New Vehicle Affordability Declines

New vehicle affordability took a hit in June, impacting both dealerships and customers.

Typical monthly payment: $756 (up 0.6% from May).

Weeks of income needed: 37.2 (up slightly from 37.1 weeks in May).

While the Consumer Price Index actually declined for the first time in 4 years suggests inflation is coming down too, an article our friend David C Rogers sent our way from Bankrate says they don’t expect a rate cut anytime this year.

Economic Impact on Trade-Ins

Pandemic-era vehicle price inflation continues to affect trade-ins.

Trade-ins with negative equity: 24% in Q2, with an average debt of $6,255.

EV trade-in debt: $10,326, highlighting accelerated depreciation.

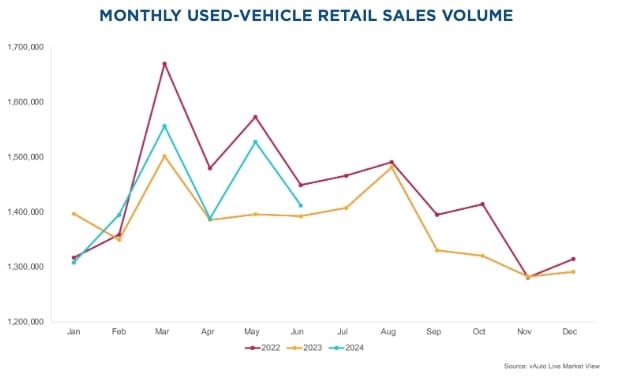

Used Vehicle Sales and Trends

The used vehicle market saw notable shifts in June.

Retail used-vehicle sales: Decreased by 7.6% from May, totaling 1.41 million units sold, though up 1.4% year-over-year.

CPO sales Fell by 6.7% in June compared to the previous month, with an estimated 208,699 units sold.

What'sit'mean?

Some key extractions to consider.

Creative Financing: Offer flexible financing options and incentives to make new vehicles more accessible.

Manage Negative Equity: Develop solutions to help customers with significant trade-in debt transition smoothly to new vehicles.

Promote CPO Vehicles: Emphasize certified pre-owned vehicles to attract budget-conscious customers.

Strategic Adjustments: To navigate market changes effectively, focus on financing, inventory management, and customer engagement.