At The Merge 2025, one message cut through every conversation about EVs, software, and affordability.

China.

Michael Dunne, one of the most respected global analysts on the Chinese auto industry, put it plainly during our live Auto Collabs recording: the biggest force reshaping the global auto market is not electrification or autonomy. It is the scale, speed, and ambition of China’s automakers, and most of the U.S. still does not see it clearly.

From the outside, it is easy to miss. The U.S. and Canada remain largely insulated from Chinese vehicle imports. Trucks are still selling. Lots are still full. But outside North America, the ground is moving fast.

And it is moving in China’s favor.

The Export Surge No One Was Ready For

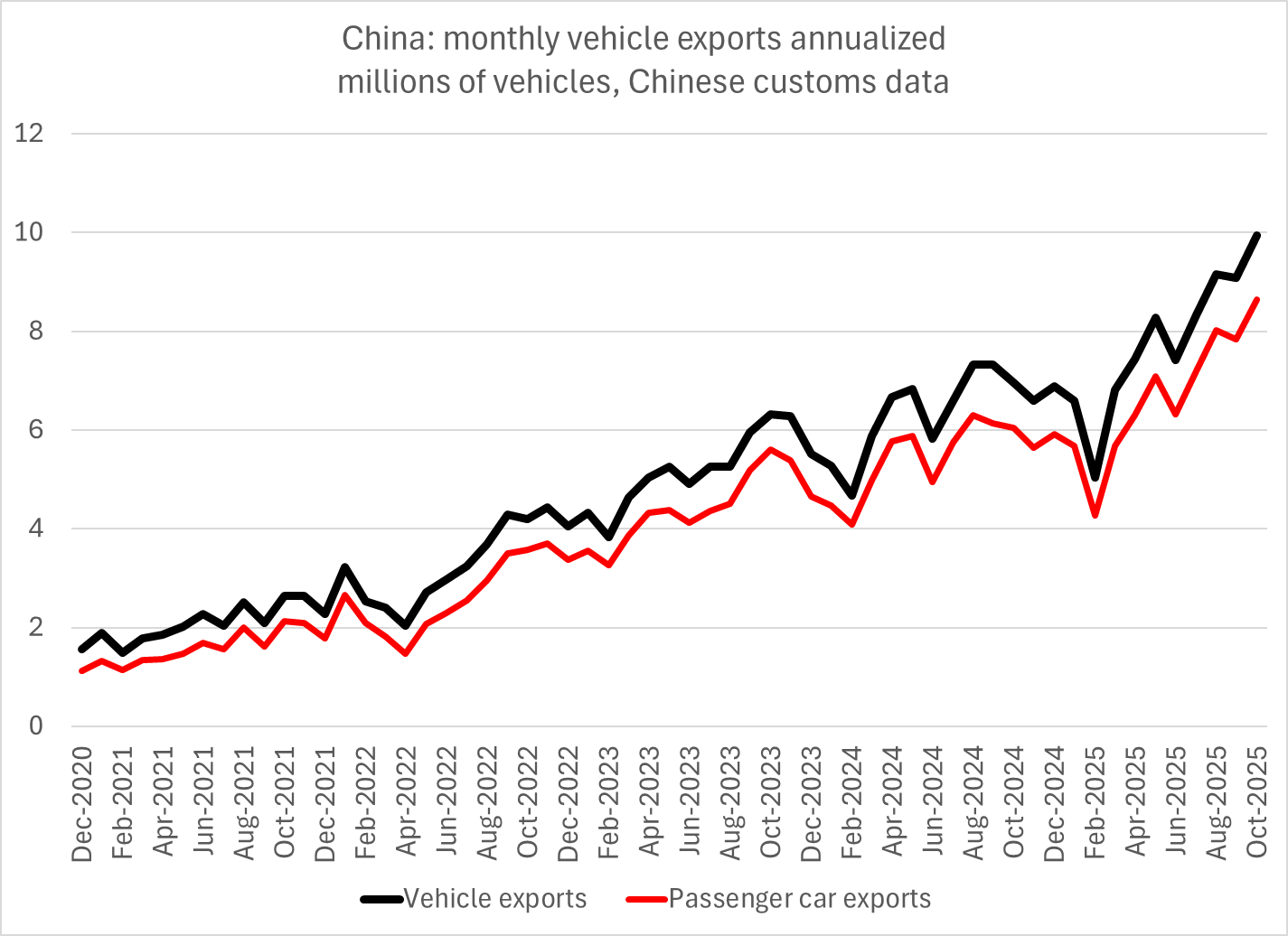

Five years ago, China exported about one million vehicles a year. Mostly low-cost models sent to developing markets.

Today, that number is on track to hit eight million.

That alone would be alarming. What surprised even seasoned observers like Dunne is what those exports actually are. Roughly 70 percent are not EVs. They are gas and plug-in hybrid vehicles, tailored market by market.

China learned quickly that different regions want different powertrains. So they adapted. Same vehicle platforms, multiple drivetrains, rapid localization. EVs where infrastructure exists. ICE where it does not. PHEVs as a bridge almost everywhere.

That flexibility is a major reason Chinese brands are flooding Europe, Southeast Asia, Latin America, and parts of the Middle East.

This Is Not Japan or Korea, Scaled Up

When comparisons come up, Dunne shuts them down fast.

This is not Japan in the 1980s.

This is not Korea in the 1990s.

This is what he calls “15 Japans at once.”

China brings scale, speed, and cost advantages that no prior auto challenger ever had simultaneously. Dozens of manufacturers. More than 100 active brands. Massive domestic competition that forces relentless cost cutting and rapid iteration.

Chinese automakers often release multiple product updates in the time it takes Western OEMs to launch one refresh. They spend less on R&D, but ship more output because their development cycles move faster and accept more risk.

At home, many are not making money at all. A brutal domestic price war is pushing them outward. Export markets offer oxygen and higher margins.

That combination changes the math.

Europe Is the Canary in the Coal Mine

If the U.S. wants a preview of what happens next, Dunne points to Europe.

At the Munich Auto Show, Chinese automakers outnumbered German brands on the floor. Hundreds of Chinese suppliers were present, including advanced software and autonomy companies.

In the UK, Chinese brands went from zero presence to roughly 13% market share in just a few years. Projections point to 30% by next year.

Consumers are responding to what they see. Lower prices. High-quality interiors. Software-forward design. Fast feature updates.

The demand is real (especially for EVs), and it is accelerating.

Why This Moment Is Different

China has followed this playbook before. Solar panels. Steel. Shipbuilding. Consumer goods. Entire industries reshaped through scale, cost control, and relentless execution.

Automotive is simply the next chapter.

What makes this moment dangerous is complacency. The U.S. market feels stable. Domestic debates still focus on incentives, EV adoption curves, and labor costs. Meanwhile, Chinese OEMs are quietly building global muscle everywhere else.

By the time the pressure becomes visible here, Dunne warns, the gap may already be too wide to close quickly.

What Has to Change

Dunne is not calling for panic. He is calling for realism.

The U.S. cannot compete alone. Scale matters. Speed matters. Cost matters. That means deeper coordination with allies like Japan, Korea, and Europe. It means tighter integration with Mexico and Canada for labor and materials. It means faster decision-making and a hard reset on how product development, sourcing, and manufacturing are approached.

This is not about blocking competition forever. It is about understanding that the competitive landscape has fundamentally shifted.

Ignoring it does not slow it down.