The Gist

Our team was on-site at the J.D. Power Auto Summit 2025, where industry leaders shared key takeaways from last year, and top predictions for the one ahead.

Thomas King outlined a stabilizing market, with total sales projected at 16.3M units; but profitability challenges persist, especially as EV production ramps up slower than expected.

Jonathan Banks highlighted the tightest late-model used vehicle supply in nearly a decade, urging dealers to adopt aggressive sourcing strategies.

Elizabeth Krear offered a realistic outlook on EV adoption, emphasizing the need for better infrastructure and consumer education to drive growth.

The Modernizing Your Dealership Playbook panel stressed the importance of inventory precision, digital retailing, and adapting to affordability pressures.

🚘 U.S. Automotive Outlook with Thomas King

Thomas King, President of Data & Analytics and Chief Product Officer at J.D. Power, delivered a comprehensive analysis of the U.S. automotive market during his annual Automotive Outlook session.

Here’s are some of the key takeaways that will shape the industry in 2025:

Market Dynamics: Stability Amidst Challenges

The automotive market is stabilizing, with total sales forecasted at 16.3M units for 2025, a modest increase of 300K units from the previous year. Retail remains the dominant channel, though fleet sales are expected to grow slightly.

Key Insight: "We’re on a gradual journey back to pre-COVID levels," King noted. While profitability is declining, the industry is holding steady in volume and expenditure.

EV Market Struggles

Despite heavy investment in electric vehicles, the anticipated surge in production and sales has not materialized. King attributed this to delays in product launches and slower-than-expected production ramp-ups.

Shifting manufacturing capacity from gas-powered vehicles to EVs has created a bottleneck, limiting overall production. If these delays hadn’t occurred, 2024’s total production could have approached 17M units instead of the actual 16.5M.

King also emphasized that significant investments in EV manufacturing have led to aging gas-powered vehicle portfolios. The average age of gas vehicles on sale has reached a record high, presenting challenges for dealers trying to sell models that feel outdated while being more expensive than their predecessors.

Pricing and Profitability: A Mixed Picture

While transaction prices for new vehicles have declined slightly, average monthly loan payments hit a record $756, driven by rising negative equity in trade-ins. A quarter of buyers are now upside down on their loans, creating major affordability challenges.

Incentives Return: Discounts are creeping back, averaging $4,000 per vehicle—on par with pre-COVID levels.

Profit Decline: Retail profitability is projected to fall to $22B in 2025, down $6B from last year.

King’s Perspective: "The profit environment is deteriorating but remains above pre-COVID levels. The industry is on a path to long-term stability."

Inventory and Fleet Dynamics

Inventory levels are improving across manufacturers, but King noted significant variation between brands. Importantly, automakers resisted the temptation to offload excess inventory to fleet customers, maintaining discipline in fleet sales.

Consumer Trends: Younger Buyers Decline

Buyers under 35 now make up just 17.5% of the market, down from 25% a decade ago. Negative equity and affordability challenges disproportionately affect this demographic, reducing their participation in the market.

Regulatory and Economic Uncertainty

Tariff speculation and potential changes to federal EV tax credits add layers of unpredictability. For example, a 10% tariff on Mexican-built vehicles could add $7.6B in costs, directly impacting dealers and consumers.

Outlook for 2025

The industry faces a balancing act as it navigates affordability, EV adoption, and inventory management. King summarized the year ahead as one of gradual progress with ongoing challenges in profitability and consumer affordability.

Bottom Line: "It’s a year of modest growth and recalibration. Dealers and manufacturers will need to remain disciplined and creative to maintain stability."

J.D. Power

🔎 Used Vehicle Outlook with Jonathan Banks

In a detailed exploration of the used car market, Jonathan Banks, VP of Product Development for Valuation Services at J.D. Power, offered critical insights for dealers, OEMs, and suppliers at the annual Used Vehicle Outlook session.

His analysis focused on 2024’s trends, challenges facing the 2025 market, and actionable strategies to maintain profitability in a competitive environment.

Key Takeaways:

Used vehicles remain a key source of profit for franchised dealers.

Lower supply of used vehicles = increased diligence on inventory selection and prices being paid.

Big drop in off-lease supply a real challenge for franchised dealers.

Understanding new vehicle performance is critical when buying used inventory.

Increased competition for used inventory = resilient wholesale values.

Strong consumer demand for affordable vehicles = resilient retail values.

Have to work even harder to maximize used vehicle profit opportunity.

J.D. Power

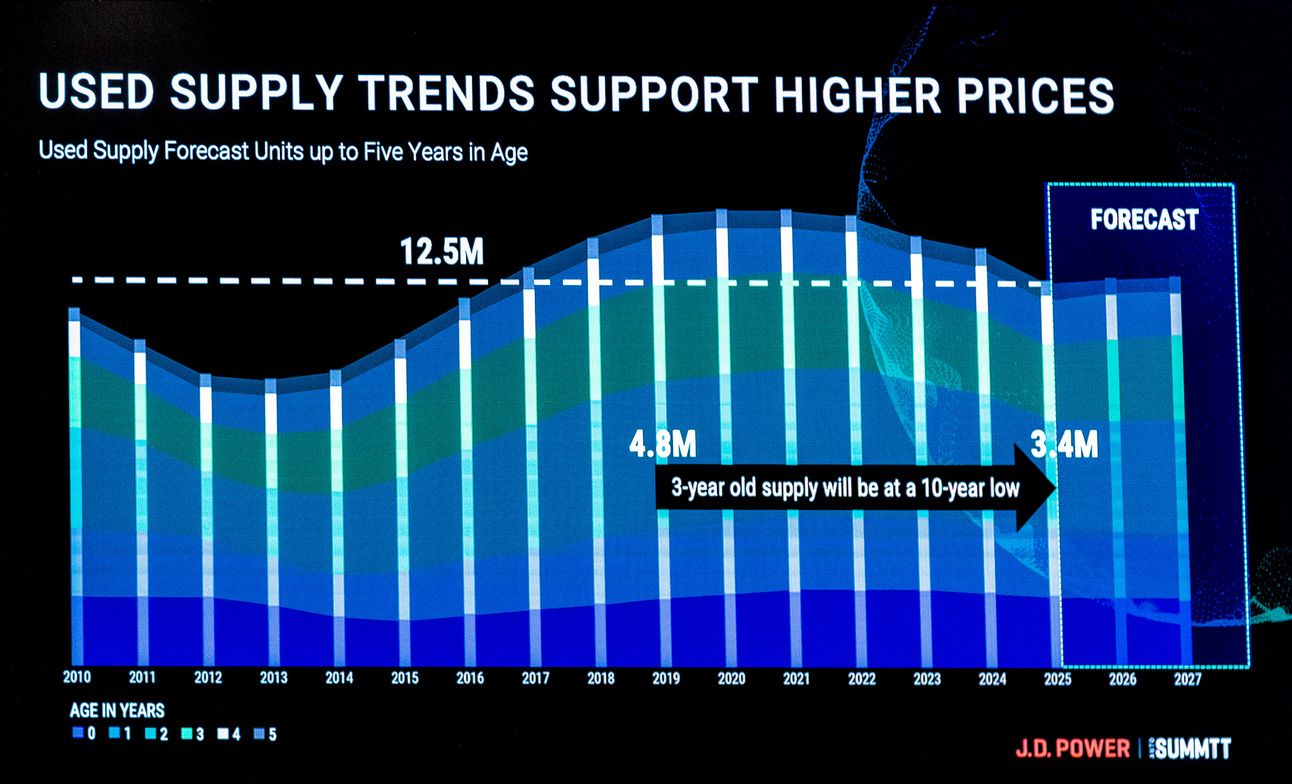

A Tight Supply Environment

Banks highlighted a critical issue for 2025: the lowest supply of late-model used vehicles since 2016. The pandemic-induced dip in new car sales from 2019 to 2021 left a significant hole in the pipeline, with far fewer vehicles entering the used market.

Key Statistic: Late-model used supply is projected to decline 10% YOY, reaching just 12.5M units.

Three-Year Lease Maturities: The number of maturing leases—a crucial source of certified pre-owned vehicles—has plummeted from 4M annually pre-COVID to only 2M in 2025.

Banks’ Take: “This isn’t just tight—it’s unprecedented. Dealers will need to be aggressive and strategic in sourcing inventory to remain competitive.”

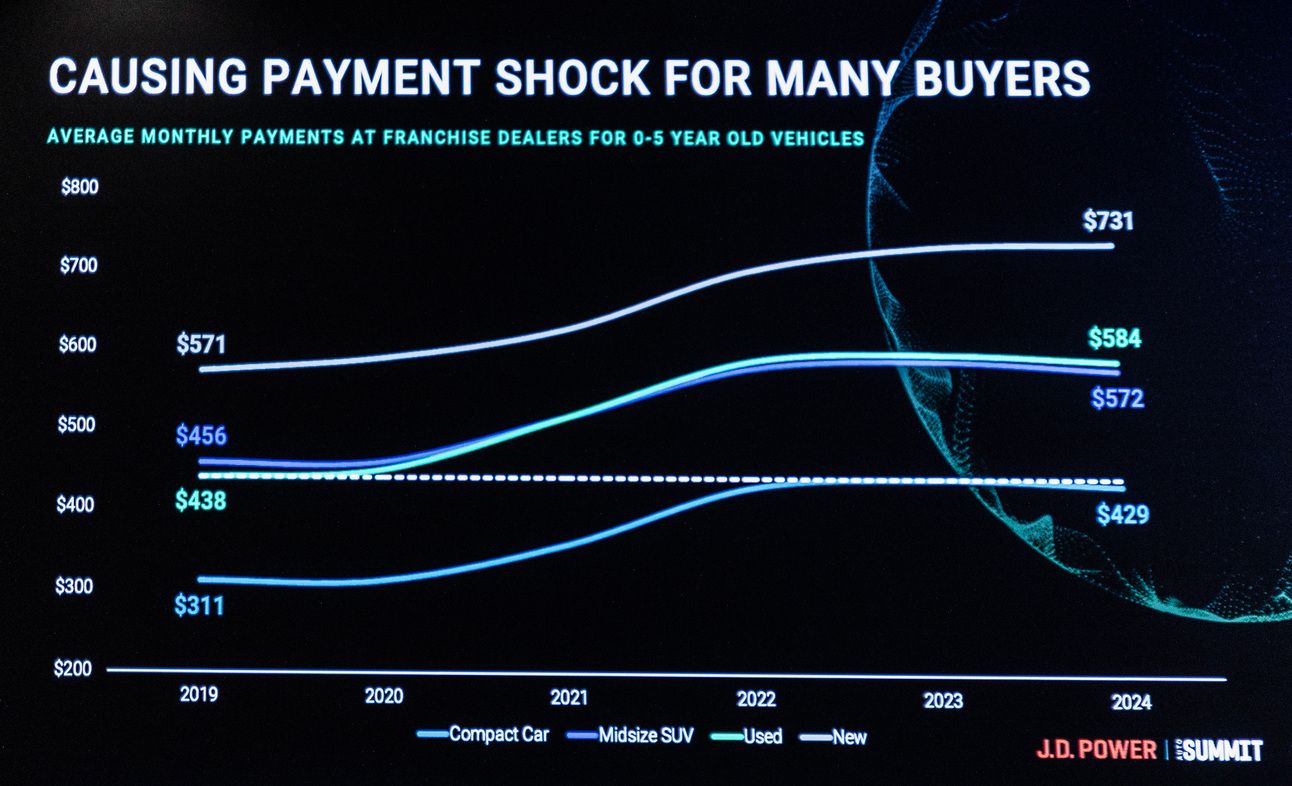

Affordability Pressures Persist

Used vehicle prices remain historically high, up 10.5% compared to pre-COVID inflationary trends. Despite slight declines in 2024, affordability challenges continue to squeeze consumers.

Average Retail Price: $28,400 for franchise dealers in 2024, with only modest reductions expected in 2025.

Payments Rising: Average monthly used car payments have surpassed pre-pandemic new car payment levels, leaving buyers with fewer affordable options.

J.D. Power

Profitability: Opportunities and Challenges

While profitability per unit has softened from its COVID-era peak of $4,000, the current average of $2,600 per unit is still historically strong. However, dealers must adjust their strategies to sustain profits in the face of increasing competition.

Independent Dealers & Online Retailers: Players like CarMax and Carvana are ramping up their efforts, making competition for used inventory fierce.

Auction Market Shift: The wholesale-to-retail price gap has widened, but dwindling auction volumes mean dealers must rely more heavily on aggressive trade-in strategies.

Younger Buyers: A Missed Opportunity

Buyers under 35 now account for just 24% of used vehicle purchases at franchise dealerships, a steep decline that Banks called a “wake-up call.”

Banks’ Recommendation: “Younger buyers need targeted strategies. They want affordability, digital convenience, and products that fit their lifestyles. Dealers must adapt to capture this untapped demographic.”

J.D. Power

2025 Outlook: Stability with Caution

Banks painted a nuanced picture for the year ahead:

Used Prices: A moderate 3% decline is expected in 2025, driven by downward pressure from increased new vehicle incentives.

Inventory Challenges: Sourcing late-model vehicles will require meticulous planning and a forward-looking approach to mitigate the impact of manufacturer discounts on new inventory.

Consumer Dynamics: High demand for affordable vehicles persists, but dealers must offer the right mix of product, pricing, and digital engagement to capitalize on this opportunity.

J.D. Power

⚡️ EV Outlook with Elizabeth Krear

At the forefront of the electric vehicle conversation, Elizabeth Krear, Vice President of Electric Vehicle Practice at J.D. Power, shared a detailed and data-driven outlook on the state of the EV market at the Summit.

From shifting consumer sentiment to the critical infrastructure challenges, Krear painted a nuanced picture of where EVs stand and where they’re headed.

Key Takeaways:

Communicating TCO (Total Cost of Ownership) benefits tailored to the unique situation of each shopper is critical.

Infrastructure must improve. Near-term, focus needs to be on shoppers reliable charging access. Access to Tesla’s network will help. Several brands now have access to Tesla’s charging network, and more to be phased in during 2025.

Many shoppers do not understand EV incentives. Shoppers are 12 times more likely to consider an EV when they have a strong understanding of incentives available to them.

Market Snapshot: Growth Is Slowing

The EV market may be expanding, but not at the pace many had hoped.

In 2024, EVs made up 9.1% of U.S. retail sales, with 1.2M units sold. Yet, growth slowed to just 10% compared to 38% the previous year, despite a significant increase in available models—from 22 in 2020, to 58 today.

“One could say this is not a sustainable business model for sustainability,” Krear noted, highlighting that the influx of new EVs hasn’t translated into proportional sales growth.

Mainstream buyers, however, are starting to convert. Market coverage for mainstream EVs jumped from 35% to 59% last year, driven by new mid-size SUVs like the Honda Prologue and Chevrolet Blazer, as well as more affordable trims for existing models.

Consumer Sentiment: A Mixed Bag

J.D. Power data reveals two key trends in EV consumer sentiment:

Unchanging Resistance: About 20% of new car shoppers remain firm in their refusal to consider an EV, a number that hasn’t budged in five years.

Price Sensitivity: The federal EV tax credit and other incentives are vital. Without them, the price gap between EVs and traditional vehicles could widen by $4,500–$5,700, dampening interest further.

Mainstream buyers are showing the most promise, with a 58% rise in EV adoption among this group last year. Still, education on the total cost of ownership remains a hurdle, as many consumers are unaware of the cost savings associated with EVs, such as reduced maintenance and lower energy costs.

Charging Infrastructure: The Achilles' Heel

Krear didn’t mince words about the state of charging infrastructure: “The number one reason for rejecting an EV is the lack of reliable charging.”

Public Charging Struggles: One in five charging attempts fails, and satisfaction with public charging has been declining year over year.

Tesla’s Advantage: Tesla’s Supercharger network stands out as a bright spot, with significantly higher satisfaction scores than non-Tesla networks.

On a positive note, home charging continues to be the most satisfying aspect of EV ownership. With 83% of EV owners having access to home charging, many wake up daily to a fully charged vehicle, bypassing the frustrations of public infrastructure.

2025 Outlook: A Reset Year

Krear predicts 2025 will be a “reset year” for the EV market. While overall EV sales will increase slightly due to general industry growth, market share is expected to hold steady at 9%.

Tailwinds include:

Improved product availability across mainstream and premium segments.

Continued momentum among mainstream buyers, who make up 80% of the market.

Headwinds include:

Potential loss of the federal tax credit.

Tariff uncertainties and regulatory changes impacting automaker portfolios.

Stalled progress in infrastructure investment.

Despite the challenges, EVs aren’t going away. With automakers heavily invested and consumers slowly warming to the idea, the market is poised for gradual but steady growth.

For dealers, the key will be navigating these complexities and equipping shoppers with the knowledge they need to make informed decisions.

J.D. Power

🤩 Leaders Look Forward with Brian MacDonald and Doug Betts

Doug Betts, President of the Global Automotive Division at J.D. Power sat down with Brian MacDonald, President and CEO of CDK Global, for a candid chat about where the automotive industry is heading.

Optimism for 2025

MacDonald kicked things off with a bright outlook for the industry, highlighting positive business conditions and a promising market setup for both manufacturers and dealers.

“I’m really optimistic about 2025,” he said. “The environment in Washington, with some relief for manufacturers around the EV transition, creates a good scenario for dealers to thrive.”

According to MacDonald, dealers and consolidators are already positioning themselves for growth, ready to take advantage of opportunities on the horizon.

Making Big Companies Feel Small

When it comes to running a company as large as CDK, MacDonald stressed the importance of keeping things simple and focused. With $250M invested annually in R&D, CDK is laser-focused on dealer-friendly innovation.

“We might be big in this space, but I always tell our employees: focus on the basics—help dealers sell and service more cars, and do it efficiently,” he explained.

EVs: Slow and Steady Wins the Race

When it comes to EVs, MacDonald kept it real. He noted that energy transitions take decades and need to align with both market demand and economic realities.

“Hybrids are gaining traction because they’re a good fit for a lot of consumers right now,” he said. “The relief from Washington helps manufacturers adjust their timelines, which means dealers won’t be overwhelmed with EVs that are hard to sell.”

MacDonald also pointed out that infrastructure—like charging stations—remains a bottleneck for EV adoption, echoing the need for a balanced approach.

🦾 Modernizing Your Dealership Playbook

The Modernizing Your Dealership Playbook panel brought together some of the automotive industry's brightest minds to explore how franchised dealerships can thrive in a our rapidly changing market.

Moderated by Chris Sutton (SVP of Auto Benchmarking and Customer Success, J.D. Power) the discussion featured Cody Tomczyk (SVP, Force Marketing), Derek Hansen (VP of Operations, Inventory Management Solutions, Cox Automotive), Ian Hunter (VP of Sales, JM&A), and James Taylor (Managing Director of Automotive at Truist Securities).

Here’s a summary of the top insights:

1. Inventory Management Requires Precision

With fluctuations in both new and used vehicle supply, panelists emphasized the need for a balanced approach to inventory. Dealers should:

Leverage data to align inventory with market demand.

Aggressively source used vehicles through trade-ins to offset limited supply of late-model cars.

Stay attuned to OEM incentives and discounts to avoid overpaying or holding stagnant inventory.

2. Consolidation is Accelerating

Dealership consolidation remains a significant trend, driven by aging dealership owners and evolving market dynamics. For dealers, the choice is clear: grow or exit. Smaller operators need to:

Decide whether to expand through acquisitions or position their business for a sale.

Prepare for increased competition from larger dealer groups with more resources.

3. Customer Retention is Critical

As affordability challenges persist, retaining customers is more important than ever. Dealers were encouraged to:

Implement loyalty programs and personalized marketing strategies to retain repeat business.

Focus on omnichannel strategies that create seamless customer experiences online and in-store.

4. Technology is Transforming Operations

Panelists stressed the importance of adopting tools and platforms that streamline processes, improve customer experiences, and enhance profitability. Key recommendations included:

Using valuation tools to optimize trade-in decisions and maintain healthy margins.

Investing in digital retailing solutions to meet the expectations of tech-savvy consumers.

Preparing for EV readiness by aligning operations with emerging electrification trends.

5. Affordability Challenges Demand Creative Solutions

With rising interest rates and tighter consumer budgets, panelists urged dealers to:

Adjust offerings to meet demand for affordable options, including compact and older used vehicles.

Educate customers on total cost of ownership, especially for EVs, to help them see long-term value.

Anticipate shifts in buyer behavior, particularly among younger demographics, who may require different marketing and engagement strategies.

6. Collaboration and Flexibility Are Essential

Panelists highlighted the importance of staying nimble in a fast-changing market. Dealers should:

Monitor regulatory changes, including EV incentives and state-by-state policies.

Build strong partnerships with OEMs, lenders, and technology providers to maintain a competitive edge.

Adapt to evolving customer needs and preferences, particularly as digital and physical retailing continue to converge.

Final Thoughts

The overarching message was clear: 2025 presents both challenges and opportunities. Dealers who embrace data-driven decision-making, prioritize customer retention, and invest in technology will be best positioned to succeed.