TOGETHER WITH

Happy Friday, Friend!

We’ve got more moving parts than a Cybertruck on the interstate. (Get it? Because the stainless steel plates are falling off 🤷♂)

Check out today’s email for news, invitations, and data, then head over to LinkedIn for more from ASOTU all day.

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 3 min

Service Costs, Canada’s Exit, and Auctions Jump

📈 Used Car Market Hits Post-Pandemic Highs

7.6M vehicles sold at auction in 2024, the highest since 2020. Prices are dipping, but volume is surging—a signal that wholesale remains a key inventory source for dealers. (Turns out, chaotic markets reward those with the right inventory.)

--

🛠 Tariffs Set to Drive Up Service Costs

A 25% tariff on auto parts from Canada & Mexico is coming April 2, and dealers are bracing for price hikes up to 15%. Some are urging customers to book service before costs rise. (If parts pricing wasn’t already unpredictable enough…)

--

✌ AutoCanada to Exit U.S. Market

The Canadian dealership group is selling its 10-store U.S. operation in Illinois after years of losses. If you’re in the Chicago market, this could shake things up.

--

➕ More

Read more on these and several more stories in our daily digest.

The Power of Data. The Precision of StoneEagle.

StoneEagle built the foundation for success by bringing dealers, agents, and providers together to drive F&I product sales. Decades of expertise led to unmatched reporting capabilities — giving you the power to measure performance at every stage of the deal.

Now, they’re taking it even further.

Unlock the power of real-time, transaction-level intelligence for a complete market view.

✅ DATA WITHOUT BLIND SPOTS — A full lens into 100% of transaction data across 50%+ of the market, delivering insights beyond any DMS.

✅ REAL-TIME INTELLIGENCE — Next-day transaction data replaces outdated, 90-day-old state registration data for unmatched accuracy.

✅ StoneEagleMETRICS — The gold standard in reporting, delivering a crystal-clear view of every deal to power sales and F&I performance.

StoneEagle is your ONE TRUE SOURCE for fueling growth with the industry's most powerful, real-time data.

See the Full Picture — Schedule a Demo Today.

DATA & INSIGHT

Market Momentum Stalls

Tenor

Wall Street’s bull party is rapidly losing steam.. Investors are pulling back, economic data is flashing warning signs, and corporate uncertainty is growing. The S&P 500 briefly entered correction territory, marking its steepest drop in over a year. With trade policies in flux and consumer confidence slipping, the road ahead looks increasingly uncertain.

Major Indexes Slide: The S&P 500 is down 10.1% from its February high, and the Nasdaq has fallen 14%, marking its sharpest pullback in over a year.

Global Markets Outperform: While U.S. equities struggle, bonds have outperformed stocks, and international markets—including Europe and China—have posted gains of 8%-10%, showing the importance of diversification.

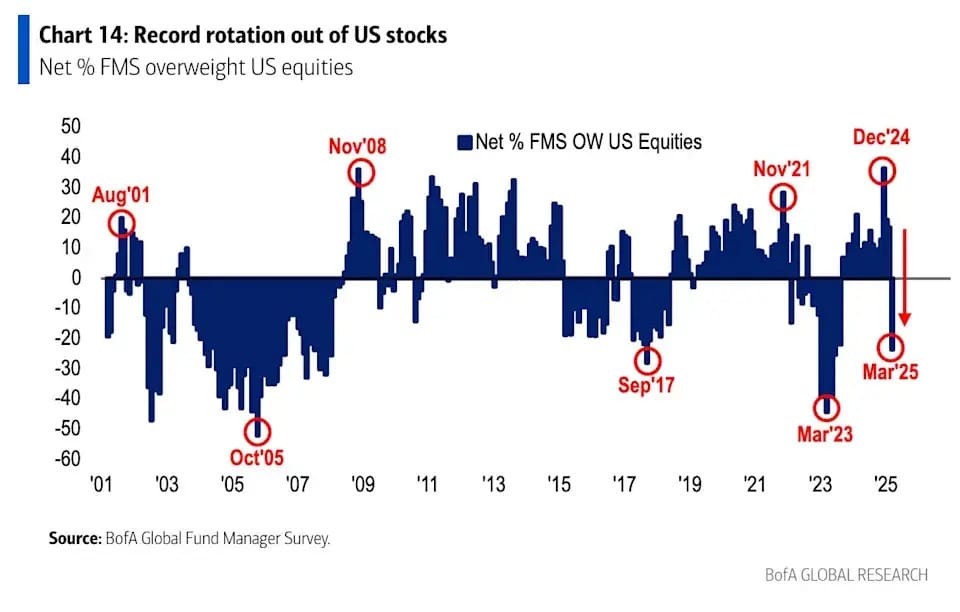

Global fund managers recently executed the biggest U.S. stock sell-off on record, shifting billions into international markets. Why? Stagflation fears, trade war uncertainty, and doubts about America’s economic strength.

U.S. Stocks Dumped: Between March 7 and 13, fund managers overseeing $426B slashed U.S. equity holdings to the lowest levels since June 2023.

Stagflation Looms: 71% of fund managers predict a painful combo of slow growth and persistent inflation, limiting the Fed’s ability to act.

The Great Rotation: Nearly 70% of fund managers believe U.S. stock outperformance has peaked, shifting capital to Europe, the UK, and emerging markets.

New EV sales dipped 5.9% last month, but overall demand is holding strong (up 10.5% YOY). Used EVs are flying off lots faster than last year with luxury brands gaining significant traction. Plus, incentives are still keeping new EVs appealing (and affordable).

Luxury EVs Shine: BMW and Rivian crushed it with 20.9% and 34.0% gains (though Tesla slipped 10%, with Cybertruck sales down a steep 32.5%).

Tight Inventory: New EV supply jumped 16.8% to 104 days but remains 31.7% below last year. Used EV supply is up slightly to 49 days, keeping the market competitive.

Deals Are Getting Sweeter: New EV prices slipped 1.2% to $55,273 thanks to record-high incentives. Used EVs crept up 1.8% to $38,057, with nearly 40% selling under $25,000.

AROUND THE ASOTU-VERSE

The Automotive Troublemaker’s 1000th Episode

Join us Tuesday, Mar 25, 2025, at 8:15 AM CST for a celebration of 1,000 episodes of the Automotive Troublemaker podcast.

1,000 early mornings of prep.

1,000 conversations.

1,000 looks at retail auto and all it’s accomplishing in its people and communities.

And, of course, well over 1,000 ✨ segues ✨

RSVP here so LinkedIn can remind you when it's showtime!

🥊 Quick Hits

Chat app Discord is looking into video ads ahead of its expected IPO. 📺

Mortgage rates increased for the first time in 9 weeks. 🏠

According to early reviews, the new Toxic Avenger is gross, offensive, and great (apparently, the trailer is pretty rough, so there is no link this time). ⚠

🔁 Today in History

1923: The one millionth Buick is produced. 🚘

1965: Martin Luther King Jr. leads 3,200 people on the start of the third and finally successful civil rights march from Selma to Montgomery, Alabama. 🇺🇸

1970: San Diego Comic-Con, the largest pop and culture festival in the world, hosts its inaugural event. 💥