giphy

If you’ve been feeling the heat lately when it comes to sales, you’re not alone.

According to a new survey from Edmunds, it turns out there’s a Grand Canyon-sized gap between what car shoppers expect to pay and what they’re actually shelling out.

As inventory improves and incentives slowly trickle back into the market, car shoppers are still getting smacked with some harsh realities.

The days of low-interest rates and $35K average prices are gone, and shoppers returning to showrooms for the first time in six years are in for some serious sticker shock.

And while the industry has adapted, data shows that consumers’ expectations have not.

Nearly half of new-car shoppers dream of spending under $35,000 on their next vehicle. 14% are even holding out hope for something under $20,000.

The reality? The average transaction price for a new vehicle in July 2024 hit $47,716.

When it comes to used cars, shoppers seem to have some similarly..uhh, ambitious goals.

50% of respondents in the survey said they’re aiming for a price tag of $15,000 or less. Meanwhile, only 5% of actual transactions in July hit that mark.

The reality? The average transaction price for used vehicles was $26,936.

The exact same thing is happening with interest rates. According to the Edmunds survey, 37% of new-car shoppers expect to snag an interest rate between 0% and 3%.

The reality? The average APR for new vehicle purchases in July 2024 was 7.1%, and zero-percent financing made up just 4% of all new financed purchases.

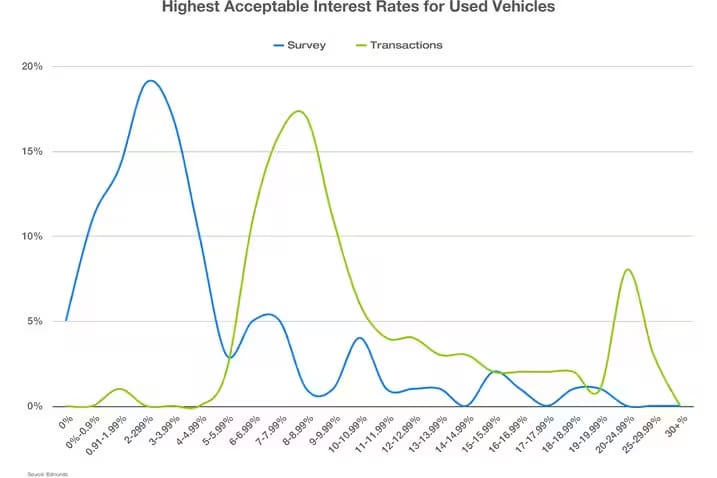

For used-car shoppers, the unrealistic optimism doesn’t stop. A whopping 76% of them are targeting rates between 0% and 5%.

The reality? The average APR for used vehicles was 11.4%. That’s right—double digits, folks.

So, how do I deal with unrealistic expectations?

It starts with understanding where the customer is coming from and recognizing that their expectations are often rooted in past experiences. The key is to bridge the gap between what they remember and what the current market looks like.

Empathy and education. Sometimes, it’s best to be direct, but with empathy. Use up-to-date data from trusted sources to show how prices and rates have shifted. Positioning yourself as a guide through the process can show that you’re on the customer’s side while also grounding them in the current market reality.

Provide solutions. If a customer is focused on getting that dream price, shift the focus to other incentives, trade-in offers, or leasing options. That way, you’re offering alternatives without making the them feel defeated.

Be patient. Some shoppers just need a little more time to process new information, so avoid rushing the conversation or making them feel pressured. This allows the customer to feel heard and respected, which makes them more open to adjusting their expectations.

📬 For more data and stats like this delivered right to your inbox, subscribe to our daily email. 👇