TOGETHER WITH

Good Morning, Friend!

We’ve got news to get to, but first, one of the best parts of this business: giving one away every now and then.

The Super Chevy Dealers of Baton Rouge teamed up with Our Lady of the Lake to surprise an exceptional member of their community with a new 2026 Chevrolet Equinox RS.

Michael King is a Vietnam veteran, a former Baton Rouge police officer, and four years into his battle with cancer. Thanks to people like the team at Super Chevy and GM, he’s got one less thing to worry about, and he gets to do it in style.

Another reason retail auto is an industry worth fighting to get into.

Keep Pushing Back,

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 5 min and 27 sec

Stop losing good customers to slow, traditional lenders.

At NADA 2026, see how Upstart Auto Finance uses thousands of data points (not just a credit score) to approve more buyers with faster, more flexible offers. Close more deals with instant, AI-powered decisions, longer terms, and higher LTVs that boost back-end profit without the lender runaround.

Visit Upstart in Las Vegas, Feb 3-6 at booth #1901. The first 50 demos booked each get a $50 gift card, and everyone who stops by will be entered to win a super-automatic espresso machine for your showroom.

Book your demo here.

THE NEWS

Here’s the vibe today: the market is changing quicker than the headlines. Incentives shift, the mix follows, buyers pivot, and stores make it work.

Cox Watch: When the Rules Change, Demand Moves

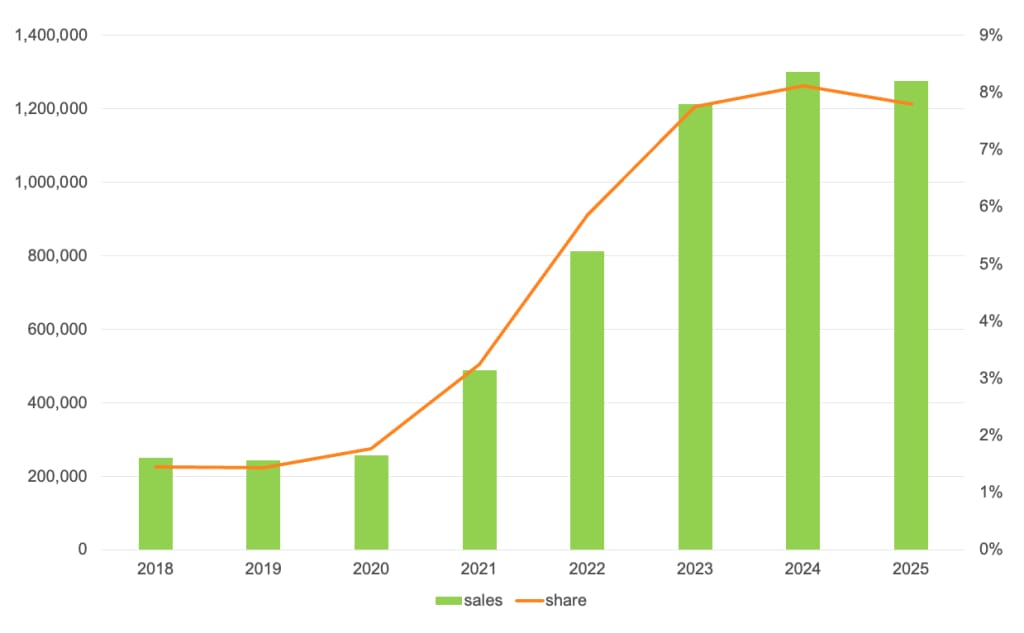

EV demand gave us a clean case study in how fast the market responds when the rules change.

Cox says Q4 EV sales fell hard after government-backed incentives ended in October, even though the full year still held together thanks to a very strong Q3 pull-forward.

Key numbers:

Q4 EV sales: 234,000 units

Quarter-over-quarter: down 46% vs Q3

Year-over-year: down 36%

2025 total EV sales: about 1.28M, down ~2% vs 2024

EV share: 7.8% in 2025 (vs 8.1% in 2024)

Tesla: 589,000 in 2025, down 7%

GM: 150,000+ in 2025, up 48%, about 13% of U.S. EV sales

The story is the speed of the shift once incentives adjust.

Also from Cox: The Whole Market Is Still Expensive

Even with more discounting, December ended with new-vehicle prices at record levels, pushed higher by mix.

A few anchors:

Average transaction price (ATP): $50,326 (record)

Average MSRP: $52,627 (record)

Incentives: 7.5% of ATP (highest level seen in 2025)

Full-size pickups sold in December: 233,000+ (best month in 5 years)

Avg full-size pickup price: $66,386

Full-size pickup revenue (retail + fleet): $15B+ in December (record)

Big mix month, big truck month, big price month. That’s the backdrop everything else is landing on.

Trade, Tariffs, and Manufacturing Updates

giphy

Trade talk is back, and the uncertainty is pretty certain.

In Detroit

In Detroit this week, the tone was less “decision made” and more “doors open.” Talk of welcoming foreign automakers to build U.S. plants widens the range of outcomes on pricing, sourcing, and volume plans.

North America is the stress test

This is where Canada matters. As Prime Minister Mark Carney heads to China to talk trade, Ontario Premier Doug Ford is pushing back on any rollback of Canada’s 100% tariff on Chinese-made EVs.

The argument is job protection and “dumping” risk. The counterpressure is retaliation, since China has already slapped tariffs on Canadian exports like canola, seafood, and pork.

A key nuance: some industry voices draw a line between imports and investment. The posture changes if a Chinese automaker builds locally, sources domestically, and employs Canadian workers. The conversation is moving from “tariff or no tariff” to “under what conditions does market access get granted.”

Tariffs on Court Watch

Tariffs are not only a policy lever right now, they are a legal question with a live calendar.

The U.S. Supreme Court heard arguments in November on whether the administration’s broad tariffs under the International Emergency Economic Powers Act exceed presidential authority. Importers are watching closely because a ruling could open the door to refund claims on duties already paid, and because timing matters for spring and summer ordering.

Nothing changes on the lot today, but a decision could reset expectations fast, including what gets ordered, when it ships, and what lands in pricing.

Older Trade-Ins Are Getting a Second Look

Automotive News reports dealers are reconditioning and retailing older, higher-mileage trade-ins that not long ago would have been automatic auction units. High prices and tight supply are forcing a deeper look down the age ladder.

Holman is a strong example. They built a separate recon checklist for older vehicles and raised their tolerance for minor cosmetic flaws (with disclosure), while keeping safety and mechanical standards tight.

What’s changing on the used side:

Holman moved from about half of trade-ins going wholesale to more than 2-to-1 retail vs wholesale after the new process

The change was often small: skipping cosmetic fixes that can run $1,000+ when the flaw is minor and disclosed

Under $15,000 inventory remains scarce and in-demand, and the piece treats those units like a unicorn class

Same used cars. Different retail math.

AROUND THE ASOTU-VERSE

Dealer Conferences and Industry Events (2026)

January 22: Public Policy Day, D.C. Auto Show, DC

February 3-6: NADA Show 2026, Las Vegas, NV (Looking for a party?)

May 12-15: ASOTU CON 2026, Hanover, MD

Quick Hits

🛒 Retail: United Airlines customers can now pre-order fresh meals for their flight.

🤖 AI: Actor Matthew McConaughey is trademarking himself to protect his likeness against AI misuse.

🇺🇸 U.S.: “Dream a Little Dream of Me” and other 1930s tunes, books, and characters entered the public domain at the beginning of the year.

Today in History

1782: Robert Morris, Superintendent of Finance, recommends to U.S. Congress the establishment of decimal coinage and a national mint. 🪙

1797: The first top hat is worn by John Etherington of London. 🎩

1892: The rules of basketball are formally published. 🏀