🌱 Plant Disruptions: VW, GM, and Ford

Tenor / Disney

Volkswagen is taking drastic measures to stay afloat, announcing factory closures and job cuts across Germany. The company’s management is facing mounting pressure to restructure, with falling profits and declining demand putting Europe’s biggest carmaker on the defensive.

Factory Closures and Layoffs – VW plans to shutter at least three factories in Germany, impacting thousands of employees. Daniela Cavallo, head of Volkswagen’s works council, confirmed that all German plants will be affected, with pay cuts and the elimination of wage raises until 2026 also on the table.

Financial Woes and Market Struggles –The company’s troubles include reduced market demand in Europe and fierce competition from imports. With production costs rising and sales struggling, VW has been forced to lower its 2024 outlook, now projecting a drop to $356.7B in annual revenue.

Too Much Ebb, Not Enough Flow – On top of its financial woes, VW recently recalled over 300K Atlas and Atlas Cross Sport SUVs due to airbag defects. AND, the company is sitting on an excess of around 50K unsold cars, which is equal to the output of two factories. Yikes.

United Auto Workers Local 2209 is gearing up for a crucial strike authorization vote at GM’s Fort Wayne Assembly Plant on Wednesday, stemming from unresolved disputes over the treatment of temporary workers and overall job security. Here’s what’s at stake:

Strike Vote at Fort Wayne Plant – UAW members will vote on whether to authorize a strike in response to GM’s decision to lay off 250 temporary workers. While the vote empowers the union, it does not automatically lead to a strike.

Worker Frustrations – UAW leadership has been advocating for many temps to be transitioned to full-time roles, but GM has resisted, leading to growing tensions.

GM’s Stance – GM has asserted that it remains compliant with labor agreements and believes there is no legal basis for a strike.

In a new deal with LG Energy Solution, Ford is shifting battery production for the Mustang Mach-E from Poland to Michigan starting in 2025, aligning with the sweet incentives offered by the Inflation Reduction Act.

Shop Local – Why build batteries abroad when you can do it in Michigan and snag tax credits of up to $7,500 for EVs and plug-in hybrids? It’s a no-brainer. Ford’s shift will qualify them for those local production incentives.

Big Battery Deal – LG is set to provide Ford with 109 GWh of batteries starting in 2026, powering the electric commercial vans in the U.S. But that’s not all—LG’s also teaming up with Toyota to fuel their U.S.-made EVs, thanks to a $3B investment in Michigan.

What’s Next? As Ford, GM, Toyota, and others scramble to lock down domestic battery supply chains, the EV race is heating up, driven by federal incentives. It's all part of the big pivot to electrification, where everyone wants a slice of those tax credits and a spot on the EV leaderboard.

🕵️ CFPB: Reel in the Recon and Junk Fee Scrutiny

giphy

The Consumer Financial Protection Bureau (CFPB) just dropped new guidance that could change how dealerships handle employee background checks and worker surveillance. This update is a wake-up call for any dealership using third-party reports or employee tracking systems—better make sure you're playing by the rules. If you're hiring or managing staff, here’s what you need to know:

Consent is Key — Before using third-party reports to make hiring or management decisions, you need to get explicit consent from your employees. Whether you're tracking performance or running background checks, transparency is no longer optional.

Facts Matter — If a worker disputes the info in one of those reports, you’re now required to correct or delete any inaccuracies. This could stop unfair actions like firing or demotion based on bad data.

Stay in Your Lane — These reports can only be used for evaluating employees — not for marketing, reselling, or anything outside the legal limits. So make sure you're using that data for its intended purpose only.

Keeping track of consumer complaints lodged with the CFPB can give you valuable insight into what’s bothering your customers—and what might soon be on their radar.

The agency is using its complaint portal to track emerging consumer problems, and the auto industry is being put squarely under the microscope.

Out of 2,821 complaints related to vehicle loans or leases, consumers flagged the following:

Loan Servicing and End-of-Term Problems — Issues like repossessions and challenges managing loans made up 36% of complaints, while 28% were tied to general loan servicing headaches.

Fraud and Unexpected Fees — Consumers frequently mentioned fraud and unwanted products or services. Surprisingly, complaints rarely centered on the terms of their loans or aftermarket products—just the surprise charges they didn’t think they owed.

Loan Application and Approval Issues — About 15% of complaints involved struggles with securing loans, misleading marketing, or changes in terms after the deal was done.

The Bottom Line? With the CFPB zeroing in on “junk fees” and consumer pain points, dealers and lenders should focus on transparency and customer service to stay ahead of any potential regulatory action.

🛒 How Customers Search for EVs

Tenor

Carvana's Q3 2024 EV Trends Report reveals notable shifts in consumer behavior, particularly a growing interest in electric vehicles. Here are some key insights from the report:

EV Search Growth — EV searches have surged, with EV page views on Carvana up by 226% YOY in Q3. Tesla remains the top-searched make, but Ford’s Mustang Mach-E is gaining ground, now surpassing the F-150 Lightning in popularity.

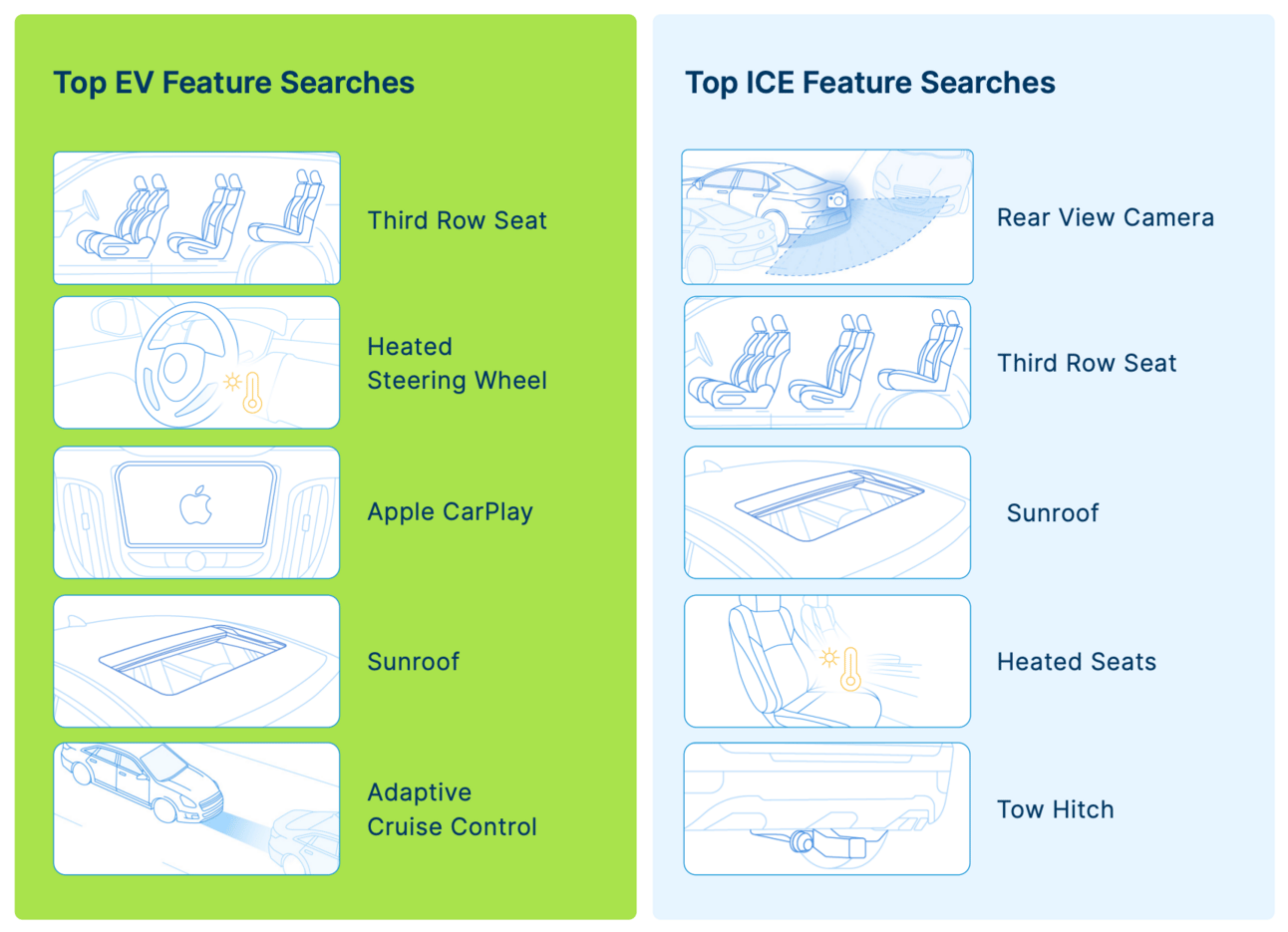

Luxury Features Drive Interest — EV shoppers tend to favor higher-end features, such as heated steering wheels, adaptive cruise control, and Apple CarPlay, which show a preference for tech-forward, luxury elements in their vehicles.

EV Shoppers Aim for Newer Models — Consumers searching for EVs typically prefer lower-mileage, newer models, and are willing to pay more for these preferences. The average search range for EVs in 2023 was $31K, compared to $18K for internal combustion engine vehicles.