TOGETHER WITH

Continuing the countdown, we’ve got just 6 days till the industry and community (two different things, trust us) will be together in NOLA for the NADA Show.

You know NOLA is the birthplace of jazz music. But did you know original jazz groups often include a banjo? Bonus factoid: The banjo, although associated with American bluegrass and folk music, was an evolution of an African instrument built from a gourd.

Now you know! 🪕

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 3 min

👑 Hybrid Records, Toyota Reigns, and Companies Consider Closing Factories

giphy

📊 EV/Hybrid Sales Hit 20% Milestone in 2024

Electrified vehicles accounted for 20% of all U.S. car sales last year, with 3.2 million units sold. Hybrids (1.9M) and EVs (1.3M) are gaining traction, but challenges like affordability and infrastructure gaps remain. Tesla leads the pack, though its market share dipped to 49% as Hyundai, GM, and Ford ramped up competition. Experts predict one in four vehicles sold in 2025 will be electrified.

📈 Toyota Holds the Crown for the 5th Year

Toyota remains the world’s largest automaker for the fifth straight year, selling 9.8 million vehicles in 2024 despite a slight decline. Its diverse lineup—from budget-friendly kei cars to rugged SUVs—caters to every market niche, keeping it ahead of VW (9.2M) and Hyundai (7.2M). Toyota’s hybrid offerings and global strategy continue to drive its dominance amid an evolving automotive landscape.

🔍 Factory Closures Shake Auto Industry in 2025

Overcapacity, emission regulations, and tariffs are driving factory closures across Europe and North America, with high-cost regions at the greatest risk. Chinese automakers see an opportunity to expand by acquiring these shuttered plants to bypass trade barriers. Despite these challenges, EV production is projected to grow by 17% in 2025, with over half of automaker lineups expected to include electric models by 2030.

Read the Full Digest

Get the full scoop on these stories and more. Dive into the latest trends shaping the auto industry—read here!

Get MOR(e)!

Get the hottest takes on 2025's automotive trends.

Dave Cantin Group delivers sharp insights, expert analysis, and industry-shaping perspectives in the upcoming Market Outlook Report (MOR).

Be among the first to receive the report

📊 Eyeing the Market

giphy

The stock market delivered a complex performance this week, with major indexes showing declines overall but hitting a notable high on Wednesday, logging their best day in over two months.

Midweek Momentum: The S&P 500 and Nasdaq posted their best single-day gains since November on Wednesday, driven by lower-than-expected core inflation data. The S&P 500 climbed 1.83%, while the Nasdaq surged 2.45%.

Tech Stocks Take Off: Plunging Treasury yields, down 13 basis points to 4.65%, pushed stock growth higher. Tesla jumped 8%, and Nvidia rose 3%, benefiting from lower borrowing costs and boosted valuations.

Jobs Data Adds Fuel: Last week’s robust jobs report, with 256,000 new jobs added and unemployment falling to 4.1%, reinforced optimism about economic growth as inflation cools.

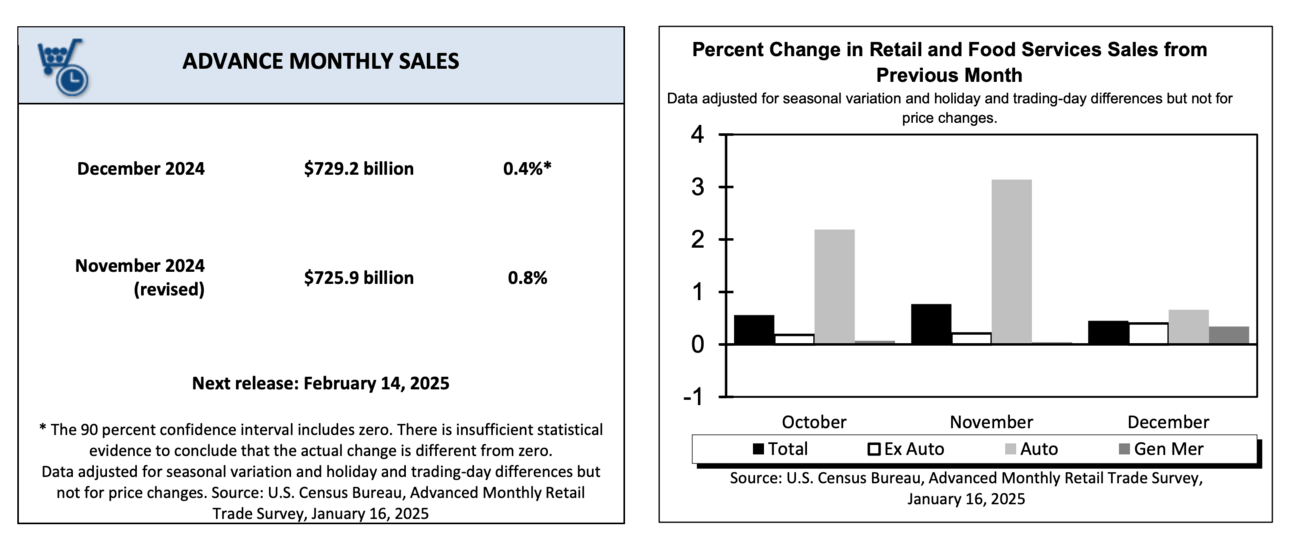

According to the U.S. Census Bureau, retail sales climbed 0.4% in December as holiday shoppers hit stores and dealerships. While spending trends revealed a sharp divide across income levels, strong demand for cars fueled much of the month’s retail strength.

Car Sales Dominate the Scene: Auto sales jumped 0.7%, leading the charge in December’s retail growth and proving the sector’s resilience amid economic challenges.

Bankruptcies Surge in Retail: Retailers filed 48 bankruptcies in 2024, with over 7,300 store closures, including a number of auto dealerships, highlighting uneven performance across the industry.

Tariffs Loom as the Next Roadblock: Retailers are already preparing for Trump’s proposed tariffs, with many diversifying sourcing strategies to cushion potential cost increases.

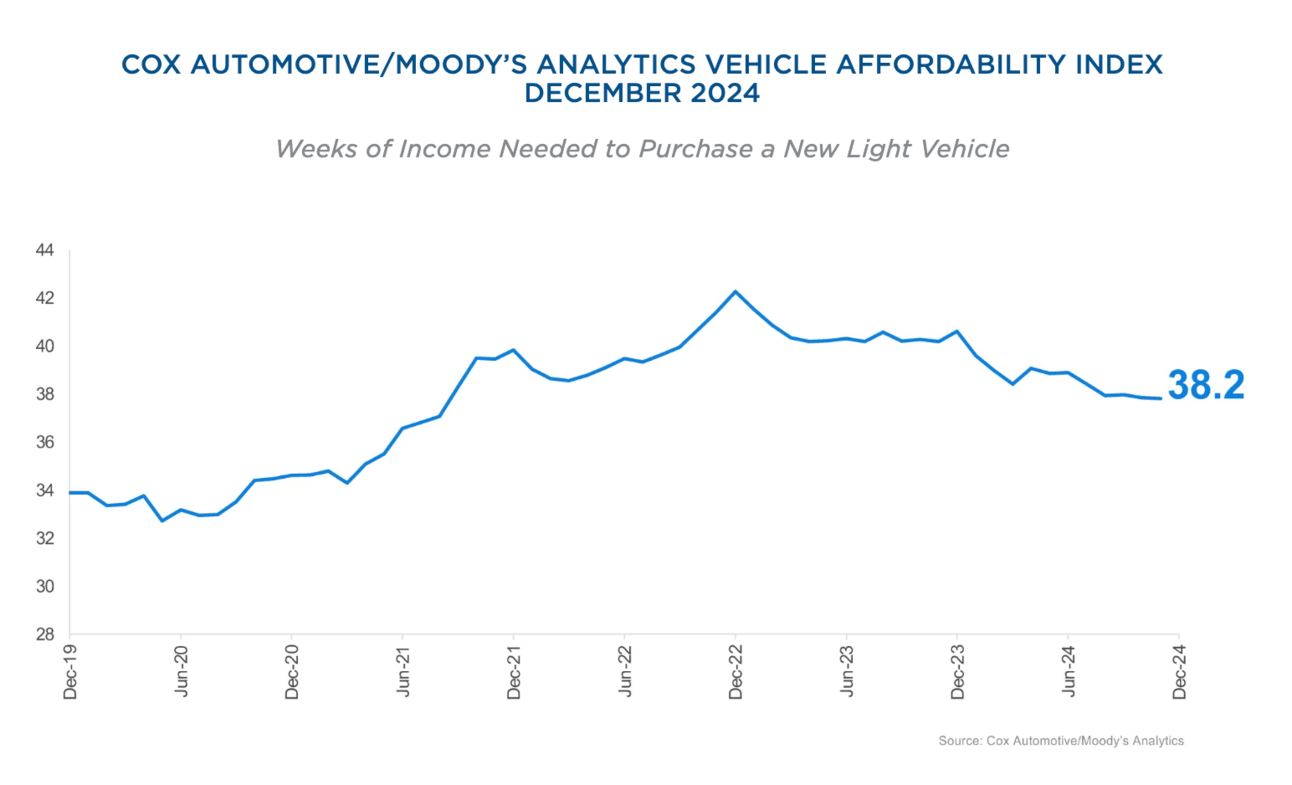

New-vehicle prices still aren’t making it easy for buyers, even with lower interest rates and better incentives in play. But, the latest Cox Automotive/Moody’s Analytics Affordability Index shows slight improvement compared to last year.

What It Takes: Buying an average new car now eats up 38.2 weeks of income, slightly more than 37.8 weeks in November but better than the 40.6 weeks it took a year prior.

Rates Dip, Prices Climb: Loan rates dropped to 9.8%, their lowest in 18 months, but higher prices still leave buyers feeling the pinch.

Salaries Help, Somewhat: Median income rose 3.6% over the past year, which is helping offset some of the sticker shock.

AROUND THE ASOTU-VERSE

🗓️ Coming Soon

📝 January 30th — Public Policy Day with WANADA and the Washington, D.C. Auto Show.

🦀 May 13-16th — ASOTU CON in Baltimore, Maryland.

🥊 Quick Hits

MrBeast is throwing in his bid to acquire TikTok before the ban goes into effect this Sunday. 👹

DJI says they will no longer prevent users from flying their drones over restricted spaces. 😳

Bundle up, America. A polar vortex is on the way. 🥶

🔁 Today in History

1871: The first cable car is patented by Andrew Smith Hallidie in the U.S. (begins service in 1873). 🚎

1920: First day of prohibition of alcohol comes into effect in the U.S. as a result of the 18th Amendment to the Constitution. 🚫

1928: The first fully automatic photographic film developing machine is patented. 🎞️