TOGETHER WITH

Knowledge is power. But what’s power without wisdom?

Don’t spend all day dragging something that rolls, friends.

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

TODAY’S LOT WALK

DATA & INSIGHT: Economic insights from our friends at The Automotive Advisor Team. 🤓

BUSINESS: UAW v. Ford, Toyota, Tesla, Nio. 💃

CULTURE: New robot skills. 🧱

Reading time: 4 mins 16 secs

DATA & INSIGHT

Mid-Month Market Watch

Giphy/Aardman

🎢 Economic Ups and Downs:

☝️Consumer spending was up 17% in September with transportation and services leading the way.

👇 Core price inflation continues to decline on a year-over-year basis.

☝️ Wages are up 10.2% since 2019, equating to an additional $854 per month for families earning $100K annually.

👇 Homeowners have been rushing to refinance with 62% of mortgages now below 4%, and 24% below 3%.

☝️ Credit card debt increased by $14.68B (though consumers are taking out fewer auto and student loans).

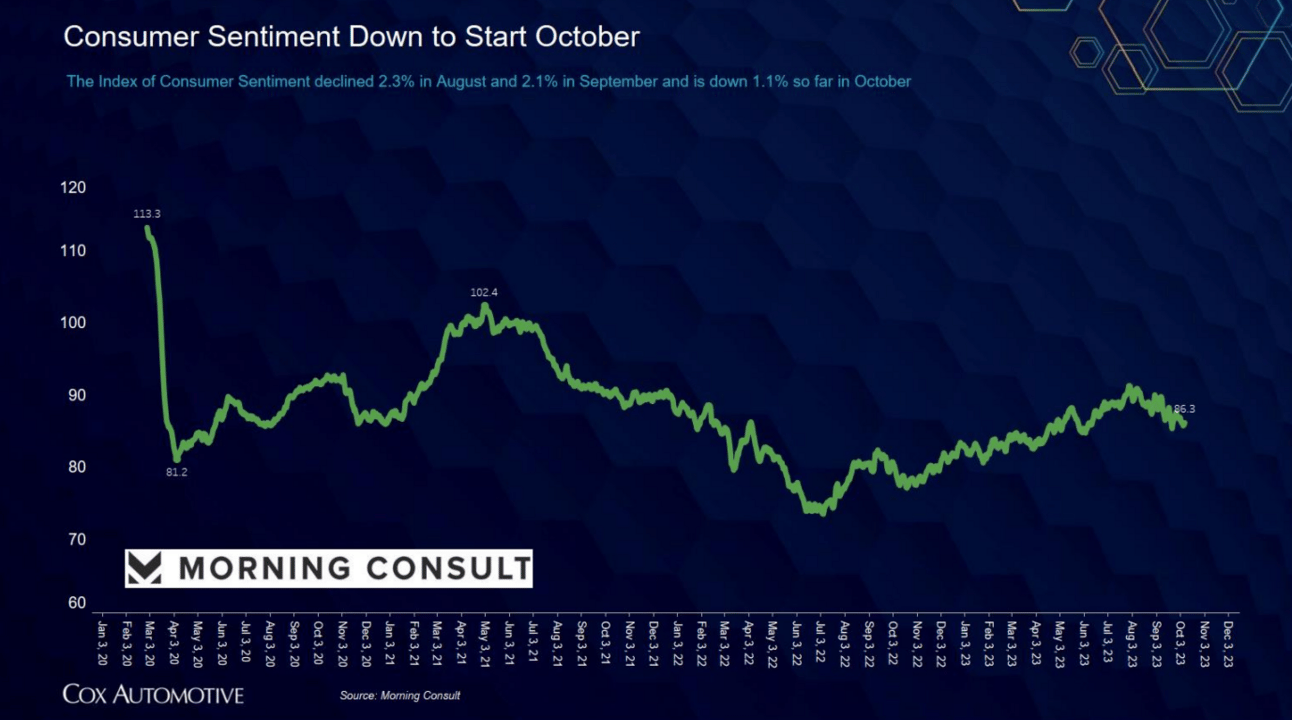

👇 So far, October has shown a decline in consumer sentiment.

🩴 New-to-Used Value Shifts:

In 2019, the new car premium was a whopping 55%, now it's a measly 15%, making used cars a competitive choice.

Consumers, once enticed by warranties and that new car smell, now find used vehicles more financially appealing.

📈 Pent-Up Demand and Retail Sales:

Automakers' production dip led to an 8.1M shortfall in new vehicles.

Retail sales rose by 30% in new cars and 6% in used cars YOY, though recent data indicates a plateau.

📉 Day Supply and Pricing Trends:

Softening retail sales led to a 7% increase in new car day supply and a 3% rise in used cars.

Used car prices fell by 2.6%, aligning with recent retail price declines.

📊 Wholesale and Acquisition Insights:

Truck segment stood out with a 1% YOY rise, while other segments dipped.

Wholesale conversion rate mirrors 2021-2022 numbers at 55.1%, with 26 days of inventory supply.

Margin compression eased slightly, but dealers continue to grapple with inventory shortages.

TOGETHER WITH VINCUE

Vision and Values

This week, More Than Cars Episode 2 will premiere for our community to enjoy! The folks at Beaver Toyota of Cumming gave us the full tour with support from our friends at VINCUE.

We asked Angela Rizzo, CMO of VINCUE, about their relationship with Beaver Toyota, and she told us:

"We support Beaver Toyota because it's more than a dealership; it's where employees grow their careers. It's almost like a family — over 50 people even relocated from Tampa to Cumming to work there. It's beyond cars, they're about community. With amenities like a restaurant and salon, they truly connect with customers, and we're proud to back their vision and values."

Learn more about how VINCUE empowers the Beaver Toyota Team in More Than Cars Episode 2, or find out for yourself with a test drive of their capabilities!

BUSINESS

Breaking Down The Biz

Giphy

UAW Strike

The strike lingers on, and Ford's chairman says it is time to make a deal:

🔹 Duration: Autoworker strike against Ford is now in its fifth week, significantly affecting operations.

🔹 Bill Ford Speaks: Ford's executive chairman appeals for strike resolution. Silent on the union status of future EV battery plants, unlike GM's recent move.

🔹 Financial Limits: Kumar Galhotra, president of Ford's operations, says they've maxed out their financial offerings to the UAW.

Giphy/NBC

🔹 Operational Impact: Strike forces shutdown of the pivotal Kentucky Truck plant. Over 34,000 workers on strike and 2,480 furloughed.

🔹 UAW's Stance: Union demands better compensation. UAW President Shawn Fain points out the disparity with Ford executive pay.

🔹 Company Image: The dispute challenges Ford's traditionally union-friendly reputation.

MEDIA ROOM

CARS is now Cars Commerce

Cars.com Inc. is rebranding as "Cars Commerce", consolidating its commercial brands to enhance its platform strategy across pretail, retail, and post-sale activities. The move aims to simplify the car buying process, reduce operational complexities, and improve profitability. The platform will feature four core capabilities: a marketplace with Cars.com at its center, a digital experience powered by Dealer Inspire, a trade & appraisal system via Accu-Trade, and a unified media network.

The Cars Commerce brand and new visual identity system was created by FutureBrand, IPG’s brand-led business transformation agency. For more information about Cars Commerce and its connected platform capabilities, visit: www.carscommerce.inc.

Paul J Daly had a chance to sit down with Doug Miller, President of Cars Commerce, to discuss the brand’s renewed focus.

Toyota’s New Hybrid

Across the globe, Toyota's not jumping fully into the EV train just yet. The 2024 Toyota Crown is the latest model showing off its hybrid prowess. It offers two mild-hybrid powertrains, a blend of luxury and tech features, and a design nodding to both future and tradition. This throwback model, big in Japan, recently made its U.S. comeback and will breathe fresh life into the "How electric is too much too fast?" conversation. 👑🔋🚘

Tesla Explores Ads and Apps

Tesla has dominated its market while playing its own game. Now, it may open up a bit. While not fully endorsing third-party apps, they're giving developers a tiny peek, hinting at potential support. Meanwhile, with Tesla slashing prices and facing sales growth concerns, some investors think it's high time Elon Musk hops on the ad train, like GM and Ford. Do you think they will conquer these new realms, or should they stay at the top of their game? 🚗📱📺

Solid State of the Art

The solid-state battery race is still on, and it looks like China is taking the lead. NIO's solid-state battery game is strong! In under 6 months, they've gone from planning this tech for 3 EVs to 11 more. Teaming up with WeLion, NIO's eyeing longer drives and quicker charges for their cars. They've got paperwork in, hinting both current and future models get an upgrade. 🚗🔋💨

AROUND THE ASOTU-VERSE

Coming Soon

Wednesday, October 18th @ 1:00 pm EST / 12:00 pm CST:

More Than Cars Episode 2

Beaver Toyota of Cumming live stream premiere.Wednesday, October 25th @ 2:00 pm EST / 1:00 pm CST:

ASOTU EDGE 30-Minute Webinar in Partnership with Foureyes

The Struggle is REAL, y’all. Find out how data is destroying the customer experience. 🤯

Podcast

Enjoying our daily email? Then, we expect you’ll dig our daily podcast, too!

The Automotive Troublemaker is a quick look at the day’s retail, tech, culture, and of course, automotive news.

CULTURE

Stackin’ Bricks

Giphy/Hadrian

🤖 Robots can do many things: build cars, write shotty poems, and even create glorious pictures of nonsense at our whim and behest.

👷♂️ The Hadrian X robot has a new skill- bricklaying.

🇦🇺 Born in Australia, it can lay a tennis-court-sized wall in just 4 hours. Arriving like a regular truck, it unfolds a 105-ft arm, placing up to 500 massive blocks per hour. Operated via tablet and guided by CAD plans, it's revolutionizing construction.

🐰 Some quick math suggests this robot could build an entire home from bricks in 2 days.

Quick Hits

History

1814: Eight people perish in the London Beer Flood. 🍺

1907: The first commercial wireless telegraph is sent over the Atlantic Ocean. 🌎

1969: The first Plymouth Superbird is completed. 🦅