TOGETHER WITH

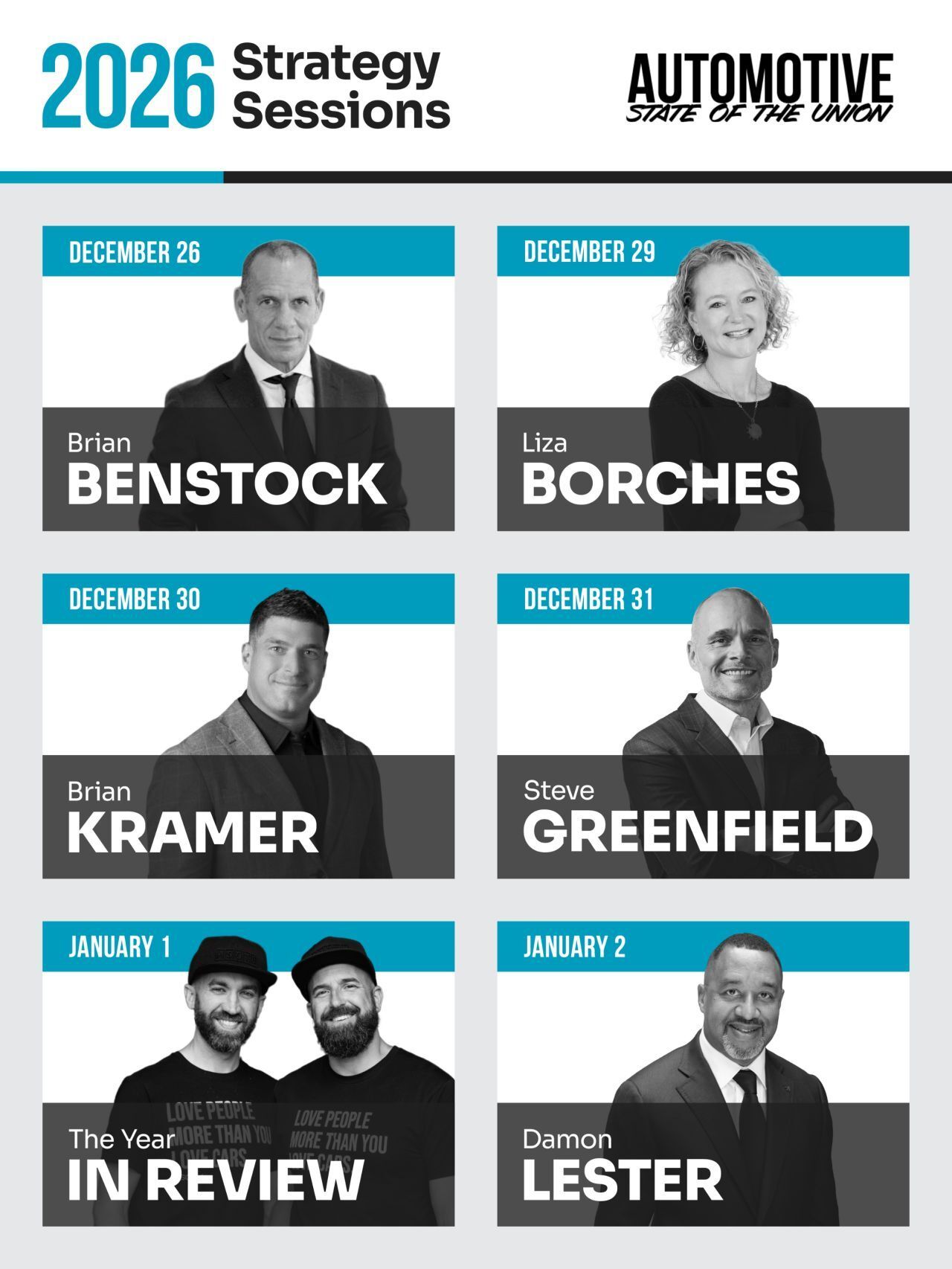

Did you watch our first Strategy Sessions, “Brian Benstock on Why The Sky Isn’t Falling?”

We’re doing more of those every morning this week. Same vibe, same goal: practical clarity from people actually running stores.

Join us for The Automotive State of the Union podcast live on LinkedIn or YouTube. Or catch the recording on Apple or Spotify.

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 3 min

Transform Your Dealership's Operations

Courtesy transportation isn’t optional anymore—it’s essential.

That’s why 80% of dealerships say offering Uber rides helps retain customers.

With Uber Central, you can book rides on behalf of customers—even if they don’t have the app. It’s a seamless way to elevate service, supplement shuttles or loaners, and streamline parts pickup and delivery.

Request one-way or round-trip rides, add multiple riders or stops, set spend and distance limits, and track trips in real time. Plus, you'll get monthly reports to keep track of everything.

Ready to cut shuttle costs and reduce loaner liability? Partner with Uber for Business today.

DATA & INSIGHT

Most Americans Anticipate Carrying Debt into 2026

giphy

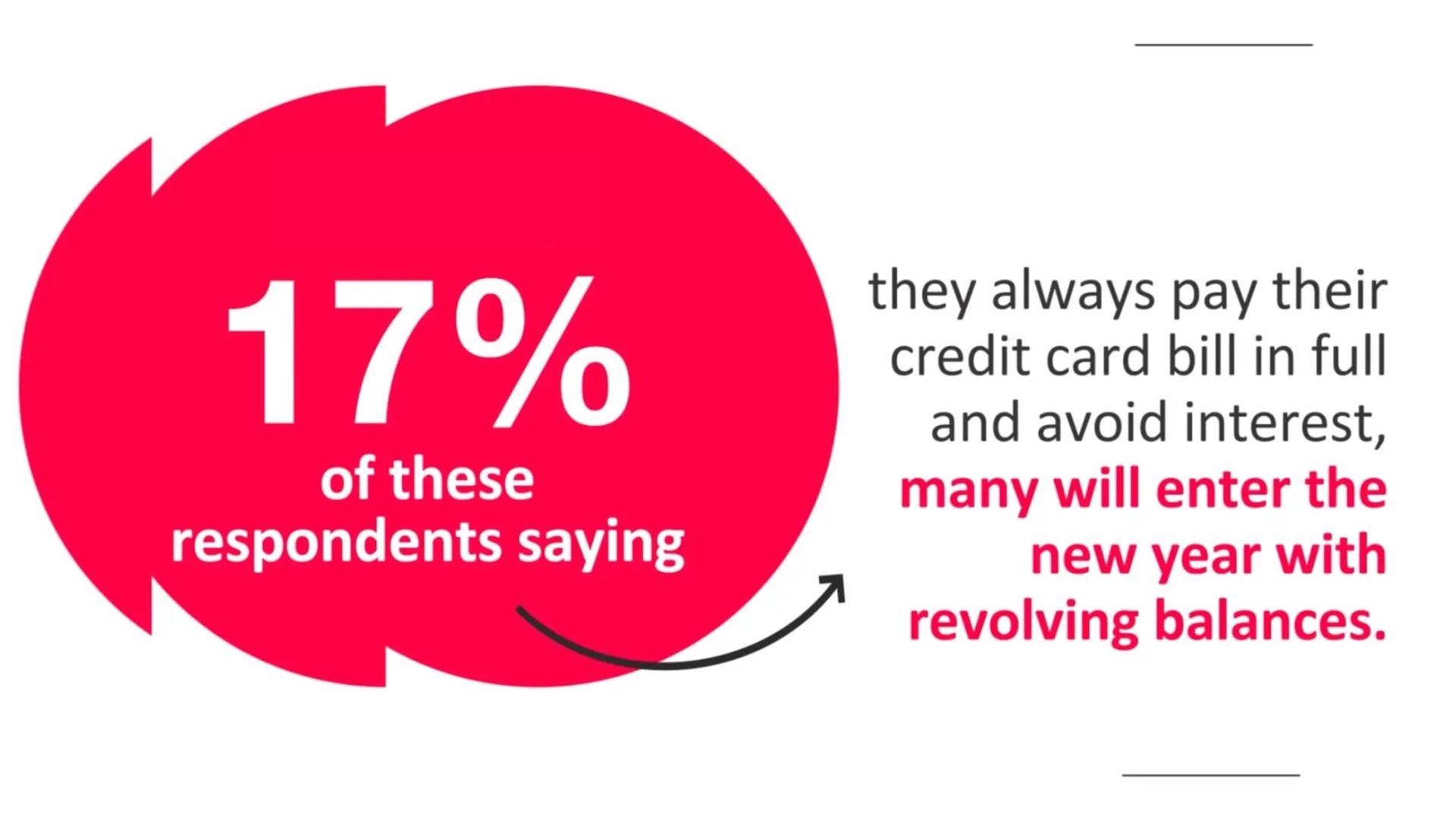

The holiday season is supposed to be joyful, but many Americans are heading into 2026 with a financial buzzkill. A recent survey shows a big chunk of holiday shoppers plan to swipe now and worry later.

Roughly a third expect to use credit cards for their seasonal spending, and most of them don’t expect to fully pay that balance off before interest kicks in.

In fact, about seven in ten people who use credit cards this season expect to carry that holiday debt into the new year, and nearly one in five say they might still be making payments well into next summer.

If the holidays stretched your wallet a little thin, you're not alone. And if they didn’t, even better. Either way, January is a good time to reset, reflect, and remember—there’s more than one way to celebrate well.

AROUND THE ASOTU-VERSE

Dealer Conferences and Industry Events (2026)

February 3-6: NADA Show 2026, Las Vegas, NV

May 12-15: ASOTU CON 2026, Hanover, MD

THE NEWS

New-Vehicle Retail Sales: 2025 Ends Strong, December Softens

giphy/”Why buy it if it isn’t worth showing off??”

The headline: retail grew, but the finish line got choppy

J.D. Power and GlobalData are forecasting full-year 2025 new-vehicle retail sales up 4.0%, even as December retail sales fall 7.4% year over year. That’s the story of 2025 in one sentence: the year ends up positive, but month-to-month it was anything but smooth.

What drove the swings: tariffs and the EV credit pull-ahead

Two big factors show up again and again in the data: tariff-driven pricing anxiety and the rush to buy EVs before the Sept. 30 federal EV tax credit expiration. That pull-ahead created a temporary surge, then left a softer period behind it, which is still showing up in late-year comparisons.

EVs are expected to account for 6.6% of December retail sales, down from 11.2% a year ago. At the same time, the average new-vehicle transaction price is projected to hit $47,104, so even with EV volume easing, pricing pressure is not.

The real pressure point: payments and loan terms

Affordability remains the daily fight. Average monthly payments reached $776, and 84-month loans are projected to make up 10.1% of financed deals. That number is worth sitting with, because it tells you what customers are doing to make the payment work.

Western Automakers Ease Off EV Targets as Policies Shift and China Advances

giphy/”Sound advice from a Macho Man”

Strategy resets are accelerating

Automotive News reports that cooling EV demand, high production costs, and regulatory changes are pushing Western automakers to dial back aggressive EV timelines. More brands are leaning into hybrids, extended-range solutions, and the profit stability of their core ICE lineups.

Policy is moving, too

The story points to reduced incentives and softened mandates across the U.S., Canada, and Europe. That matters because incentives and regulation are not just “EV news.” They shape what inventory gets built, what customers ask for, and how quickly the market can move.

China’s advantage is still the cost curve

Even with tariffs and restrictions trying to slow exports, China remains positioned to gain share globally thanks to low-cost vehicles and a highly efficient supply chain.

Cox Forecast: Tesla U.S. Sales Could Fall Nearly 9% in 2025

giphy/ “We’ve all been there…”

Tesla is a real-time signal for the post-incentive EV market

Cox Automotive forecasts Tesla’s U.S. sales could decline 8.9% in 2025, dropping from 633,762 to 577,097 vehicles, even as overall U.S. auto sales are expected to rise about 1.8%. Market share is projected to slip from 4.0% to 3.5%.

Why dealers should care

Tesla is not the whole EV story, but it is a good barometer. If the category leader is expected to shrink while the overall market grows, that tells you the post-incentive EV market is still rebalancing, and the mix is still shifting fast.

Other Automotive Headlines

Rare earth magnets just became the world’s newest “tiny part, huge leverage” problem, and Western makers are racing to build a mine-to-magnet supply chain before China reminds everyone who owns the on-switch. 🧲

Mitsubishi is suing a Washington store for not matching the corporate branding kit and for sending service work next door. 🧑⚖

Nikola is now officially a “startup” again: one employee, zero revenue, and a balance sheet held together by liquidation spreadsheets and vibes, which must have made for a very lonely Christmas party at the office. 1⃣

Today in History

1845: Texas is admitted as the 28th state of the Union. 🇺🇸

1862: The modern bowling ball is invented. 🎳

1908: Otto Zachow and William Besserdich of Clintonville, Wisconsin, received a patent for their four-wheel braking system, the prototype of all modern braking systems. 🛑

It’s a humbling joy to know these emails are landing in inboxes to be enjoyed by real people. I hope it helps you help your people today, Friend!