Tenor

Despite some market jitters, there’s no sign the bull market is losing steam anytime soon. Growth scares, coupled with election uncertainties, may cause more volatility in the short term, but the bigger picture remains encouraging.

Inflation Eases, but Not Without Hiccups — Inflation has cooled significantly from its 2022 peak, holding steady at 3.2% in the latest report. Most of the recent stagnation comes from rising shelter costs, though other categories like used vehicles and home furnishings saw price declines.

Markets Look Beyond Near-Term Noise — Despite inflation-induced market dips, stocks remain near all-time highs, with investors largely viewing pullbacks as buying opportunities.

The S&P 500 hit an all-time high of 5,678 right after the Fed’s half-point rate cut announcement on Wednesday, but the excitement was short-lived as the market seesawed before closing slightly lower.

While some clarity was expected, the Fed’s decision left more questions than answers, especially regarding the size and speed of future rate cuts.

Mixed Reaction — Chair Jerome Powell defended the cut as sensible both economically and for risk management, while Michelle Bowman’s dissent signaled ongoing debate within the Fed itself.

Foggy Future — Though interest rates are expected to drop to 3.4% by the end of next year, the unpredictability surrounding future cuts is fueling market volatility.

New-vehicle inventory may have stabilized, but dealers are still grappling with the ongoing challenge of moving older models off the lot, and incentive spending is hitting new highs to keep sales afloat.

Inventory Overload — At the start of September, new-vehicle days' supply was holding at 77, down slightly from earlier this year but still far above last year’s 60. With 25% of showroom stock now MY25 vehicles, dealers are trying to juggle the arrival of fresh inventory while sitting on aging MY23 models that refuse to budge.

Aging Stock Weighs Heavy — Brands like Dodge are feeling the pinch, with a staggering 149 days' supply on the ground for MY23 vehicles, nearly twice the national average. Even hefty incentives (5.6% of ATP) aren’t moving these cars fast enough.

Incentives Rise as Prices Slip — Automakers are boosting incentives, with Stellantis lifting them to 7.8% of ATP in August from 5.7% in July. Meanwhile, the average listing price dropped to $46,841—down 1% from the previous month, but not enough to spark major movement.

Compact SUVs Still in Demand — While overall inventory remains high, compact and subcompact SUVs like the Toyota RAV4 and Honda CR-V are still hot, with about a third of all available models now priced below $46,000 as dealers chase affordability-conscious consumers.

Consumer sentiment is showing cautious signs of improvement, despite continued volatility in spending and vehicle supply. The auto market is steadying as vehicle sales hold firm, though financing trends are beginning to shift.

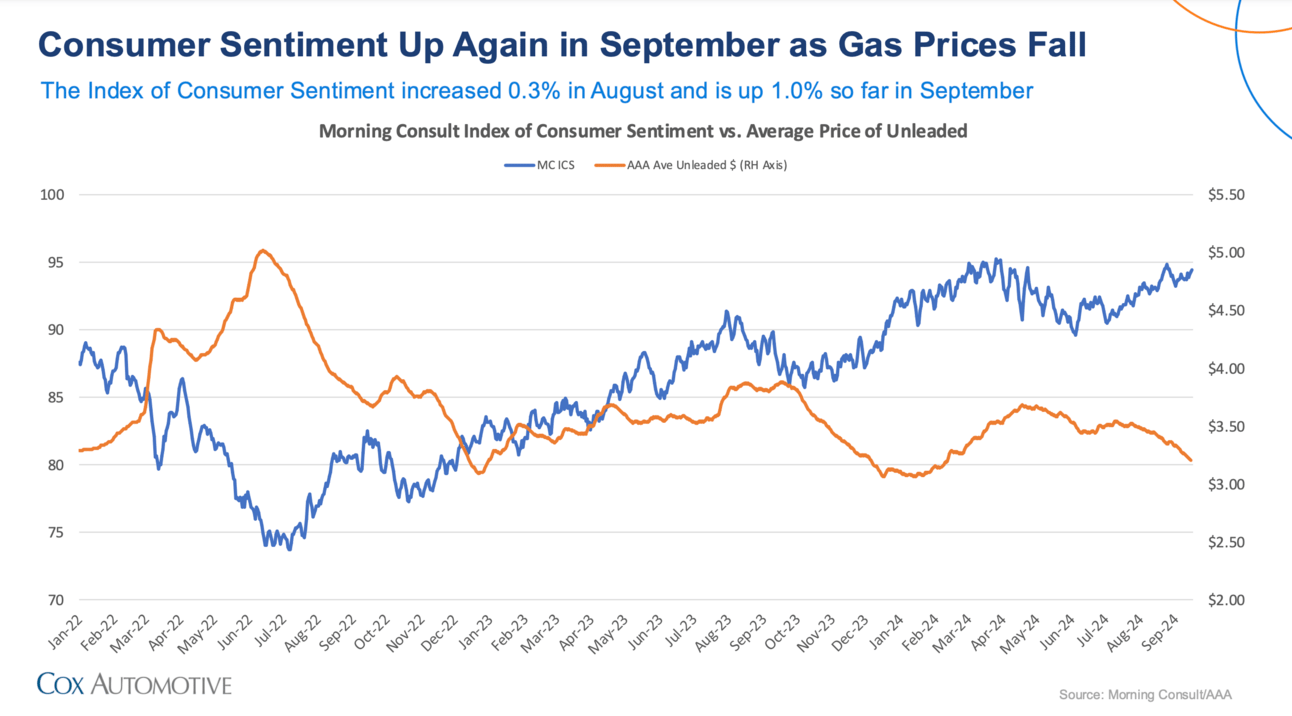

Consumer Sentiment — The Index of Consumer Sentiment increased by 0.3% in August and is up 1.0% so far in September, but consumer spending remains inconsistent, with a negative trend in the second half of June.

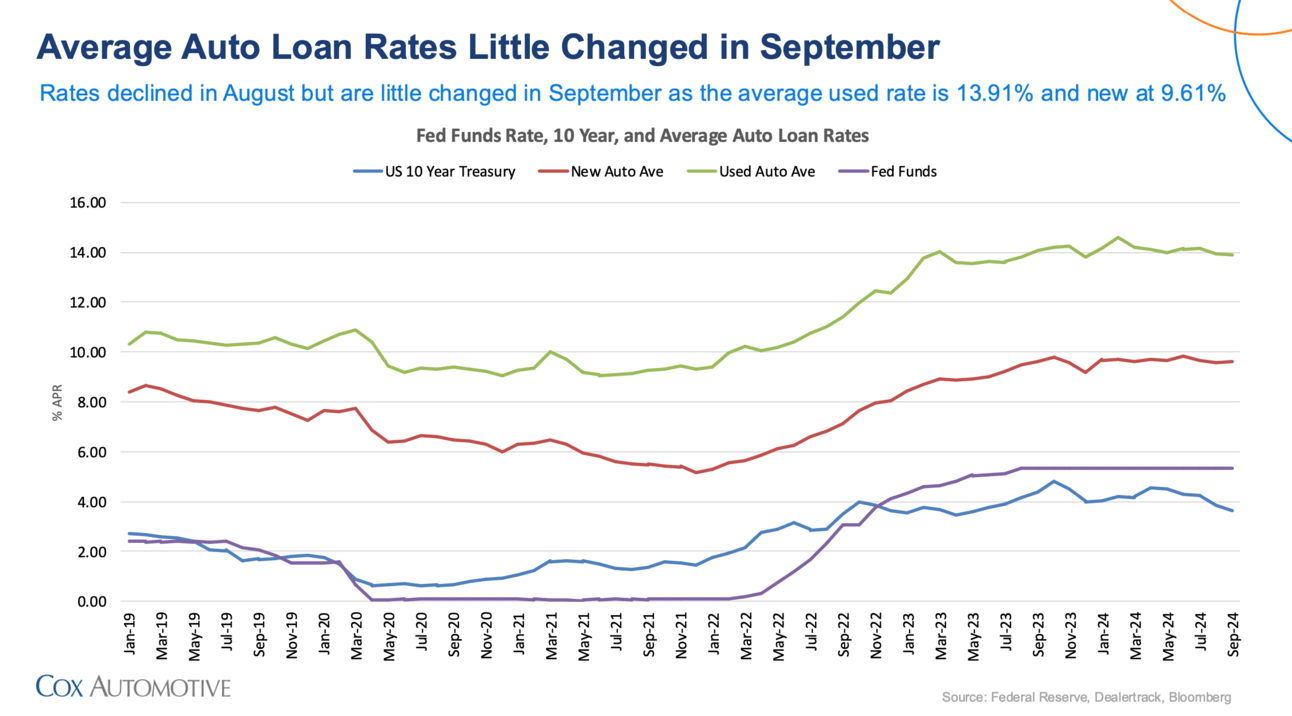

Financing and Loan Trends — Auto loan rates have stabilized, with used car loans averaging 13.91% and new car loans at 9.61%.

📬 For more data and stats like this delivered right to your inbox, subscribe to our daily email. 👇