TOGETHER WITH

Good morning, Friend!

We’ve got something special for you today. ASOTU is in Washington, D.C., to bring you the latest from Public Policy Day—where decisions get made and dealers make their voices heard. We’re talking CARS Rule, compliance, and why F&I is far from the villain some make it out to be.

Check out yesterday’s morning live stream with our friends Adam Marburger from Ascent Dealer Services and Jim Ganther, CEO of Mosaic Compliance Solutions , and subscribe on YouTube to catch the next one.

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 3 min

👑 Toyota Holds The Globe, Tesla’s Promise-Packed Decline, and New B2B Jumps

giphy

🚗 Toyota Still on Top, But…

Toyota sold 10.8M vehicles in 2024, holding the #1 global spot for the fifth year. But sales fell 3.7%, hit by governance scandals in Japan (-10% locally) and a 6.9% drop in China. Hybrids now make up 40.8% of Toyota’s sales, while BEVs remain just 1.4%.

🔥 Tesla’s Sales & Margins Take a Beating

Tesla’s automotive revenue fell 8%, and net income plummeted 71% YOY. Despite price cuts, deliveries declined for the first time since 2011. Musk teased “cheaper Teslas” and unsupervised robotaxis, but details? Nonexistent.

🚛 Used Commercial Sales Slump, New Trucks Soar

New commercial truck sales jumped 14.2% YOY, with Q4 up 19.4%. Meanwhile, used sales dropped 2.6%, mileage rose 9.4%, and inventory shrank as trade-ins lagged. Dealers—B2B sales are your next goldmine.

Get Your Gear in Gear!

Let’s be real—parts management isn’t for the faint of heart. Between juggling inventory, pricing strategies, and manufacturer programs, it’s a high-stakes game. Luckily, PartsEdge is handing you the cheat codes.

Join their monthly Parts Meet Up webinars, where industry pros like Chuck Hartle break down pricing strategies, DMS hacks, and ways to keep obsolescence from eating your profits. Got questions? Hit the live Q&A.

Prefer to listen on the go? The Parts Management Podcast with our dear friend Kaylee Felio serves up expert insights straight to your ears. Because turning parts into profit shouldn’t feel like a mystery.

Check out the next webinar on February 13th and start running your parts department like a boss. 🚗💨

🫸 Wall Street Rebuffs Tech-Sector Scare

giphy

Concerns over DeepSeek’s tech sent the Nasdaq spiraling down 4% on Monday—its worst one-day drop since 2022. But despite the turbulence, Wall Street shrugged off the panic and the major indexes are likely to close out the week in the green.

Tech Tremors Hit Hard: The Magnificent 7 stocks—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla—were most affected this week. With most stocks down 5% or more, their implied loss exceeds $1T.

Bull Run Isn’t Slowing Down: The S&P 500 broke through its previous all-time high this week. The Dow and Nasdaq also notched solid gains, climbing around 2% each, though they’re still a hair shy of their record levels.

The U.S. GDP grew 2.3% in Q4, bringing the year’s total to 2.8% and proving yet again that this economy refuses to take a break.

Shoppers Did the Heavy Lifting: Consumer spending surged 4.2%, its best run in nearly two years. Businesses, on the other hand, sat this one out—investment in equipment nosedived, breaking a two-quarter streak of growth.

Fed Hits Pause on Rate Cuts: With the economy chugging along and inflation proving stubborn, Jerome Powell isn’t in any hurry to cut rates further. The Fed is playing the long game, much to the market’s frustration.

What’s Next?: Growth has been above 2% in nine of the last ten quarters, but economists see that cooling below 2% in early 2025.

Americans’ economic confidence went from bad to worse in January with Gallup’s Economic Confidence Index falling to -19 (down from -14 in December). While perceptions of current conditions remain stable, fewer Americans are optimistic about what’s ahead.

Mixed Reviews: 26% of Americans rate the economy as “excellent” or “good”, while 40% describe it as “poor.” The current conditions score held steady at -14, slightly better than last year’s average of -19.

Outlook Dims: 34% of respondents believe the economy is improving, down from 38% in December. The economic outlook score dropped to -23, the lowest in six months.

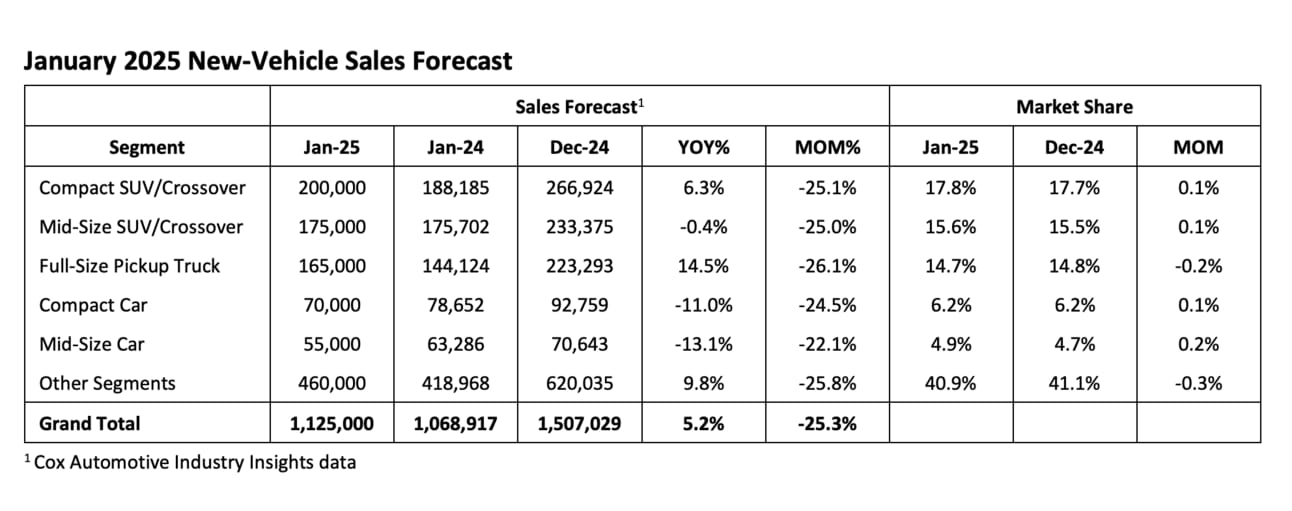

New-vehicle sales are kicking off 2025 with solid year-over-year gains, though harsh winter weather and normal seasonal trends are slowing momentum from December’s high. Despite this expected dip, January’s pace remains the strongest in three years.

YOY Growth Continues: January sales volume is forecasted to hit 1.125 million units, marking a 5.2% increase from January 2024. This would be the fourth consecutive month of year-over-year sales growth.

Inventory and Incentives: New-vehicle inventory sits at 2.88M units, dipping below 3M for the first time since October. While supply is tightening, dealers still have more inventory and incentives than last year, keeping deals competitive.

Looking Ahead: 2025 new-vehicle sales are projected to reach 16.3M, a 2-3% gain over 2024. However, potential policy changes on tariffs and EV tax credits could shake up the market later in the year.

AROUND THE ASOTU-VERSE

🗓️ Coming Soon

🦀 May 13-16th — ASOTU CON in Baltimore, Maryland. Get the app!

The NADA Show just ended, and we’re already counting the days until we can all get together again! ASOTU CON has improved each year, and we are ready to guarantee this year will be as unique as it is unmissable.

🥊 Quick Hits

Louis Vuitton joins Formula 1 for a ten year partnership. 🏎️

UPS shares tank after announcing plans to cut Amazon deliveries by half. 📦

“Little House on the Prairie” is getting a Netflix reboot. 🌾

🔁 Today in History

1865: Congress passes the 13th Amendment of the U.S. Constitution abolishing slavery. 🇺🇸

1928: Scotch tape first marketed by 3-M Company. 📍

1948: Magnetic tape recorder developed by Wireway. 📼