Stocks bounced back midweek, shaking off trade drama and tech struggles to notch their second straight day of gains.

Tech Stumbles: Semiconductors fell 7.8%, tech dropped 5.6%, but the sector stabilized as investors dialed back the panic.

S&P 500 Follows Tech’s Lead: Even with 70% of stocks gaining, the index took a hit, showing just how dominant the Magnificent 7 (now 32% of the S&P) still is.

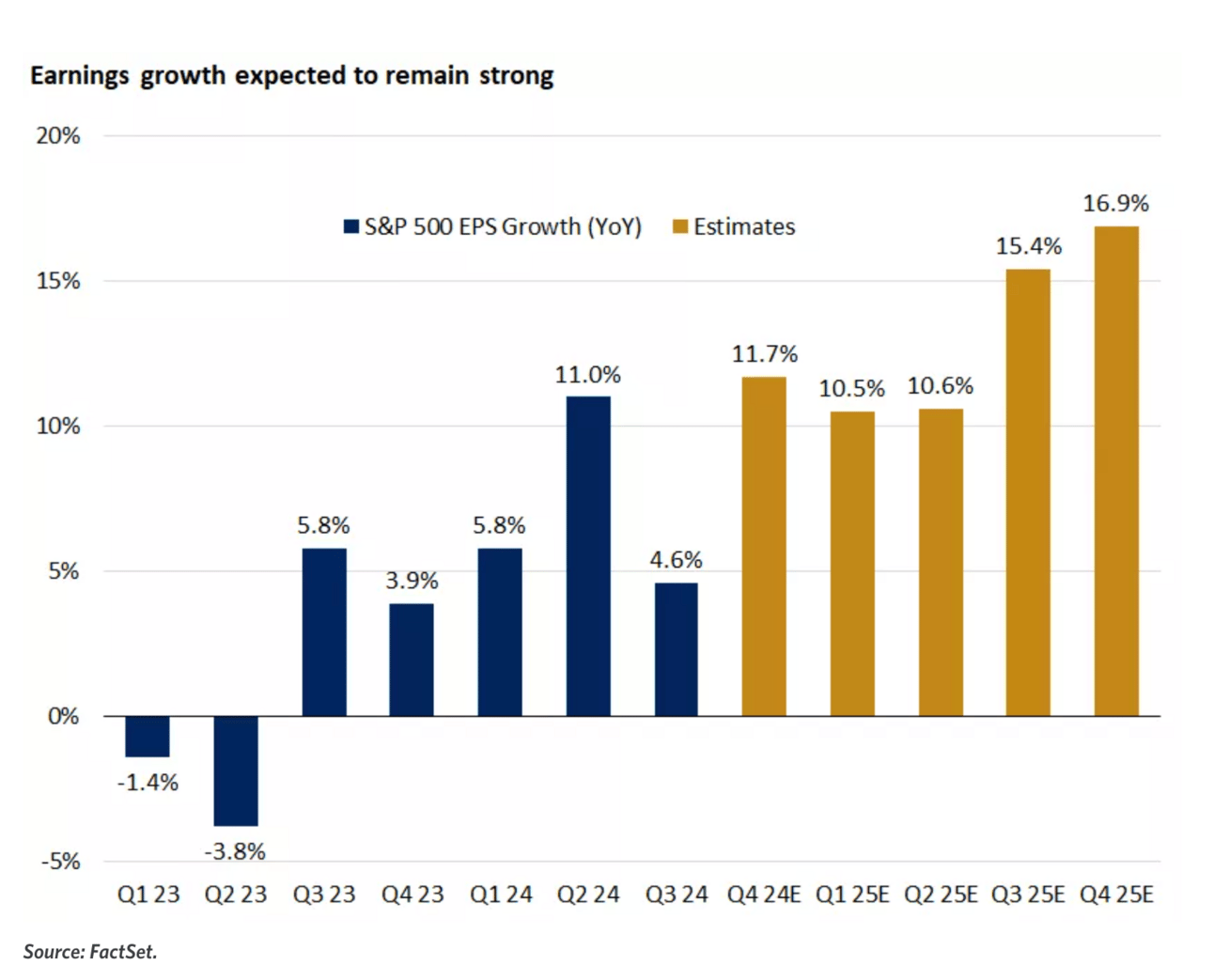

Corporate earnings are rolling in strong, proving that the market’s momentum isn’t just hype. With profits climbing and sectors beyond tech stepping up, the rally has legs.

Profits Are Climbing: S&P 500 earnings are up 12%, marking the strongest growth since 2021. Seven out of 11 sectors are reporting higher earnings.

2025 Looks Strong: Analysts are calling for 14% earnings growth, setting up another strong year for the bulls.

The S&P 500’s lofty valuation keeps grabbing attention, but a closer look at the sectors tells a different story. While tech and consumer discretionary stocks stretch well above their historical averages, some areas of the market still offer solid growth at a more reasonable price.

Healthcare Stands Out: The only sector trading below the S&P 500’s forward P/E while also outpacing it in revenue and earnings growth projections—a rare find in today’s market.

Energy and Financials Offer Stability: While not the fastest-growing sectors, they remain attractively priced relative to historical levels, making them a potential hedge against market volatility.

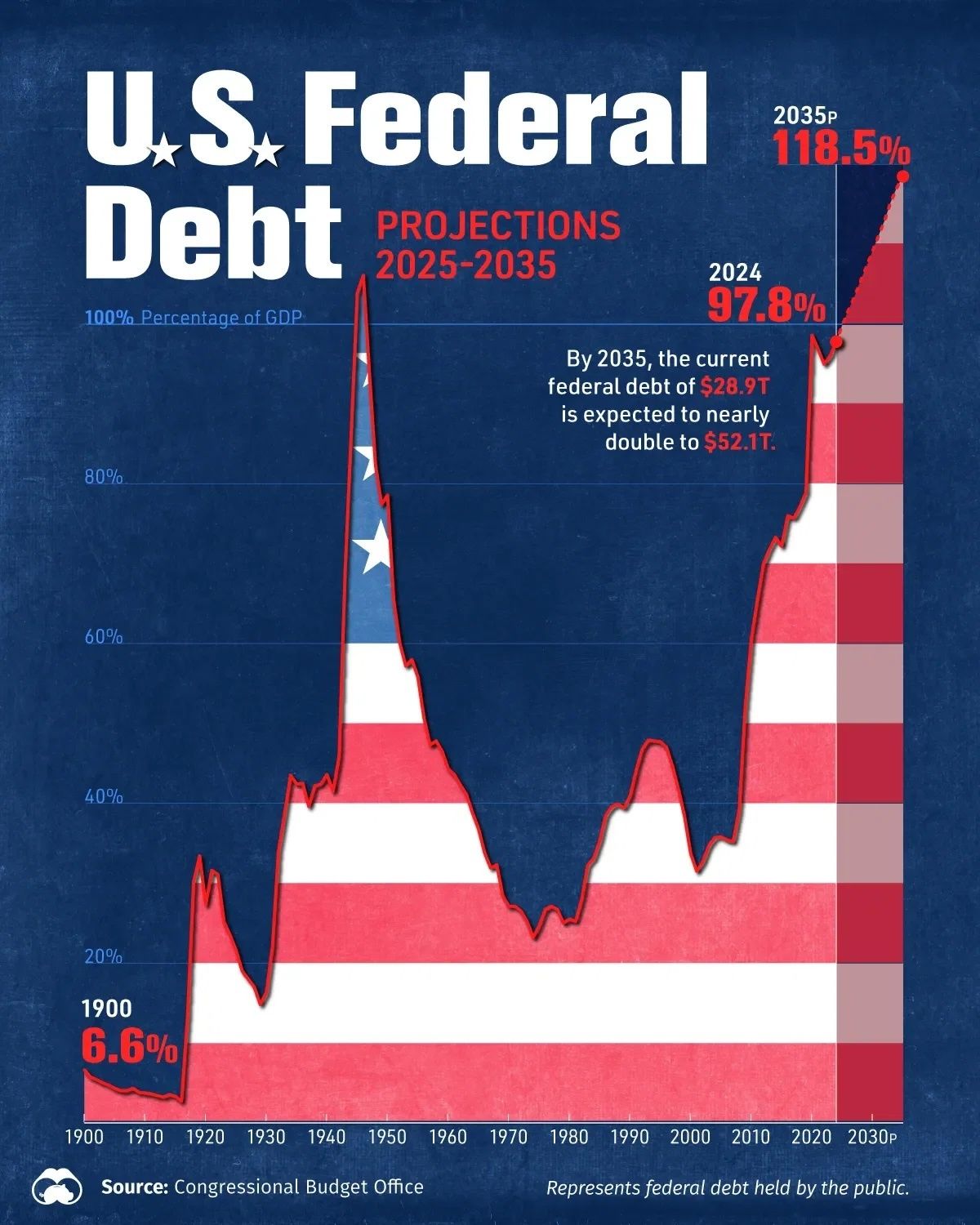

Zooming out, the U.S. national debt is set to hit 100% of GDP this year, an all-time high outside of wartime. Unlike past cycles, deficits are widening even as the economy grows, with $1.9T in red ink driven by soaring interest payments and mandatory spending.

Debt on a Historic Path: Federal debt is expected to surpass WWII-era levels by 2029 and climb to 118.5% of GDP by 2035 as borrowing costs surge.

Interest Costs Soar: By 2035, annual interest payments will hit $1.8T, exceeding defense spending by 70%.

Historically Speaking: Superpowers that spent more on debt than defense—Habsburg Spain, the British Empire—eventually lost economic dominance.

Fiscal Crossroads: Rising debt raises tough questions. Will policymakers rein it in, or is an ever-expanding deficit the new normal?

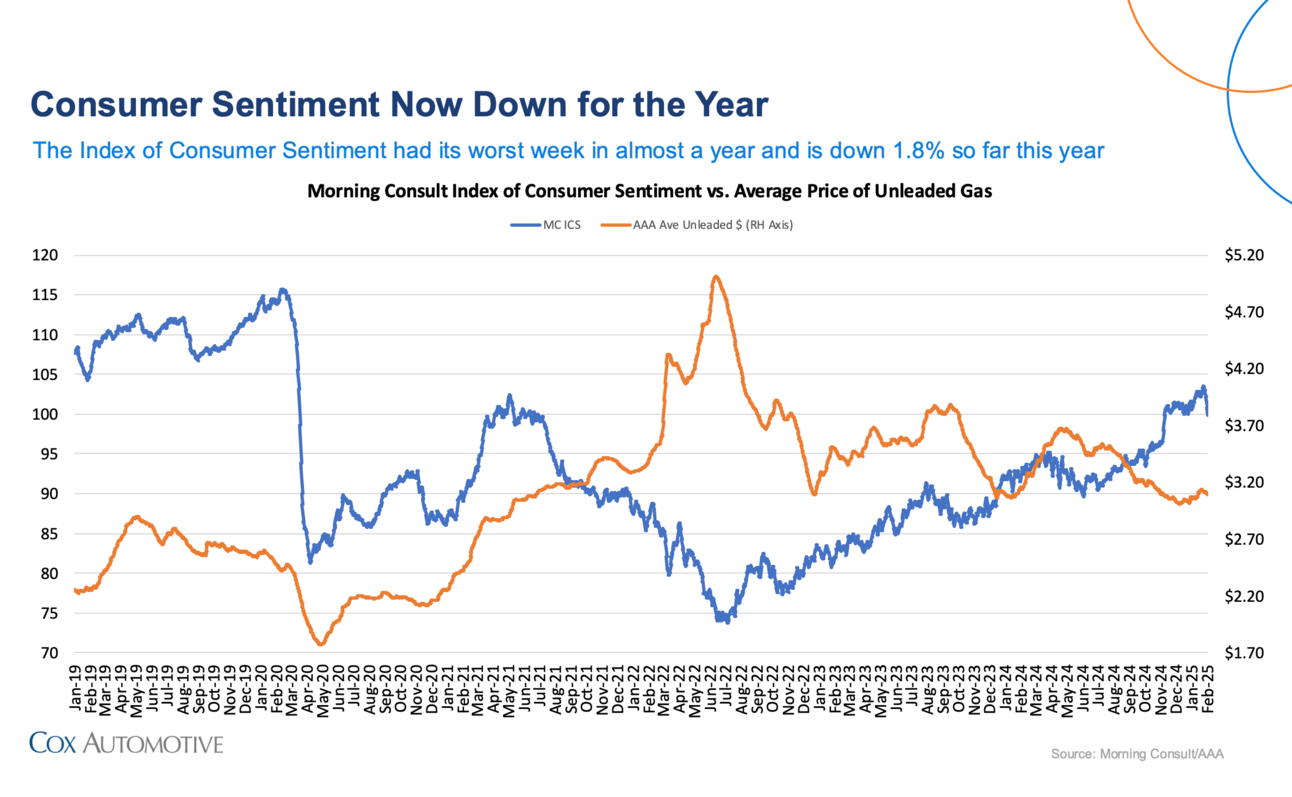

Americans are kicking off 2025 with solid spending driven in large part to high used vehicle demand. However, economic confidence is slipping with sentiment seeing its worst week in nearly a year.

Spending Surge: Consumer spending posted YOY growth in three of the last five weeks.

Auto Demand on the Rise: New retail vehicle sales are running 10% above last year’s pace, with used vehicle transactions up 15% YOY.

Confidence Cools: The Index of Consumer Sentiment is down 1.8% so far in 2025 marking its sharpest decline in nearly a year.