TOGETHER WITH

Welcome to another day in the automotive community.

By participating in meeting the mobility needs of your community today, you join millions of people spanning the nation and reaching back over 100 years.

A reminder that each wave that hits the beach is sent by the whole ocean. And the ocean always wins.

Happy Friday!

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 5 mins

BUSINESS

More from May and an Interesting Survey

Giphy

No, we didn't name yesterday's May report news "May Flowers Pt. 1," but that's the cool thing about art; you can only do it moving forward (exactly like life).

--

May Flowers Pt. 2

May was a poppin' for most of the automotive industry, with significant automakers reporting strong US light-vehicle sales and exports, which hit $3.2B over the month. Exports were down 6.2% year-over-year, but passenger cars were up 24% to about $1.12B of the total. Germany was the leading importer of US auto exports. Take that VW?

Toyota

Sales rose 16% to 216,611 units in May.

39% of sales were hybrids, plug-in hybrids, hydrogen-powered, or electric vehicles.

Toyota RAV4 sales surged by 27%.

Honda

May sales climbed 6.4%, with Honda brand sales up 8.2%.

CR-V deliveries increased by 11% and HR-V by 47%.

The all-new Prologue EV began deliveries with 612 units.

Hyundai

Posted a 12% gain in May light-vehicle sales.

The eco-friendly lineup saw a 50% year-over-year increase.

A notable drop in Elantra sedan sales by 15%.

Kia

May deliveries increased by 5% to 75,156 units.

Sportage crossover sales rose 21%, and Forte sedan 31%.

New EV9 deliveries reached 2,187, a 39% gain over April 2024.

Subaru

Sales grew 7% in May, with Crosstrek up 32% and Forester up 45%.

Electric Solterra sales soared by 255%.

Mazda

Reported a 6.9% increase in May sales, with best-ever sales of CX-50 (6,307 units) and CX-30 (8,305 units).

The company's year-to-date sales are up 8.3%.

Consumers Still Favor ICE

A recent KPMG study reveals that Americans still favor gas vehicles over hybrids or EVs, even when prices and features are the same.

Only 20% of respondents would choose an EV over gas or hybrid vehicles.

60% of US consumers want EV charging times of 20 minutes or less, while 41% of auto executives think longer times are acceptable.

Consumers prioritize safety, WiFi, and charging locators over self-driving features and in-car entertainment.

The preference for gas vehicles persists despite a global push for EV adoption, causing automakers like Ford, GM, and Mercedes to rethink their EV strategies.

--

Why should KPMG get to ask all the questions? We want to know from you:

What powertrain would you like to buy next?

TOGETHER WITH ACTIVATOR

30 Minutes to a Better Connection

Reconnecting with customers post-COVID has been a challenge for dealers across the community.

Join Activator Dealer Solutions and ASOTU for an exclusive webinar, "Reawakening Your Dealership: Overcoming Industry Challenges from the Covid Coma," on June 26th at 2 PM ET.

The quick 30-minute session will breathe new insight and hope into critical topics like:

Shifts in customer loyalty

The impact of inventory shortages

And how aggressive pricing strategies have strained dealership-customer relationships.

Win back customers with actionable strategies from our special presenter, Bobby Gaudreau, VP of Sales and Marketing at Activator Dealer Solutions.

Secure your spot today and join us on June 26th for a (re)awakening. Your customers will thank you later.

/MTCM

You’ve got stories, and we want to help you tell them.

This community proves that the car business is about much more than cars. Communities are supported, associates are elevated, teams are formed, and customers are served.

We love it all! Hit the button, and share some of your More Than Cars vibes with us.

DATA & INSIGHT

Checking on the Economy

Giphy

Weekly Economic and Automotive Market Summary

Economic data from this week is shifty and marked by the term “accelerated depreciation,” which are the words we would use to describe that feeling in your chest when you drink too much cold coffee and then sit to read a book.

Automotive Market Insights:

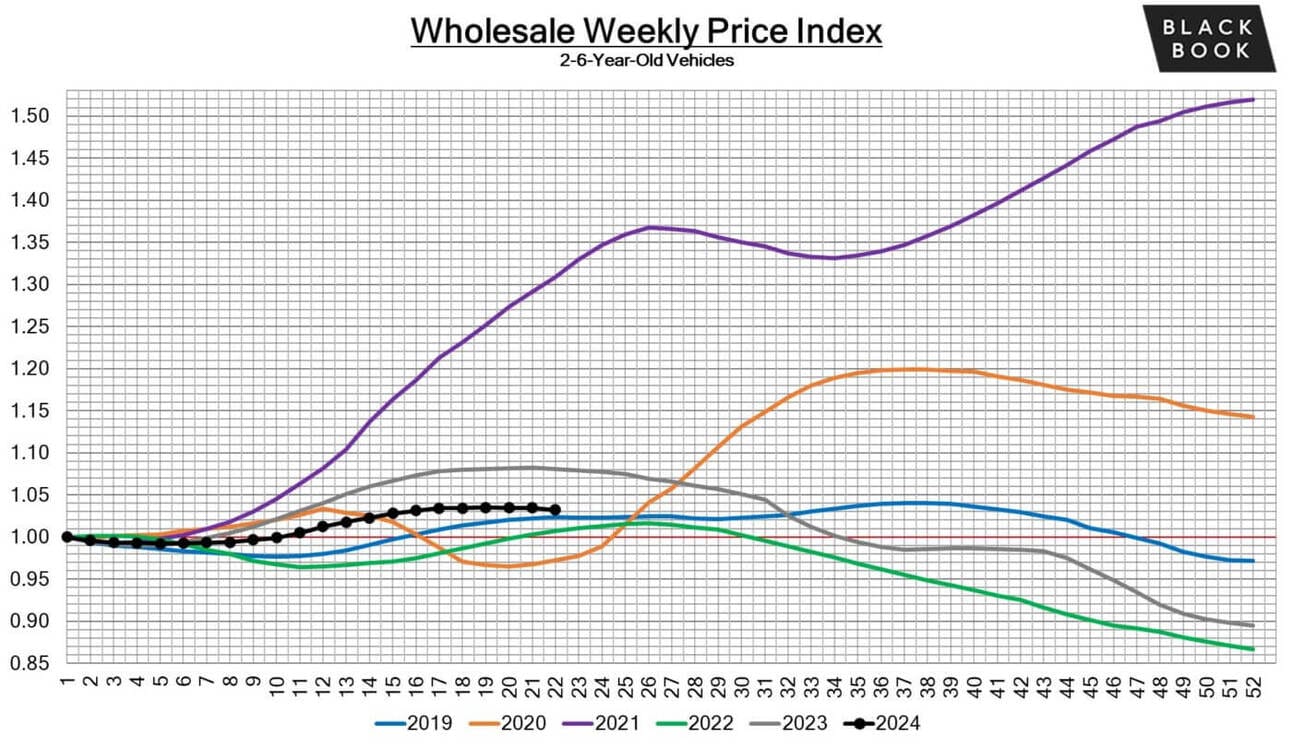

Wholesale prices experienced the most considerable single-week decline since mid-January.

Overall, the market depreciated by 0.49%, up from the previous week's 0.15%.

Truck and SUV segments faced a 0.55% drop.

The compact crossover segment plummeted by 0.78%, marking the most significant decline.

Car Segments:

Mixed performance with an overall decline of 0.34%.

Sub-compact cars led the decline with a 0.77% drop, continuing eight weeks of depreciation.

Sporty and premium sporty cars showed resilience with minimal gains of 0.03% and 0.01%, respectively, continuing a positive trend for ten weeks.

Used Retail Market:

Inventory remains robust, with an estimated day-to-turn time of approximately 40 days.

The average auction sales rate dropped by 2% to 53%, reflecting cautious market sentiment amid fluctuating wholesale prices.

Broader Economic Overview:

Zooming out from the automotive sector, we see a GDP slowdown, causing consumer spending to drag its feet. They’re still spending, but they’re less pumped about it.

GDP and Personal Income:

Fourth-quarter GDP growth revised down to 1.3% from 1.6%.

Personal consumption adjusted to a 2.0% increase from 2.5%.

Personal Income Growth:

Decelerated to 0.3% in April from 0.5% in March.

Employee compensation growth slowed to 0.2%.

Spending Breakdown:

Spending on goods declined by 0.2%, and services decelerated to 0.4%.

Pending Home Sales:

Dropped 7.7% in April, highlighting ongoing challenges in the housing market.

Midwest experienced the most significant decline both monthly and annually.

Consumer Confidence:

Mixed signals with the Conference Board's index rising by 4.6% in May.

University of Michigan's sentiment index fell by 10.5%.

Gas prices declined by 2.8%, potentially boosting sentiment in June.

In summary, trucks and SUVs, once the big moneymakers, are facing depreciation pressure as other mixed economic factors urge consumers to use their cash more cautiously.

AROUND THE ASOTU-VERSE

(Live) Podcasts

ASOTU CON 2024 content is still trickling out across our channels, but our YouTube channel is the place for keynotes, sessions, and podcast stage content.

Check out this ASOTU CON Sessions by Effectv chat with Jim Colon, co-owner of Toyota of Marysville.

They discuss Jim's unique approach to running a negotiation-free dealership, the benefits of a customer-centric sales model, and how this strategy has attracted a diverse workforce, particularly women.

Quick Hits

History

1939: King George VI becomes the first British monarch to visit the United States. 👑

1975: Sony launches Betamax, the first videocassette recorder format. 🎥

1982: Priscilla Presley opens Graceland to the public; the bathroom where Elvis Presley died five years earlier is kept off-limits. 🎸

Thanks for reading, friend! This Friday had a lot of bullet points, but sometimes that is the best way to get to the …well… point. Enjoy, and let us know what’s going on in your world with a reply or on the social media of your choice. (Links below)