giphy / Lincoln

Markets pulled back slightly last week, but positive fundamentals appear to be keeping the bull market alive and well as we head into year-end.

Market Performance — The S&P 500 dropped 2% for the week but remains up over 23% for the year and 1% since election day.

Inflation Update — October’s CPI data met expectations, showing a gradual downward trend. However, costs like shelter, rent, and auto insurance remain elevated, slowing progress toward the Fed’s 2% target. Long-term inflation is expected to settle between 2%-3%.

Fed Chair Jerome Powell signaled a cautious approach to rate cuts last week, highlighting resilience in the U.S. economy and labor market.

“No Rush” on Rate Cuts — Powell stated there’s no urgency to lower rates, given the economy’s strength and lack of signals requiring immediate action. This dampened market expectations for a December rate cut, with forecasts now pointing to a gradual decrease to 3.5%-4.0% in 2025.

Market Implications — The S&P 500 already outperforming global indexes in 2024. A measured rate cut cycle could support consumers and corporations without stoking inflation fears.

Federal interest costs have skyrocketed, reaching $882B this year—nearly triple what they were in 2020—as rising rates and mounting debt take their toll.

Interest Spending Soars — Net interest costs increased by $223B from FY 2023 and now account for the second-largest federal expenditure, trailing only Social Security. In FY 2024, interest spending surpassed Medicare, national defense, and all programs benefiting children combined.

The Debt Burden Grows — Interest payments have surged from $345 billion in FY 2020, driven by post-COVID rate hikes and an additional $6 trillion in pandemic-era borrowing. The cumulative effect is straining the federal budget and crowding out spending in other critical areas.

Long-Term Outlook — Without intervention, interest costs are projected to keep climbing, eventually outpacing Social Security by 2051. Policymakers face mounting pressure to address the growing debt before it spirals further out of control.

The Magnificent Seven—Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla—may lose some of their sparkle in 2025 as their dominance over the S&P 500 shows signs of cooling.

Market Movers — Over the past two years, these seven tech giants powered more than half of the S&P 500’s 57% rise. In 2023, they delivered a 76% return, compared to 14% for the rest of the index. However, their “premium return” gap has shrunk to 22 percentage points in 2024 and could narrow further to just 7 points next year.

Concentration Concerns — Goldman highlights that the market is at its most concentrated in a century, drawing parallels to eras like the dot-com bubble and the 1960s Nifty Fifty. While such concentrations historically don’t last, these companies’ growth trajectories will heavily influence overall market performance.

As the Magnificent Seven's growth cools, the rest of the market is stepping up, driving a more balanced earnings landscape in 2025 and beyond.

Broader Market Earnings Growth — S&P 500 earnings are expected to rebound from 0% in 2023 to 9% in 2024, followed by 15% growth in 2025 and 13% in 2026. This growth hinges on strong economic resilience and more even contributions from all 500 companies, not just the big seven.

What’s Driving the Shift — AI remains a key driver, but investors are shifting focus toward return-on-investment concerns and diversified profits. A stronger dollar and potential tariffs could pressure multinational earnings, but a broad corporate tax cut might soften the blow.

The Big Picture — As the other 493 companies start to pull their weight, earnings breadth should translate into market breadth.

Despite high prices and borrowing costs, consumer spending and business investment have driven strong economic growth in 2024, with real GDP on track to grow 2.3% for the year.

Consumer Spending Dominates — Consumer spending accounted for 78% of GDP growth in the first three quarters, with inflation-adjusted spending up 3.0% in Q3, an acceleration from 2.7% in Q2. High-income households led the charge, benefiting from gains in wealth, interest, and property income.

Thriftier Shopping Habits — Even with high retail prices, consumers stretched their budgets, supported by gains in real after-tax income. However, spending is expected to slow in 2025 as pent-up savings and debt-driven consumption fade.

Sector Struggles and Stabilization — Interest rate-sensitive sectors like housing and manufacturing faced challenges in Q2 and Q3 but showed signs of stabilization as rates peaked. Residential investment contracted, and manufacturing growth slowed, but potential rate cuts in 2025 could offer a boost.

Business Investment Resilience — Corporate investment remained robust, thanks to strong balance sheets and fiscal support from policies like the CHIPS Act and Inflation Reduction Act. Tech companies led the way, driven by the AI investment boom, with potential for broader sector gains if rates decline.

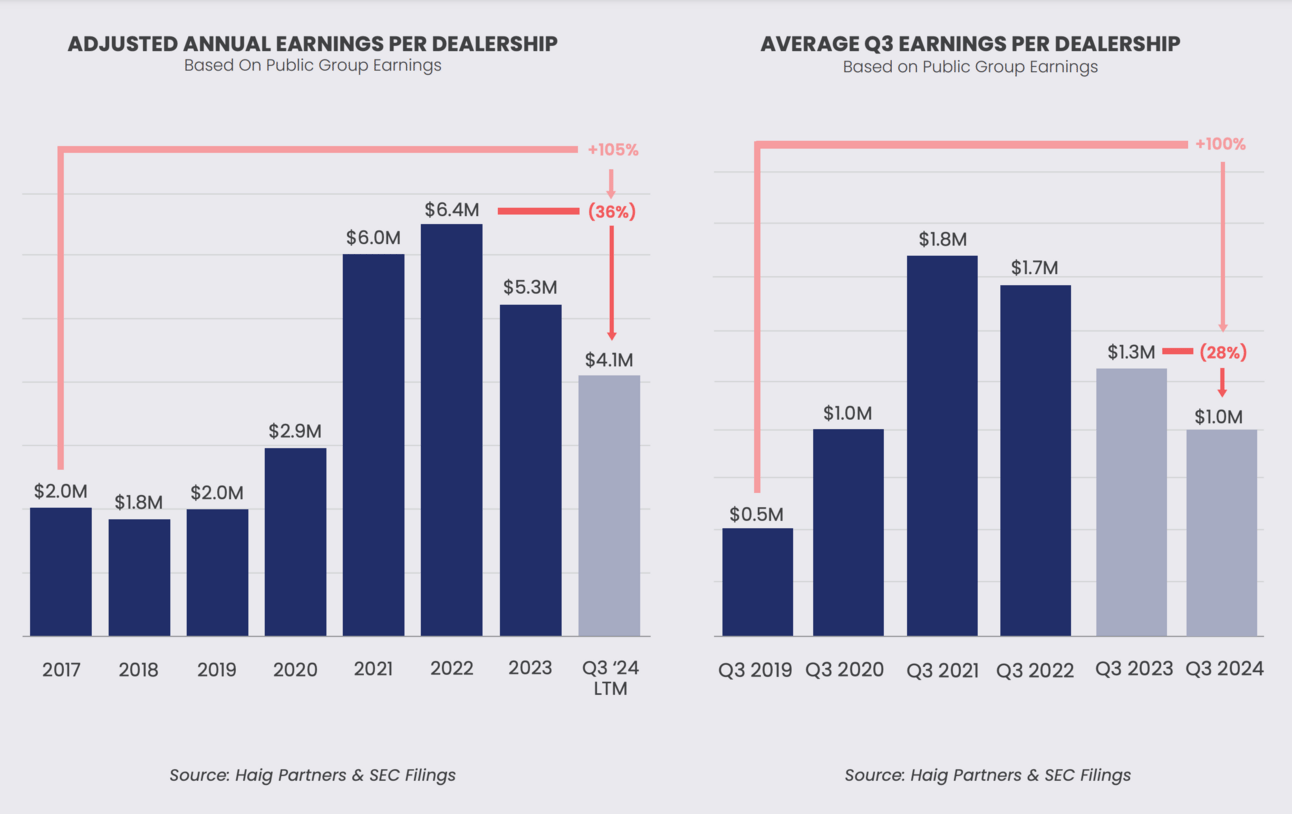

Even with profits cooling from their record highs, dealerships are still earning well above pre-pandemic levels according to the most recent Haig Report.

Q3 2024 Earnings — Average pre-tax earnings per publicly owned dealership hit $1.0M for Q3 (down 28% from last year but still 100% higher than Q3 2019).

Annual Earnings Per Store — Over the past 12 months, adjusted annual earnings per dealership averaged $4.1M, reflecting a 22.8% drop from 2023 and a 35.5% decline from 2022’s peak, but those sky-high 2022 numbers were always going to be tough to maintain.

New vehicle gross profits continue their post-pandemic descent, while used vehicle grosses stabilize at pre-COVID levels, signaling some shifting dynamics in auto retail.

New Vehicle Gross Profits — The average gross profit per new vehicle in Q3 2024 was $3,173, a 5.4% decline from Q2 and the 10th consecutive quarterly drop. Despite this, grosses remain 30% above 2019 levels, though some franchises, particularly Stellantis, are facing sharper declines—down 53% year-to-date.

Used Vehicle Gross Profits — Used vehicle gross profits averaged $1,566 per unit in Q3 2024, back to 2019 levels. However, higher sales prices mean lower margins today. Fierce competition for two-to-four-year-old units and rising reconditioning costs are expected to pressure used vehicle grosses for the foreseeable future.

Looking Ahead — Dealers may see years of compressed used vehicle profits due to limited inventory of desirable units, increased competition, and the need for costly reconditioning of older and high-tech vehicles.