On the surface, China’s dominance in the global auto industry might not seem like an immediate concern for U.S. dealers. There are no Chinese-branded cars on American roads, 100% tariffs keep them at bay, and Washington isn’t exactly rolling out the welcome mat.

But according to Michael Dunne, CEO of Dunne Insights and a 26-year veteran of the Chinese auto market, ignoring China’s rise would be a huge mistake.

“They haven’t arrived yet, but they’re coming,” Dunne warned during his presentation at the NADA Show this year. “And when they do, they won’t be playing for second place.”

Michael explained that China’s strategy isn’t subtle. It’s built on overproduction, scale, and global saturation—a playbook that has already disrupted several industries.

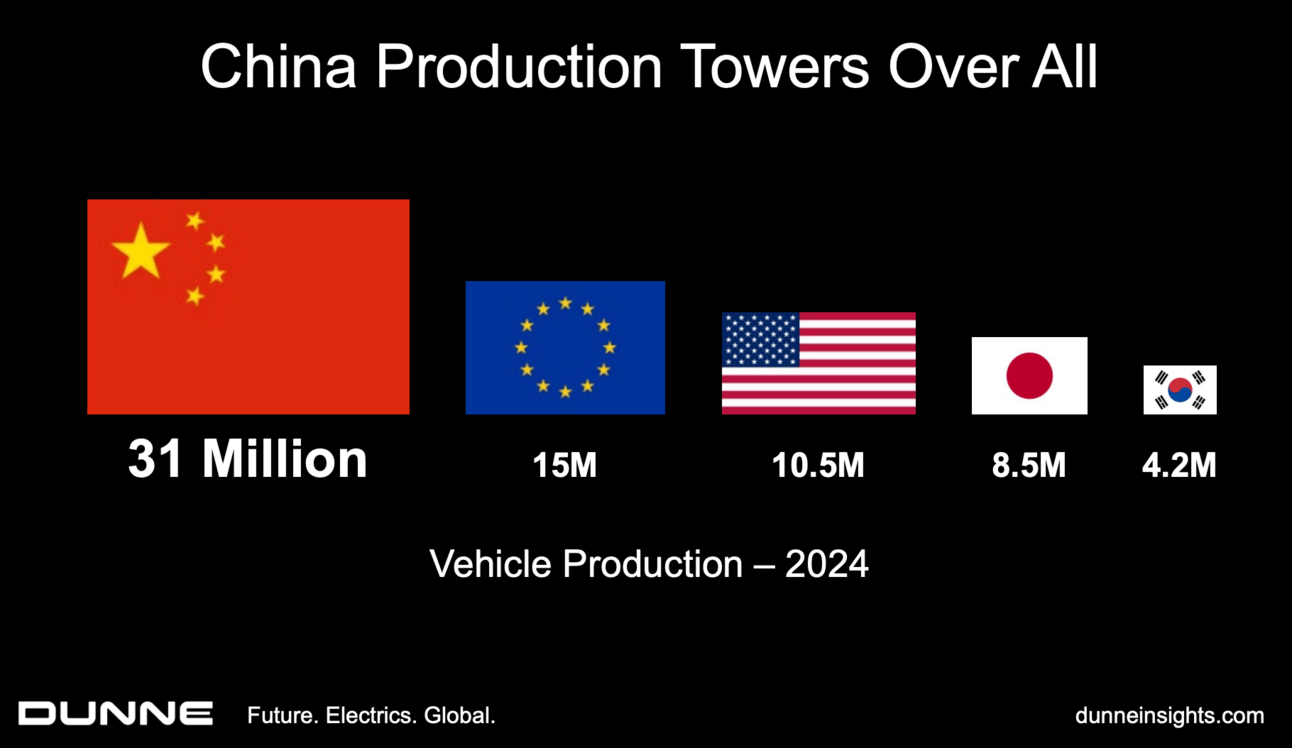

China produces 30M cars per year—twice the volume of North America.

The country has 50M units of production capacity, enough to supply nearly half the world’s auto demand.

It doesn’t stop at cars. China slays in ships, solar panels, and battery production as well.

China floods the market with low-cost, high-tech vehicles, leveraging subsidies, low-interest loans, and strategic investments to force competitors out. It’s not competition in the traditional sense—it’s an economic onslaught.

The West isn’t just lagging—it’s watching in disbelief as China redefines what’s possible in cost-effective, high-volume production. No other country comes close to matching China’s scale.

31M vehicles rolled off Chinese production lines in 2024, compared to 15 million in North America and 10.5 million in Europe.

China produces more EVs than the rest of the world combined.

Factories operate in ludicrous speed, developing new models in half the time it takes Western automakers.

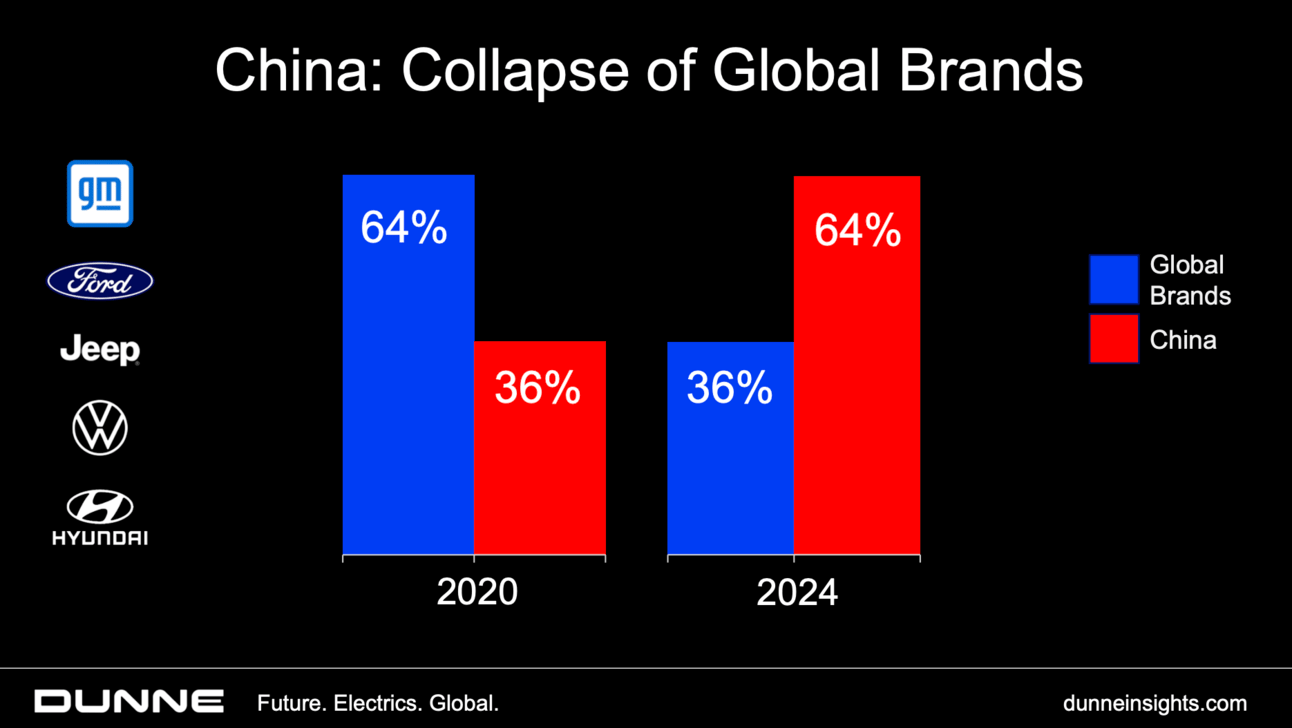

Foreign automakers that once dominated China’s car market are now struggling to stay relevant. Legacy brands like GM, Volkswagen, Toyota, and Hyundai have seen their market shares shrink as Chinese automakers surge ahead, particularly in the EV space.

GM, once a profit powerhouse in China, is on track to lose hundreds of millions in the market.

Hyundai is shutting down factories as demand for their vehicles plummet.

Even luxury brands like Porsche are feeling the impact, with China sales dropping 28% in 2024.

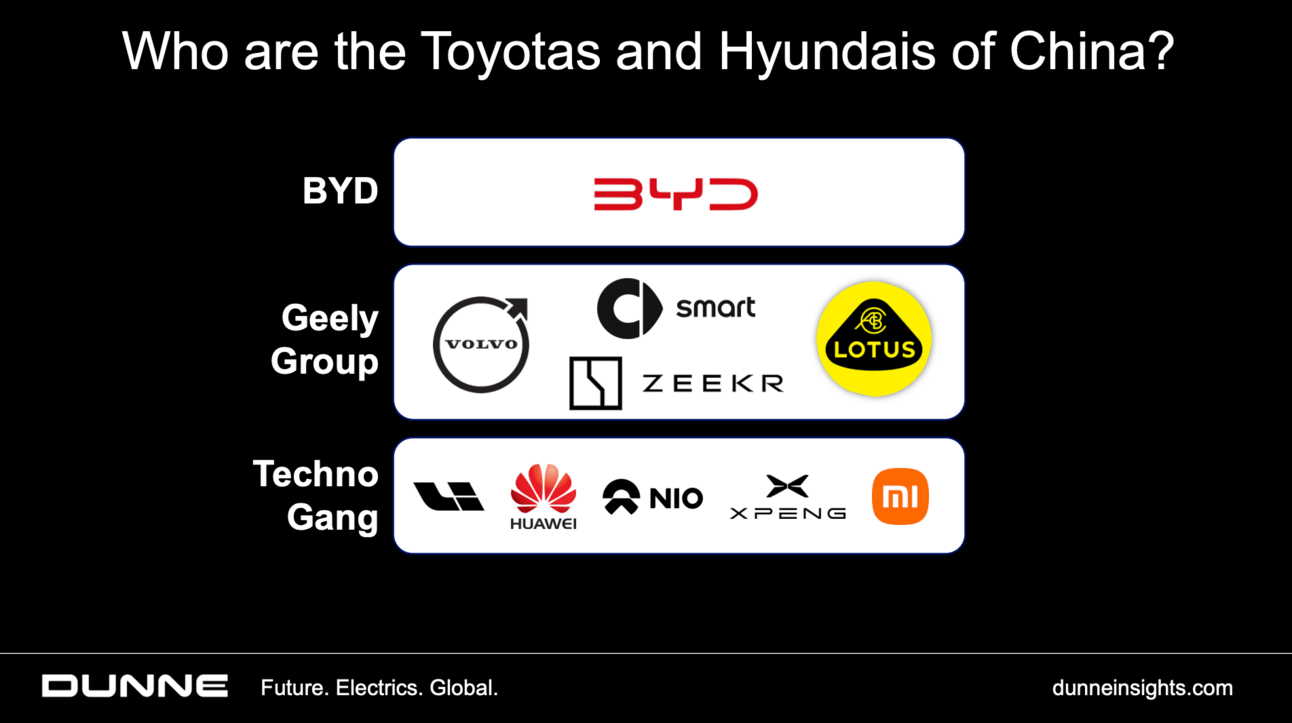

China’s auto industry isn’t just one or two brands either—it’s a flood of well-funded, fast-moving companies that are already outselling Western automakers in multiple regions.

BYD, Geely, Changan, and SAIC are emerging as China’s version of Toyota and Hyundai—scalable, reliable, and increasingly trusted in global markets.

BYD alone sold 4.27M New Energy Vehicles (NEVs) in 2024, surpassing Ford, Nissan, and Honda.

China’s Techno Gang of Five—Huawei, NIO, XPeng, Li Auto, and Xiaomi—are leading the charge in software-driven EVs.

If there’s only one name that you remember from all of this, it’s BYD (Build Your Dreams). Ironically enough, if there’s one company you don’t want to sleep on, it’s this one.

BYD is now larger than Ford, Nissan, and Honda in global sales.

The company is leading in EV technology, battery production, and aggressive pricing.

The BYD Seagull, a fully electric city car, starts at just $9,650.

BYD’s production speed, vertically integrated supply chain, and ability to undercut global prices by 25-30% make it China’s strongest contender for global dominance.

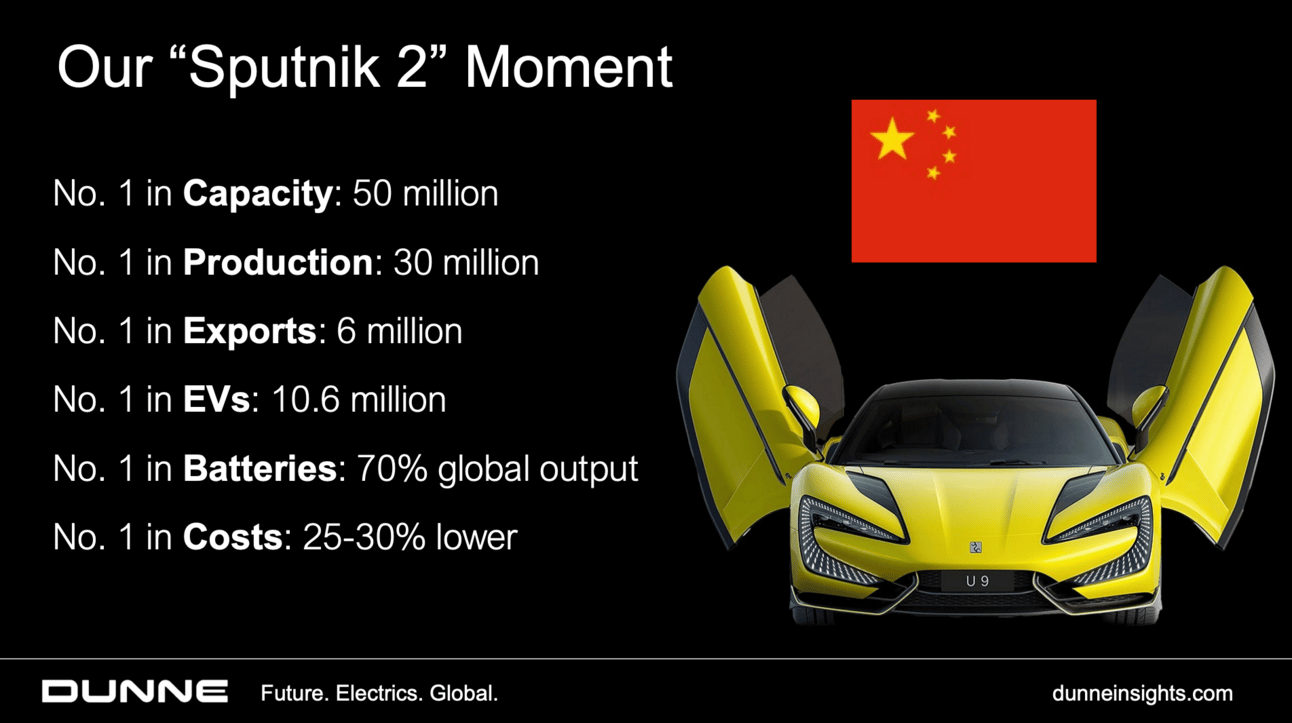

The world is witnessing another Sputnik moment, but this time, it’s playing out in the auto industry.

China is already #1 in vehicle production, EVs, battery output, and exports.

The country exported 6M cars in 2024, surpassing Japan as the world’s largest auto exporter.

Chinese automakers aren’t just producing cars faster and cheaper—they are setting the new global standard. The West has two choices: ignore the threat or adapt. And quickly.

Chinese automakers may not be in the U.S. yet, but they are right at the doorstep.

Mexico is now China’s largest overseas market, with car exports jumping 10x between 2020 and 2024.

One in three new cars sold in Mexico is Chinese-made.

BYD and other automakers already have plans to enter the U.S. market through Mexico as a working-around to the steep tariffs.

Dunne’s advice? Go to Mexico. Drive the cars, talk to dealers, and see the competitive landscape firsthand. Chinese brands are already here—the question is how soon they’ll find a way in.

How Can Dealers Prepare?

Dunne offered one clear message: do your homework.

Learn the names. Most U.S. industry leaders can’t name five Chinese automakers, while their Chinese counterparts know every major U.S. brand inside and out.

Visit markets where Chinese brands are already competing. Drive the cars. Talk to the dealers. See how the business model works.

Be strategic. If a Chinese brand does enter the U.S., could it be the next Toyota or Hyundai? Or will it disrupt traditional dealer partnerships in ways we haven’t seen before?

“The Chinese play to win it all,” Dunne warned. “If they enter this market, they won’t just want a piece of the pie—they’ll want the whole thing.”

With China already dominating EV production, battery supply, and key global markets, U.S. dealers have a choice: pay attention now or be blindsided later.