giphy

Two years into this bull market, and stocks have seen a 60% hike since the lows of October 2022.

While things are still looking solid, we’re heading into a cooler season—literally and figuratively.

More Fed Cuts Anticipated: The Fed’s are expected to keep trimming rates by a quarter-point until we hit a comfy 3%-3.5%.

Inflation’s Not Dead Yet: Prices are still sticky, so it’s no surprise that consumers are holding onto their wallets a bit tighter, which means car sales could keep feeling pressure.

Despite inflation continuing to squeeze spending power, U.S. retail sales for September picked up momentum after a surprisingly strong August.

Key Spending Categories — Lower gas prices left more room in consumer wallets, driving up spending at restaurants (+1.0%), clothing stores (+1.5%), and miscellaneous retailers (+4.0%). Online sales also edged up 0.4%, while grocery sales rose 1.0%, partly driven by hurricane preparations.

Retail Sales Boost — September saw a modest 0.4% rise in retail sales, beating the 0.3% expected by economists. Year-over-year, retail sales jumped 1.7%.

Consumers Keep Spending — With wages growing and unemployment still low, healthy consumer spending is continuing to boost retailers. With the busiest shopping season on the horizon, now is the time button up your holiday sales and marketing plans.

GDP growth has averaged a strong 3% over the past two years; but, now that things are beginning to slow down a bit, what does the road ahead look like? Let’s break down the numbers:

Still Standing Strong — GDP growth has been cruising at a solid 3%, with the Atlanta Fed projecting a 3.2% gain for Q3 2024.

Slowing Down, but Not Stopping — Experts expect GDP growth to slow down to around 2% as we head into next year. Still, 2% is better than nothing, and there's a chance that all the renewed AI hype could give us a little extra juice to push growth to 2.5%.

Though retail revenue may be climbing in many markets, the story is a bit different for both new and used vehicles which have seen sliding sales for the past four weeks. Here's a snapshot of what’s been happening:

Hurricanes Hinder Sales — Thanks in part to the recent storms in the Southeast, retail vehicle sales have dropped for four straight weeks.

Cyber Breaches and Blips — As if hurricanes weren’t enough, an industry-wide cyber breach also contributed to disruptions over the past few months. Throw in some factory hiccups, East Coast port issues, and a highly contentious election year, and you’ve got the perfect recipe for sluggish sales.

On The Bright Side — The Index of Consumer Sentiment was up by 1.1% in October after increasing by 1.4% in September, showing that consumers are feeling positive about the economy despite the recent disruptions.

Financing not helping much either. Despite cuts from the Fed, rates for auto loans have stayed relatively high, and that’s not doing dealers any favors.

Unicorn Rates — Auto loan rates below 3% have seen a downward trend, hitting the lowest level of the year in September.

Realistic Rates — The average used rate now sits at 13.94%. The new rate at 9.45%.

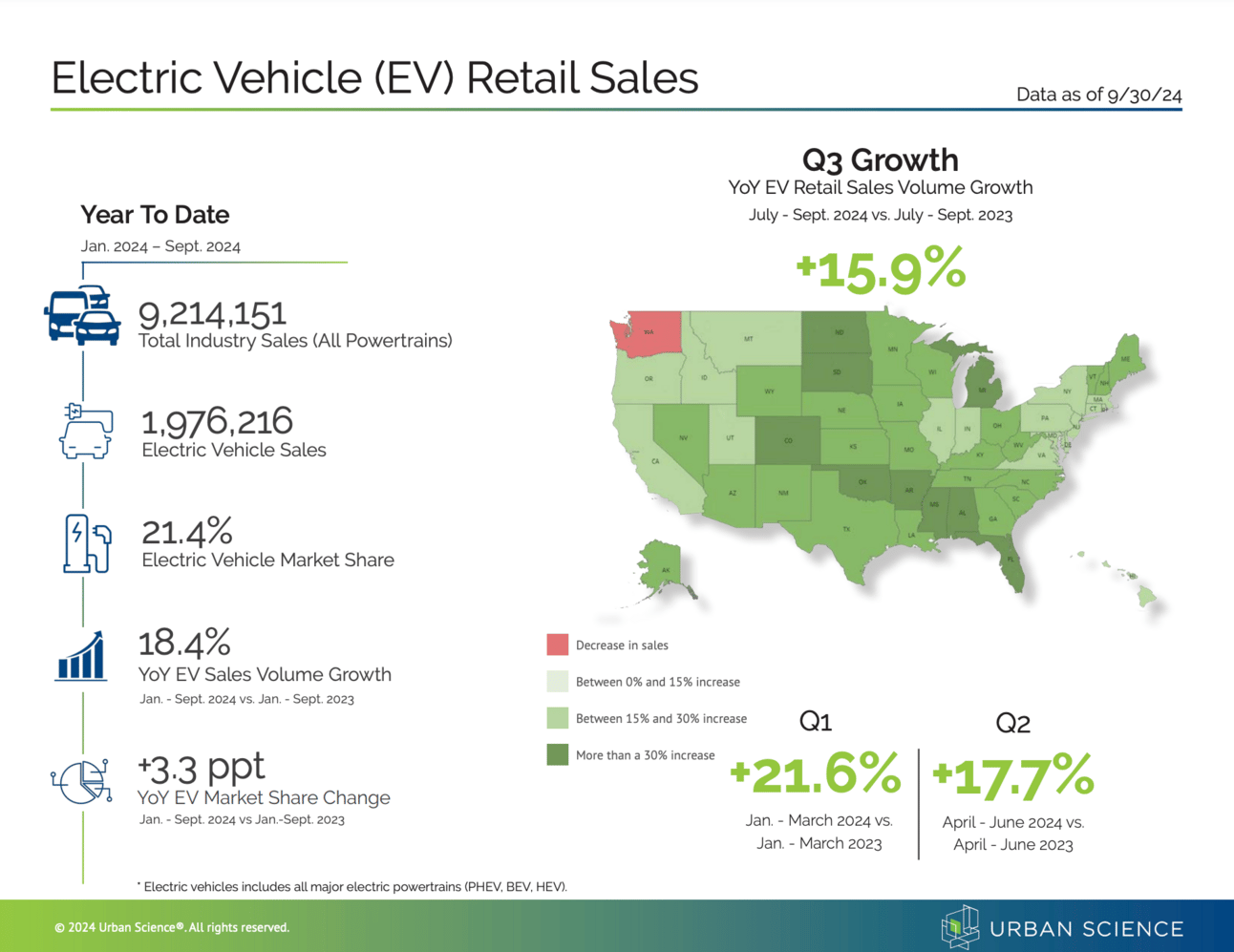

EV sales are cruising along, making up over 21% of all U.S. vehicle sales so far this year. With nearly 2M units sold by the end of September, it's safe to say the shift to electric is still picking up speed.

California's Still King (For Now) — California’s still holding the crown for EV sales, but Tesla’s dominance is starting to slip. The state saw an 8.1% bump in EV sales, though Tesla lost 7% of its market share.

Hybrids Still Popular (For Now) — Hybrids are back on the rise, especially in states like Texas, where hybrid sales jumped a solid 44.5% year-to-date, suggesting that many drivers aren’t willing to give up on gas just yet, but they are willing to dip their toes into the benefits of EVs.

📬 For more data and stats like this delivered right to your inbox, subscribe to our daily email. 👇