TOGETHER WITH

Happy Halloween, Friend!

We know you’ll have your hands full with ghouls and ghosts today, but don’t forget to snap a couple of pictures and send them our way! While you celebrate, chime in on our own little costume contest.

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 3 min

This Email

ℹ News and Data: Dealers Vs. October and More

giphy

October’s sales numbers are up, but don’t break out the champagne yet—inventory’s still uneven, and used Tesla prices are falling like leaves in autumn.

Chevy’s Silverado EV got a boost in range and a trim in price, while Kia’s funky Tasman work truck leaves folks divided.

Over in Michigan, Kei cars are back on the road after a legal brawl, and Xiaomi’s quietly taking over the Chinese EV market.

Meanwhile, Polestar might need a Plan B in the U.S. Thanks, Biden.

Oh, and there’s a $3M Batmobile you can’t even drive.

Check it all out in the full digest at Daily.ASOTU.com

Auditing your year and building your 2025 Advertising Strategy

Join ASOTU and our friends at Stream Companies for a fast-paced 30-minute webinar on preparing for a successful 2025!

Learn how to review your past advertising performance, spot opportunities for optimization, and stay ahead of emerging trends.

Get practical insights on refining your budget, integrating new tools, and aligning your strategies with your business goals from

Don’t miss this chance to elevate your advertising strategy and drive success in the year ahead!

Keep an eye on the ASOTU Edge page for more details soon!

🗳️ Pre-Election Market Watch

Tenor

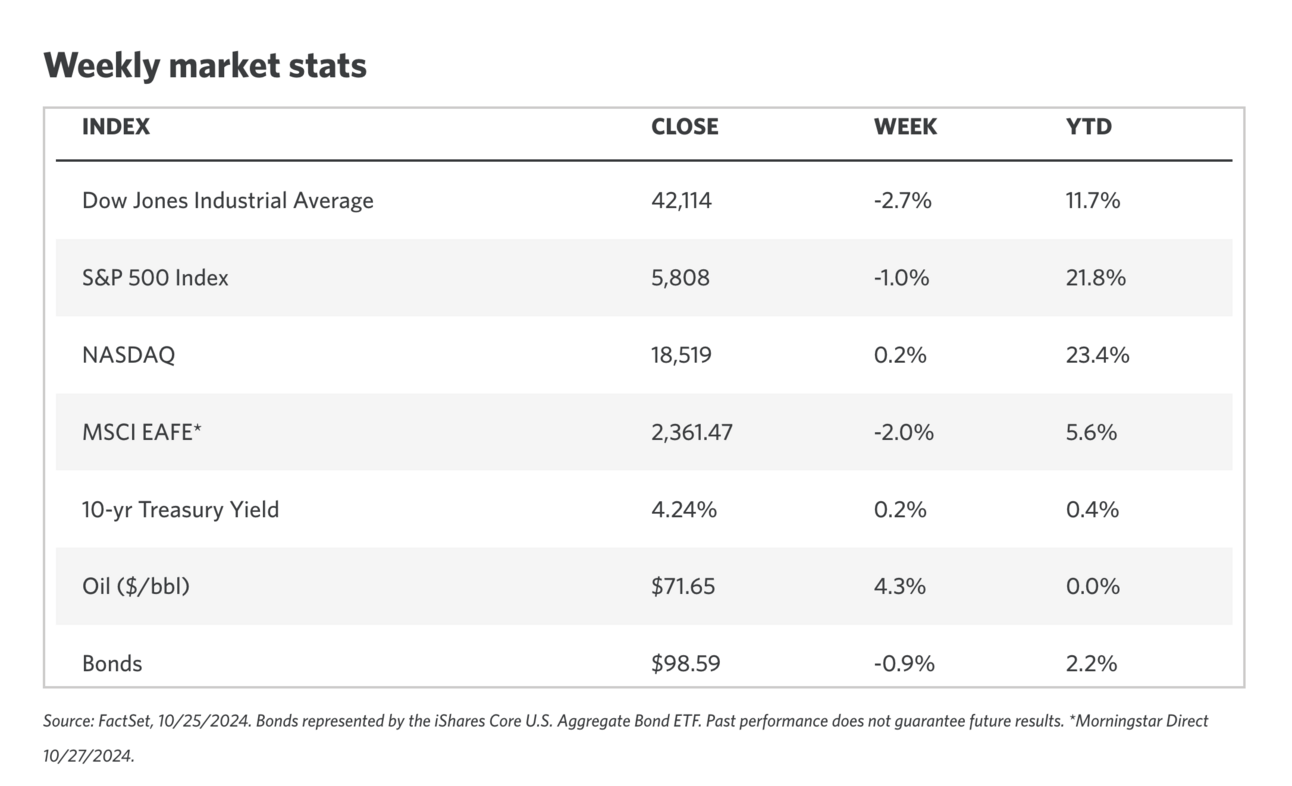

The stock market's six-week winning streak came to a halt last week, as rising bond yields stole the spotlight. Here’s what’s driving the shift:

Rising Yields – Despite the Fed’s initial rate cut, both 2- and 10-year Treasury yields have risen, driven by stronger-than-expected economic data and inflation concerns. September’s job gains were the highest in six months, and retail sales surged, pushing GDP estimates for Q3 up to 3.4%.

Election Impact – The upcoming U.S. election is also raising fiscal concerns. Both candidates' plans are expected to increase U.S. debt significantly, which could force the Fed to keep rates higher for longer. Tariff talk and fiscal policy shifts are also making investors nervous.

Historical data shows that the U.S. stock market tends to perform well during inauguration years, regardless of who’s in charge. Here’s what the data shows:

Inauguration Year Wins – In the past four inauguration years, the S&P 500 has posted returns of over 20%. It seems that the market likes to rally when a new president takes office, no matter which party holds the reins.

Economy Over Politics – While presidential leadership grabs attention, market performance is more often driven by broader economic conditions and corporate earnings. Past administrations, regardless of party, have delivered solid market returns during strong economic periods.

This year’s presidential election is expected to have a major impact on the U.S. auto industry, with differing potential outcomes depending on the results. Here’s what analysts are expecting:

🔴 Republican Win with Split Congress

Expect a freeze on emissions regulations through 2032, halving consumer tax credits for EVs and closing the lease loophole. This could result in a 6% boost to overall industry volume, with more focus on internal combustion engines and hybrids.

🔵 Democratic Win with Split Congress

Stricter emissions standards would remain, with IRA incentives intact and possibly more incentives for home EV chargers. BEVs would continue to grow, and hybrids will likely see more attention, leading to an anticipated 2% industry volume bump.

🌎 Trade and Tariffs

Both parties' trade policies will affect tariffs on Chinese automakers and the USMCA (United States-Mexico-Canada Agreement), which could disrupt supply chains and pricing.

AROUND THE ASOTU-VERSE

🗓️ Coming Soon

🤠 November 5-8th — Opening presenters at the 2024 ATAE PR & Communications Focus Group Meeting in Austin, Texas.

⚜️ January 23-26th, 2025 — NADA Show in New Orleans.

🦀 May 13-16th, 2025 — ASOTU CON in Baltimore, Maryland.

🎬 Episode 4 of More Than Cars at Mohawk Chevrolet

🥊 Quick Hits: Refunds, Wind, and Reddit

The U.S. Department of Transportation's ruling on automatic airline refunds went into effect this week. ✈️

The first Atlantic floating offshore wind lease sale raised $21.9M, awarding four lease areas. 🎐

Reddit's IPO success led to a 25% stock surge, turning profitable with $29.9M net income. 🔼

Ryder awarded “Top Company for Women to Work in Transportation” by the Women in Trucking Association for the sixth year in a row. 💁♀️

🔁 Today in History: 95, Toyota, and Impala

1517: Martin Luther posts his 95 Theses on the door of the Castle Church in Wittenberg. 🔨

1957: Toyota establishes American headquarters. 🇺🇸

1957: The Chevrolet Impala is announced. 📣

Thanks for reading, friend! Today, may your treats be many and your tricks be few.