Tenor

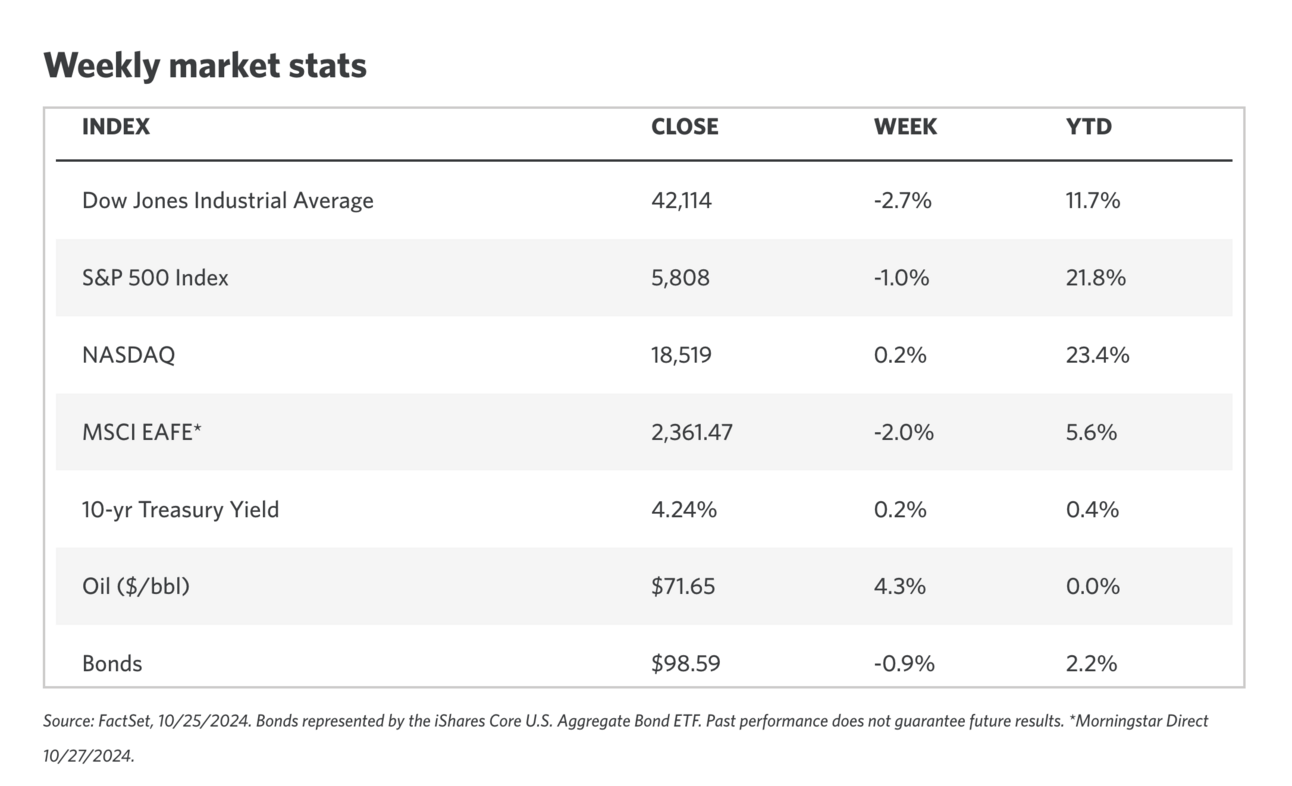

The stock market's six-week winning streak came to a halt last week, as rising bond yields stole the spotlight. Here’s what’s driving the shift:

Rising Yields — Despite the Fed’s initial rate cut, both 2- and 10-year Treasury yields have risen, driven by stronger-than-expected economic data and inflation concerns. September’s job gains were the highest in six months, and retail sales surged, pushing GDP estimates for Q3 up to 3.4%.

Election Impact — The upcoming U.S. election is also raising fiscal concerns. Both candidates' plans are expected to increase U.S. debt significantly, which could force the Fed to keep rates higher for longer. Tariff talk and fiscal policy shifts are also making investors nervous.

Historical data shows that the U.S. stock market tends to perform well during inauguration years, regardless of who’s in charge. Here’s what the data shows:

Inauguration Year Wins — In the past four inauguration years, the S&P 500 has posted returns of over 20%. It seems that the market likes to rally when a new president takes office, no matter which party holds the reins.

Economy Over Politics — While presidential leadership grabs attention, market performance is more often driven by broader economic conditions and corporate earnings. Past administrations, regardless of party, have delivered solid market returns during strong economic periods.

This year’s presidential election is expected to have a major impact on the U.S. auto industry, with differing potential outcomes depending on the results. Here’s what analysts are expecting:

🔴 Republican Win with Split Congress

Expect a freeze on emissions regulations through 2032, halving consumer tax credits for EVs and closing the lease loophole. This could result in a 6% boost to overall industry volume, with more focus on internal combustion engines and hybrids.

🔵 Democratic Win with Split Congress

Stricter emissions standards would remain, with IRA incentives intact and possibly more incentives for home EV chargers. BEVs would continue to grow, and hybrids will likely see more attention, leading to an anticipated 2% industry volume bump.

🌎 Trade and Tariffs

Both parties' trade policies will affect tariffs on Chinese automakers and the USMCA (United States-Mexico-Canada Agreement), which could disrupt supply chains and pricing.

🐡 Inflation Reduction Act (IRA) Funding

The future of IRA funding, which helps consumers buy EVs and plug-in hybrids, is up for grabs. This funding also supports building out North American supply chains. Depending on the election, we could see that funding cut back, maintained, or even expanded.

🛑 California's Emissions Waiver

California’s ability to set its own tough emissions standards is another hot topic. If the right party wins, the state’s waiver could be revoked, forcing automakers to follow one national standard instead of dealing with California’s stricter rules.

If the Republican Party wins the White House and the House and Senate are split, significant changes to emissions regulations and EV incentives are expected. Here's what could be in store:

Emissions Freeze — Regulations for model years 2028 through 2032 would likely stay at 2027 levels, slowing the push for stricter emissions standards.

Cuts to EV Incentives — Consumer tax credits under the Inflation Reduction Act (IRA) could be halved, and the current lease loophole might be closed, reducing financial incentives for electric vehicle buyers.

Lower Prices, Less Electrification — With a reduced focus on full electrification, we could see more internal combustion engines with mild electrification, leading to lower vehicle prices and a stronger emphasis on sedans and larger vehicles like trucks and SUVs. The scenario projects a 6% increase in total industry volume by 2030, with EV market share at 29%.

If the Democratic Party wins the White House, it’s expected that emissions regulations could align closely with the National Highway Traffic Safety Administration guidelines. Additionally, consumer incentives under the Inflation Reduction Act are likely to stay intact, though the lease loophole might still close. Here's what that could mean:

More Focus on PHEVs and FHEVs — With less emphasis on fully electric vehicles (BEVs), expect the spotlight to shift towards plug-in hybrids (PHEVs) and full hybrids (FHEVs). Internal combustion engines with mild electrification may also see less attention.

Sedans Making a Comeback — Similar to the Republican scenario, small and midsize sedans could gain more focus, while full-size pickup trucks and SUVs might level off.

Slight Bump in Sales — This scenario forecasts a 2% increase in total industry volume (TIV), driven by a more balanced vehicle mix at different price points to meet consumer demand for affordability.

It’s clear that many voters weren’t waiting until the last minute to make their voices heard. More than 50M Americans have already locked in their votes a week ahead of Election Day, according to the University of Florida's early-vote tracker.

Party Lines — So far, 39% of early voters are registered Democrats, with 36% representing the GOP. The remaining voters are independents or from other affiliations.

Seniors Showing Up — Older voters are leading the early charge, with 41% of ballots coming from those aged 65 and up.

A Familiar Trend — In 2020, about 100M voters cast early ballots, and this year’s numbers seem to be following a similar path.

Despite election anxieties, consumer confidence is on the rise, bolstered by dropping gas prices and steady growth in retail vehicle sales. Despite some economic bumps this year, both new and used vehicle markets are showing resilience as we head into the last few months of the year.

Resilient Vehicle Sales — New vehicle sales have jumped 10% year over year, while used vehicle sales are up 9%, reflecting solid demand despite the recent challenges in the market.

Supply Stabilizes — New vehicle supply remains strong compared to last year, though used supply is tighter, which has had some impact on pricing trends.

Spending Growth Holds Steady — After some volatility in the summer months, consumer spending has stabilized, growing steadily at just over 4%.

Labor Market Dynamics — Job growth picked up again in September with 254,000 new jobs, though continuing unemployment claims reached 1.90 million, their highest level since late 2021.

Consumer Sentiment Continues to Climb — Despite recent hurricanes and disruptions, consumer sentiment is at its highest point since spring 2021, helped by falling gas prices, which are down 10% year over year.

October is shaping up to be a strong month for U.S. light vehicle sales, with projected year-over-year growth hitting 11%, boosted by two extra selling days.

SAAR Boosted to 15.9M Units — While the volume improvement is helped by more selling days, the seasonally adjusted annual rate is on track to hit 15.9M, one of the strongest performances in 2024.

Consumer Pressure Continues — Automakers may introduce more incentives as high interest rates and vehicle prices keep new car shoppers feeling the pinch. This extra support could help ease high monthly payments.

Inventory Growth — Retail advertised inventory crossed the 3M mark in September, up 4.7% from August, signaling stronger supply for potential buyers heading into the final quarter of the year.

EV Sales Stay Strong — With new electric vehicles like the Chevrolet Equinox EV and Honda Prologue rolling out, BEV sales are expected to hold steady above 9% for October.

📊 For more data and insight like this delivered directly to your inbox, subscribe to our daily email today! 📬👇