TOGETHER WITH

You oughta be in pictures…

Or, at least memes.

Send us some pictures of your team, store, or self, and you may see a familiar face in future ASOTU content. 😉

Of course, an easier way to see familiar faces would be to grab an ASOTU CON ticket.

You know, before they’re all gone.

Keep Pushing Back,

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 4 min and 32 sec

Finding F&I, Carvana vs. Expectations, and the RAV-4’s Crown

F&I Sales Are Up—But So Is Consumer Confusion

A new survey shows that while 70% of dealers saw F&I growth in 2024, nearly 30% of customers declined products simply due to lack of awareness. Online F&I is changing the game—20% of dealers report that at least 75% of customers now buy protection plans digitally, and most say online education has boosted sales.

With affordability concerns still looming, the opportunity is clear: educating customers before they reach the desk could drive even bigger gains.

Are you ready to meet customers where they shop? The data says you should be.

--

Carvana’s Q4 Pyrrhic Victory?

Carvana’s latest earnings report is a masterclass in customer acquisition and margin maximization. They sold 416,000 units in 2024 (up 33%) and pulled in $6,900+ per unit, yet Wall Street still sent shares down 10% after hours—because their 2025 outlook lacked clarity.

But dealers don’t need clarity from Carvana. They need insight.

Carvana is proving where customers are shopping, how they’re buying, and what they’re willing to pay. They’re not just competition; they’re a lesson in evolving consumer behavior.

--

The F-150 and RAV-4 Trade Hats

For the first time in decades, the F-150 isn’t America’s best-selling single vehicle. That title now belongs to the Toyota RAV4.

🔍 RAV4 Sales: 475,000 units

🔍 F-150 Sales: 461,000 units

Ford still leads overall—the full F-Series lineup (F-150 through F-450) moved 765,000 units last year. But here’s the real insight: vehicle type often matters more than brand loyalty.

Many RAV4 buyers aren’t die-hard Toyota fans—they’re compact SUV shoppers. So if Ford dealers play it right, those same customers might drive off in an Escape or Edge instead.

🥊 Quick Hits

GPT-5 isn’t just chatting—it’s planning, reasoning, and maybe even fact-checking itself. Wild times when AI starts second-guessing better than humans. ☑

Stellantis is keeping Peugeot and Opel out of the U.S.—because fixing dealer relations and slashing Jeep prices is already enough homework. 📝

The Last of Us Season 2 will be shorter than Season 1, and only tell part of the story from the video game it is adapting. But it’s coming in April, so that’s exciting. 🍄

What Do You Mean Yelp Sells Cars?

In case you missed it, CEO Matt Murry from Widewail shared some masterful data and insights regarding reputation management and getting out of the pit of reacting to online reviews by embracing a proactive strategy!

Check out the full replay here.

And, a little ASOTU write-up from the event here.

Tax Refunds Drive Demand

Tenor

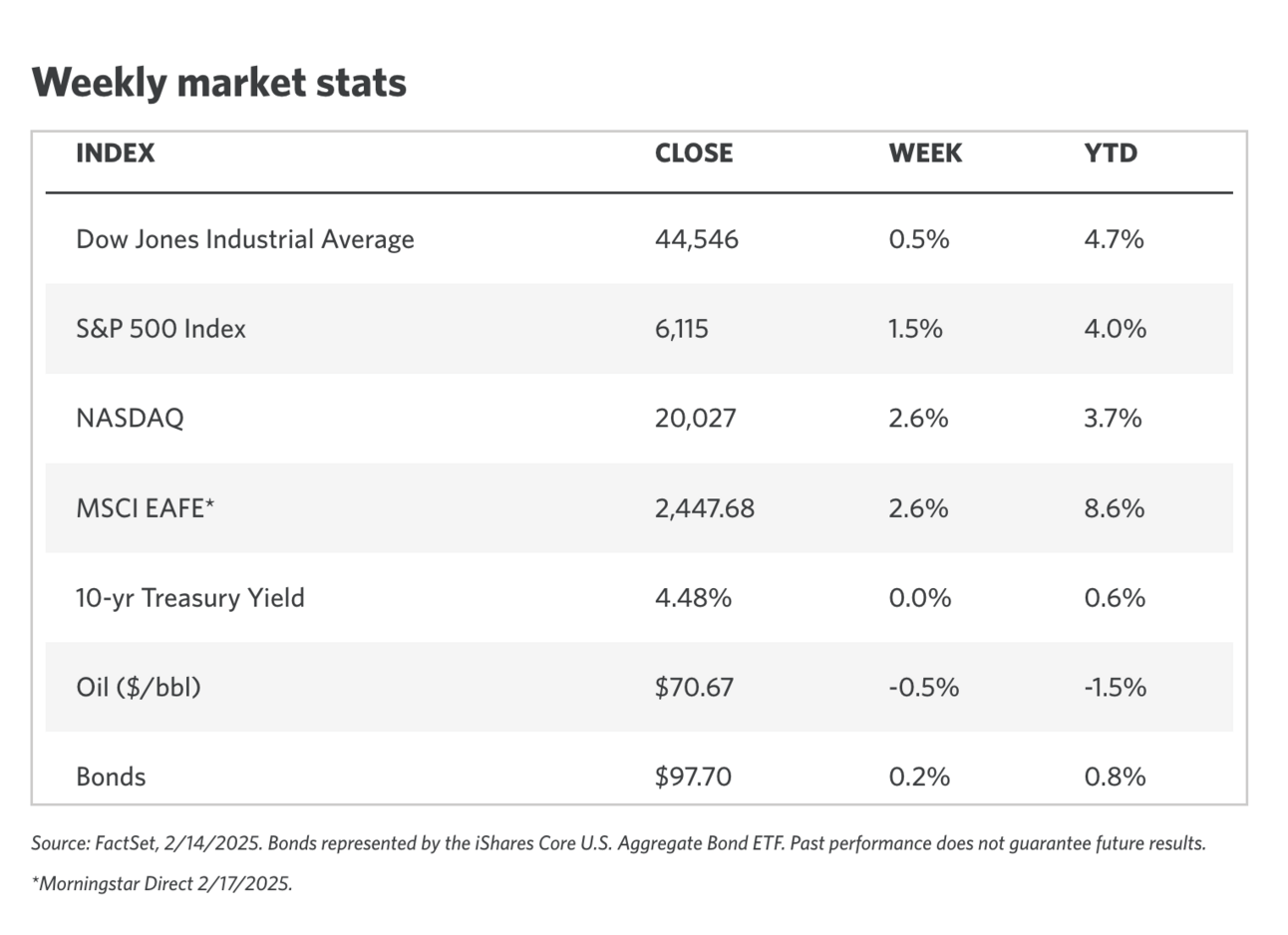

Markets are treading carefully as inflation refuses to budget, but the Feds appear in no rush to further cut rates. Despite mixed signals, earnings growth outside the Magnificent 7 is breathing fresh life into the broader market.

Inflation’s Stubborn Streak: Inflation remains stuck at 3.3% for the eighth straight month.

Fed’s Waiting Game: Fed Chair Powell is holding steady, signaling no urgency to chop rates. With trade uncertainties looming and inflation holding firm, markets now expect the first rate cut closer to October.

Stock Market Shake-Up: The Magnificent 7 aren’t carrying the market quite like they used to. While their profits still rose 25% in Q4, broader market earnings—led by financials, healthcare, and real estate—are gaining momentum.

Tax refunds are hitting bank accounts and buyers are wasting no time. Used cars specifically are flying off lots as shoppers put their extra cash to work.

More Money More Demand: Refunds jumped 19% giving buyers the power to close deals fast.

Loan Rates Climb: Used-car loan rates sit at 14.12% and new-car rates are at 9.53%, but that isn’t deterring buyers.

Inventory Stays Tight: Used cars remain scarce pushing buyers to act before prices climb further.

February’s shaping up to be a big month for car sales with new-vehicle retail sales expected to rise 8.1% YOY.

Sales Surge: Retail sales are projected to hit 1,010,000 units—up 8.1% from last year—making this the fifth straight month of sales growth.

Spending Hits High Gear: Buyers are on track to drop $42.6B on new vehicles, a 2.5% increase from February 2024 and the highest total for the month ever recorded.

Profit Squeeze: Despite the sales boom, retailer profit per unit has slipped nearly 12% to $2,171.

AROUND THE ASOTU-VERSE

🗓️ Coming Soon

🦀 May 13-16th — ASOTU CON in Baltimore, Maryland. Get the app!

🔁 Today in History

1937: First successful flight of a flying car. 🛸

1947: In New York City, Edwin Land demonstrates the first "instant camera"—the Polaroid Land Camera—to a meeting of the Optical Society of America. 📸

1948: NASCAR is founded. 🏁