TOGETHER WITH

Some of today’s stories first hit our LinkedIn yesterday.

Got thoughts? We’d love to read them, reply, and maybe even share them in the email.

Don’t let us do all the talking. 📣

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 3 min

Brand Loyalty, Used Inventory, Toyota’s Production Bounce Back, and a Q&A from NADA’s Board

🏀 Brand Loyalty Rebounds—But Will It Stick?

After years of post-pandemic declines, brand loyalty in auto retail is stabilizing—and even making a small comeback. S&P Global Mobility reports that retention rates inched upward in 2024, with some brands securing their grip on returning customers.

Who’s leading the loyalty race?

@General Motors holds the title for manufacturer loyalty (10 years strong).

@Tesla leads make loyalty for the third year.

@Subaru reclaims its spot for dealer loyalty after a 2023 slip.

@Lincoln Corsair tops model loyalty, while @Land Rover takes most improved.

“We are starting to see a consistent trend of customers going back to the brands they are familiar with.” — Joe LaFeir, S&P Global Mobility

--

⚖ Mitsubishi Dealers Lean into Used Inventory as Margins Tighten

New car margins are shrinking, and some Mitsubishi dealers are adjusting their focus. A recent dealer memo to Mitsubishi’s North American CEO calls for swift action to keep engagement and profitability on track.

What’s happening?

🔹 Some Mitsubishi dealers are prioritizing used inventory over new due to profitability concerns.

🔹 The automaker has responded with trade-in rebates, lower sales targets, and increased bonuses.

🔹 Despite these efforts, some dealers report significant financial struggles, with closures in certain regions.

“We want to do everything to support our dealers.” — Mark Chaffin, Mitsubishi North America CEO

--

🏭 Toyota’s Production Bounces Back—For Now

After a turbulent year marked by a certification scandal, Toyota is back in the green with its first global production increase in 12 months. But is this a sign of lasting momentum?

What’s driving the rebound?

Global output rose 6% in January, with a total of 781,729 vehicles produced.

Japan’s domestic production surged 22%, making up for overseas declines.

North America saw a modest 3% boost, fueled by a major production shift in Mexico.

U.S. sales dipped 1%, while China dropped 14%, balancing out strong domestic demand.

"North American demand remained strong despite snowfall impacts," Toyota noted.

--

❓ Bill Perkins: NADA Board Member

From GM exec to multi-store dealer, Bill Perkins knows retail auto inside and out. His take? Dealers who adapt thrive. With inventory, revenue, and OEM influence top of mind, he’s ready to tackle key industry challenges. Read more in NADA’s recent Q&A

🥊 Quick Hits

BMW remains the top U.S. auto exporter by value, with $10.1B in 2024 exports. 🚢

OpenAI’s GPT-4.5 spotted in ChatGPT’s Android beta, signaling an imminent launch. 🤖

The global automotive fabrics market is set to hit $56.7B by 2035, fueled by demand for sustainable, high-performance materials. 🪡

A Shrek 5 is coming out and has a teaser trailer on YouTube. 👹

Reynolds Makes It Happen

For Reynolds and Reynolds, ASOTU CON isn’t just about lead generation—it’s about investing in what retail auto is today and will be tomorrow.

As a driving force behind the Retail Revolution, Reynolds is equipping dealers with a seamlessly connected system that unifies workflows, minimizes errors, and maximizes profitability—all while empowering teams to deliver a better customer experience.

Their commitment to innovation and dealership success is what makes events like ASOTU CON possible, and we’re beyond grateful for their partnership.

See Reynolds and Reynolds in action at ASOTU CON 2025, May 13-16th in Baltimore!

🦷 The Market in Flux

giphy

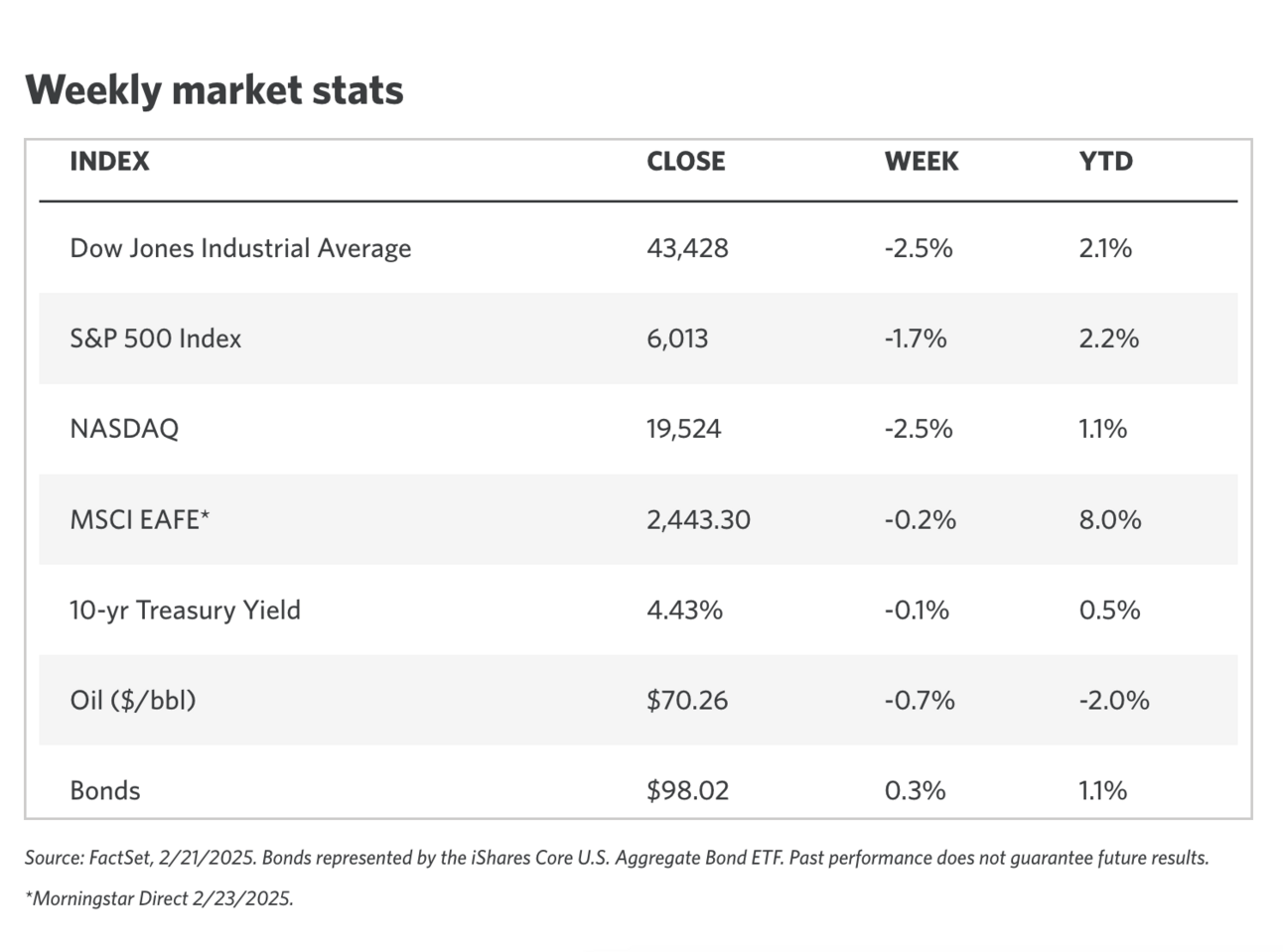

Stock market volatility continues as Trump’s tariff announcement and Nvidia’s earnings shake up investor sentiment. Meanwhile, economic data suggests a shift in consumer confidence.

Tariffs Incoming: A 25% tariff on Canada and Mexico takes effect March 4, while China faces an additional 10% levy. If trade costs rise, vehicle pricing and supply chains could feel the impact.

Consumer Concerns: Jobless claims jumped to 242K, adding to a string of weaker economic reports, including soft retail sales and declining consumer confidence—factors that could influence buyer behavior in showrooms.

Amid concerns about inflation and economic uncertainty, fears of rising tariffs are actually driving some consumers to buy now rather than later.

Buying Before the Hike: Consumers snapped up vehicles late last year, anticipating higher prices due to looming tariffs. That momentum is still carrying over, keeping demand steady.

Strategy Shift: Many retailers are adjusting pricing and inventory to capitalize on both tariff fears and tax refund season. Some are leaning into promotions and flexible financing to turn urgency into sales, while others are stocking up on in-demand models before potential cost increases hit.

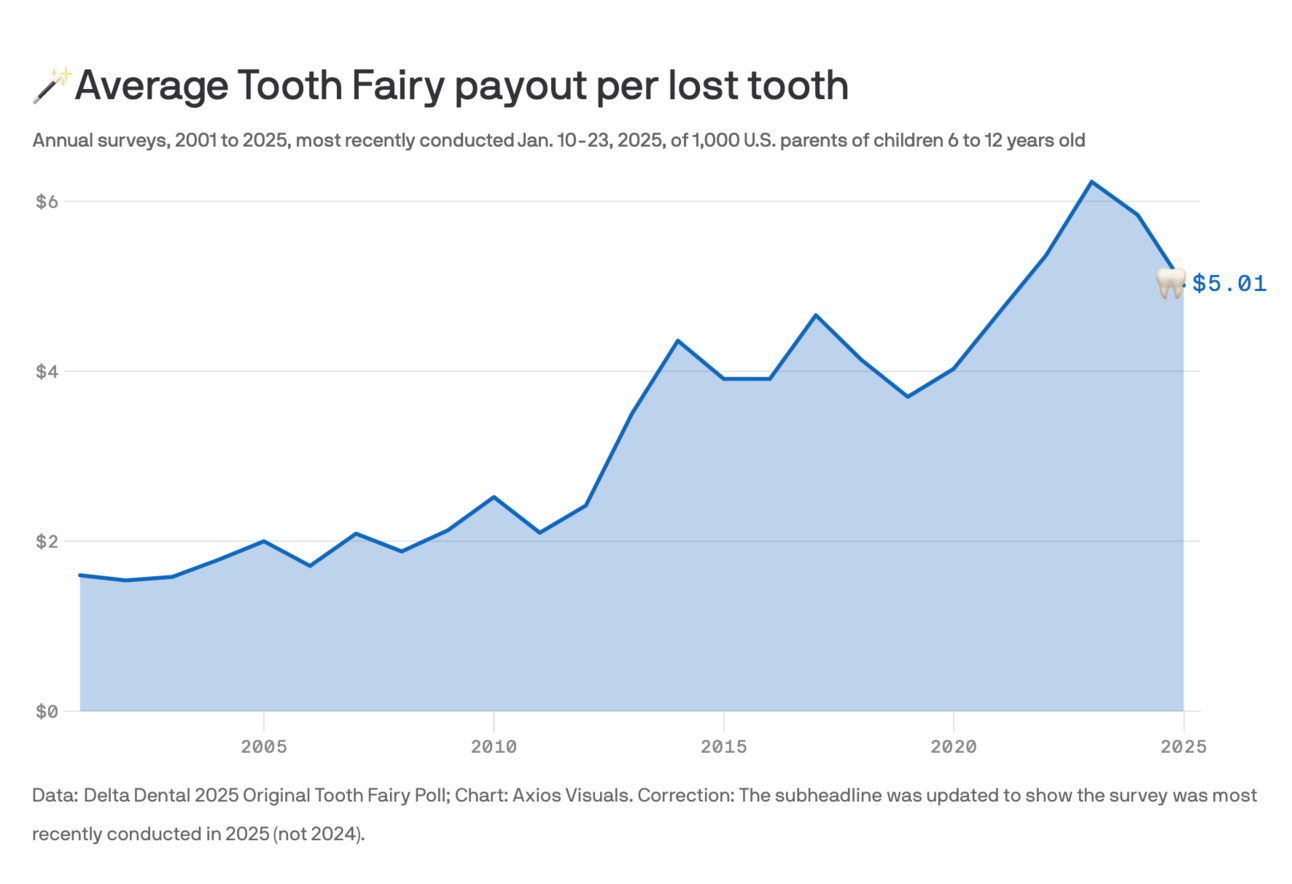

It seems even the Tooth Fairy is feeling the squeeze these days. Delta Dental’s latest survey reveals a harsh reality for kids across America—payouts for lost teeth have hit their lowest rate in years. With tooth futures down, consumer confidence is crumbling like a poorly flossed incisor as young Americans question their financial futures.

Panic at the Pillow: The going rate for a single tooth dropped 14% to $5.01, down from last year’s $5.84 and well below the 2023 peak of $6.23.

First Tooth Discount: Even the traditionally lucrative first tooth payout has suffered a 12% drop, sliding from $7.09 to $6.24—a brutal devaluation for young investors.

Regional Disparities: The South takes the crown at $5.71 per tooth, the only region where the Tooth Fairy raised wages. The Midwest, meanwhile, is in a dental recession, bottoming out at $3.46.

🔁 Today in History

1975: AMC Introduces the Pacer. 🪟

1983: The final episode of M*A*S*H airs, with almost 110M viewers. 🏥

1990: Space Shuttle Atlantis is launched on STS-36. 🚀