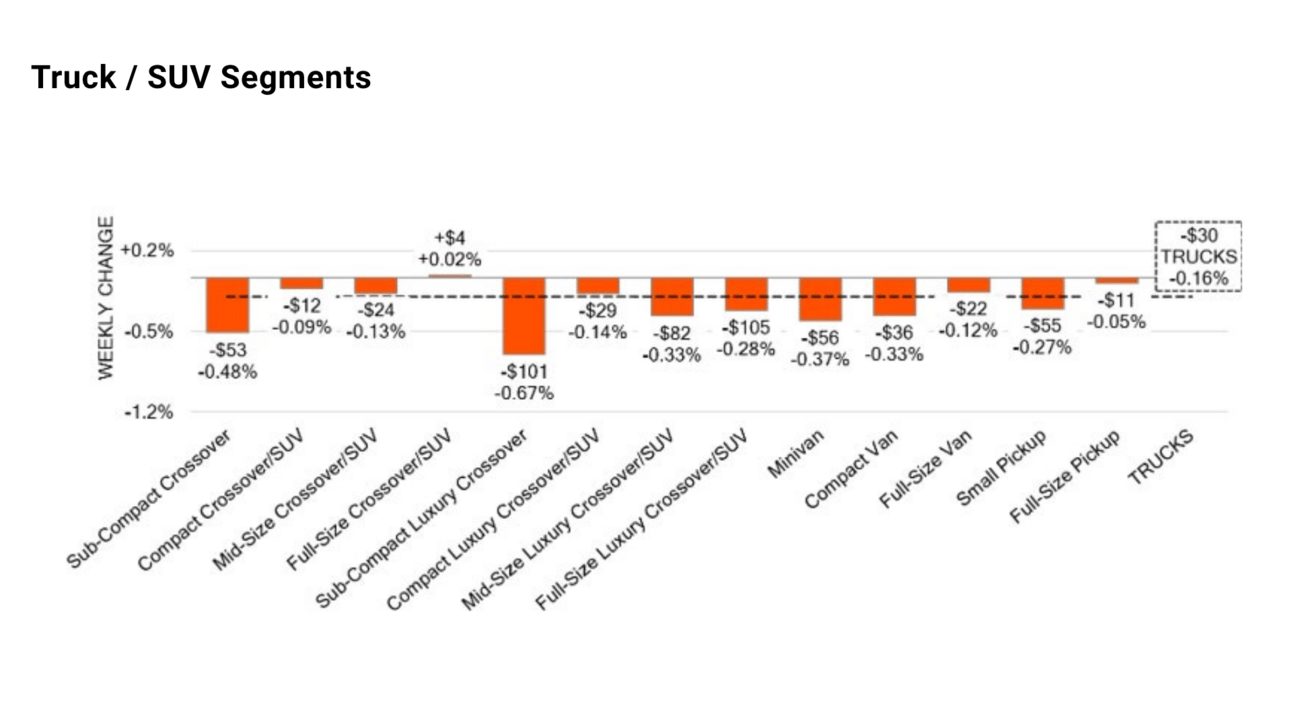

Used truck prices are also seeing depreciation slow, and a few segments are already showing signs of recovery.

Declines Ease Up: The overall Truck segment dipped just 0.16% last week, a softer drop than the previous week’s 0.29% decline.

Newer Models Holding Steady: 0-to-2-year-old trucks saw only a slight drop of 0.10%, while older 8-to-16-year-old models continued to face steeper declines, down 0.51%.

Signs of a Spring Rebound: Full-Size Crossovers moved into positive territory with a 0.02% gain—their first increase of the year, though later than last year’s February bounce.

Pickups Gaining Ground: Full-Size Pickups (0-to-2 years old) saw a modest 0.01% price bump, three weeks ahead of last year’s seasonal uptick.

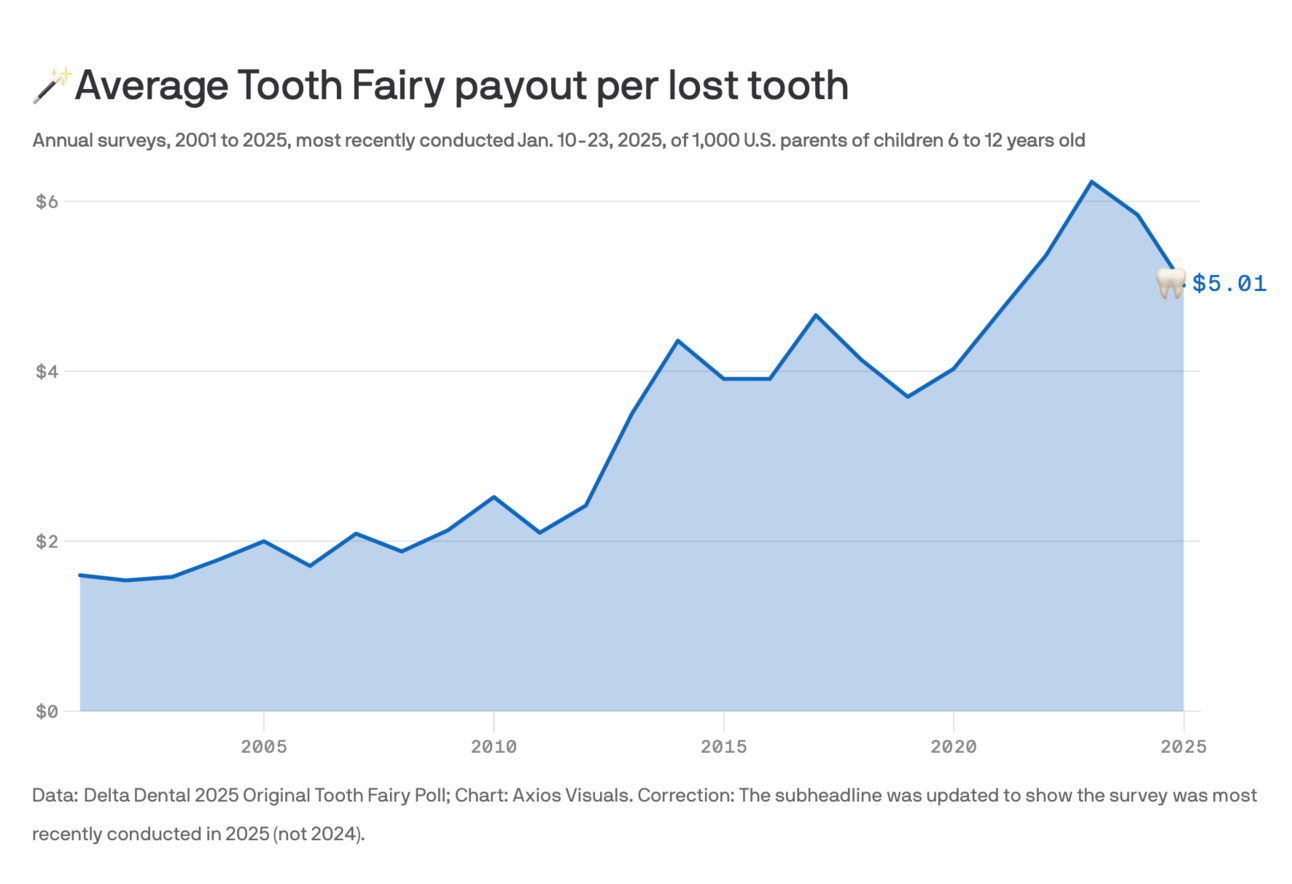

It seems even the Tooth Fairy is feeling the squeeze these days. Delta Dental’s latest survey reveals a harsh reality for kids across America—payouts for lost teeth have hit their lowest rate in years. With tooth futures down, consumer confidence is crumbling like a poorly flossed incisor as young Americans question their financial futures.

Panic at the Pillow: The going rate for a single tooth dropped 14% to $5.01, down from last year’s $5.84 and well below the 2023 peak of $6.23.

First Tooth Discount: Even the traditionally lucrative first tooth payout has suffered a 12% drop, sliding from $7.09 to $6.24—a brutal devaluation for young investors.

Regional Disparities: The South takes the crown at $5.71 per tooth, the only region where the Tooth Fairy raised wages. The Midwest, meanwhile, is in a dental recession, bottoming out at $3.46.