The Fed's 0.5% interest rate cut last week has set the stage for a new chapter in the market, but don’t expect everything to be smooth sailing just yet. While lower borrowing costs should give both businesses and consumers a breather, there are still a few bumps ahead.

Cyclical Stocks Poised for Gains — With rates headed down, cyclical stocks like industrials and financials are starting to steal the spotlight from tech giants, who’ve had their moment..

Valuations High — Stocks are in a good place, but with valuations already elevated, don’t expect a meteoric rise. Think more of a steady climb.

Bond Yields Falling — As rates drop, bond yields are expected to follow, making this a great time to look at longer-term investments—before those returns shrink further

No Recession in Sight (Yet) — The Fed is cutting without the recession alarm blaring, a rare scenario historically linked to solid market returns. Keep an eye on consumer spending and employment for signs of how long the good times can roll.

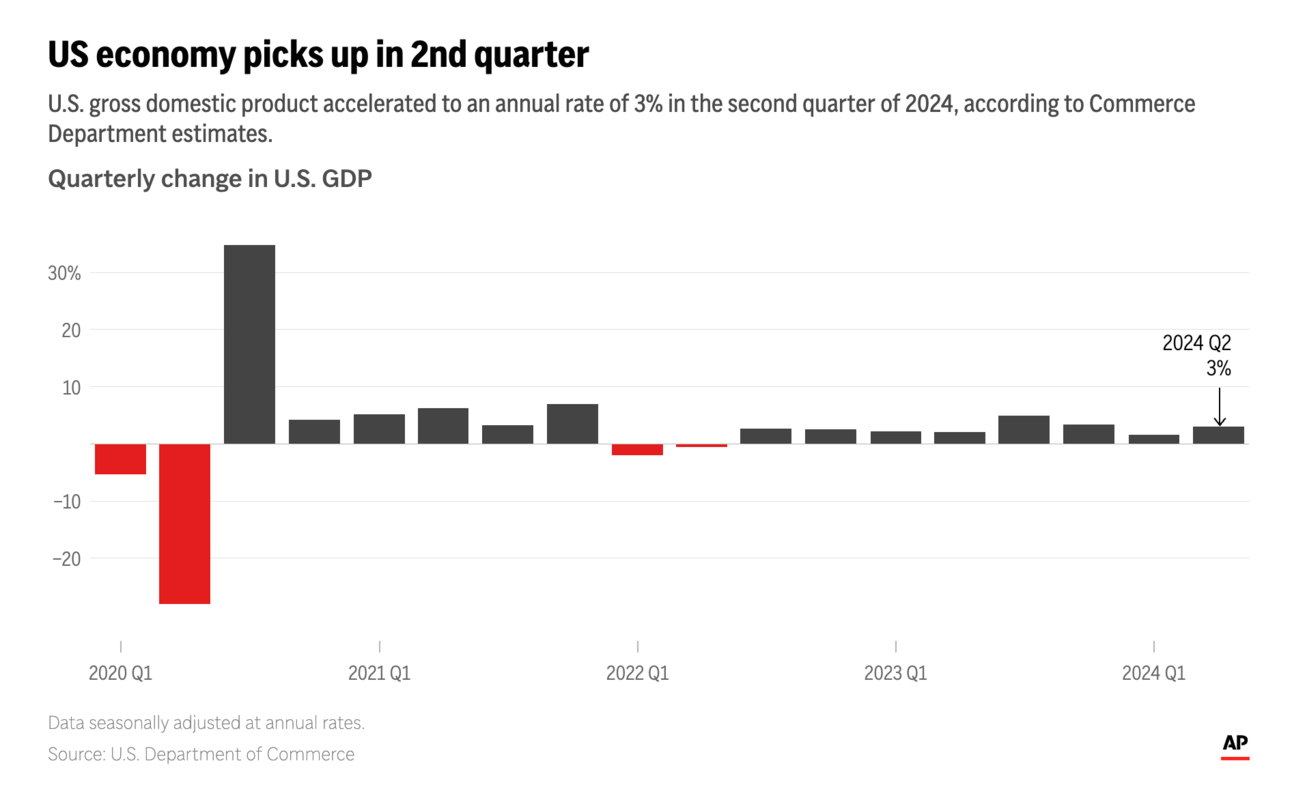

The U.S. economy grew at a solid 3% rate last quarter, driven by strong consumer spending and business investment. Despite rising borrowing costs and job market softening, the economy has shown resilience, especially in sectors like housing and retail.

Consumer Spending Stays Strong — While consumer spending grew at 2.8%, down slightly from earlier estimates, it remains the key driver of economic growth.

Business Investment Surges —Investment in equipment jumped 9.8%, fueling overall business growth at an impressive 8.3% annual rate.

Inflation Eases — Inflation dipped to 2.5%, marking a significant improvement from earlier in the year and moving closer to the Fed's 2% target.

The Fed's latest rate cut has the central bank working to balancing economic growth with rising unemployment and falling inflation. While GDP growth is expected to remain steady, the labor market shows signs of softening as inflation and interest rates continue to drop.

Jobless Claims Hold Steady — Continued unemployment claims remain elevated at 1.83M, down from July’s peak but still higher than earlier in the year.

Layoff Trends — Layoffs hit their highest point of 2023 in August, with 1.76M reported—though still within typical pre-pandemic levels.

Rising Unemployment — The Fed forecasts a gradual but minor rise, with rates hovering just over the 4% mark for the next three years.

Cox Automotive has reported a slight dip in September sales volume. Year-to-date sales remain up less than 1% compared to 2023, signifying a somewhat slower recovery pace for the auto market.

September Projections — Sales are forecasted to drop more than 16% from August, largely due to fewer selling days, but the SAAR is expected to rise to 15.9M.

Cox also updated their overall 2024 forecast slightly to reflect a year of flat to weak growth in sales. Certified pre-owned (CPO) sales continue to struggle due to supply constraints, and the used market, while starting to recover, is hampered by a shrinking pool of younger vehicles.

2024 Outlook — Total new-vehicle sales are expected to reach 15.7M, up from 15.5M in 2023. However, most of the growth is being driven by fleet demand, not retail consumers.

Leasing Boom — Leasing is projected to rise, as manufacturers increase incentives, with lease penetration expected to hit 25%.

Used Car Blues — The availability of younger vehicles in the used market is constrained, leading to slow recovery. Lease maturities, a key source of used inventory, are expected to decline substantially through 2025.

Vehicle Values — Used-vehicle values are projected to decline for the third straight year, but the drop will be less severe compared to the last two years, signaling a return to more normal depreciation trends.

Sales declines at GM, Toyota, and Stellantis are throwing a wrench into the otherwise steady market.

Honda on the Rise — Honda's riding high with CRV and Accord sales leading the charge, boosting its market share by nearly 1%. Honda has muscled its way into the Top 5 automakers in the U.S., bumping Stellantis to No. 6.

Retail Sales Dip — Despite the slight overall market increase, retail sales—vehicles bought with cash or loans—are down 4% year over year. Meanwhile, fleet sales are up by 7%, and leasing has jumped a whopping 24%, thanks to hot EV and plug-in hybrid deals.