TOGETHER WITH

Howdy, Friend!

Today, we have data outlining the CDK bounce-back we expect through July, several automaker-specific pieces, and some global data on alternative energy vehicle sales.

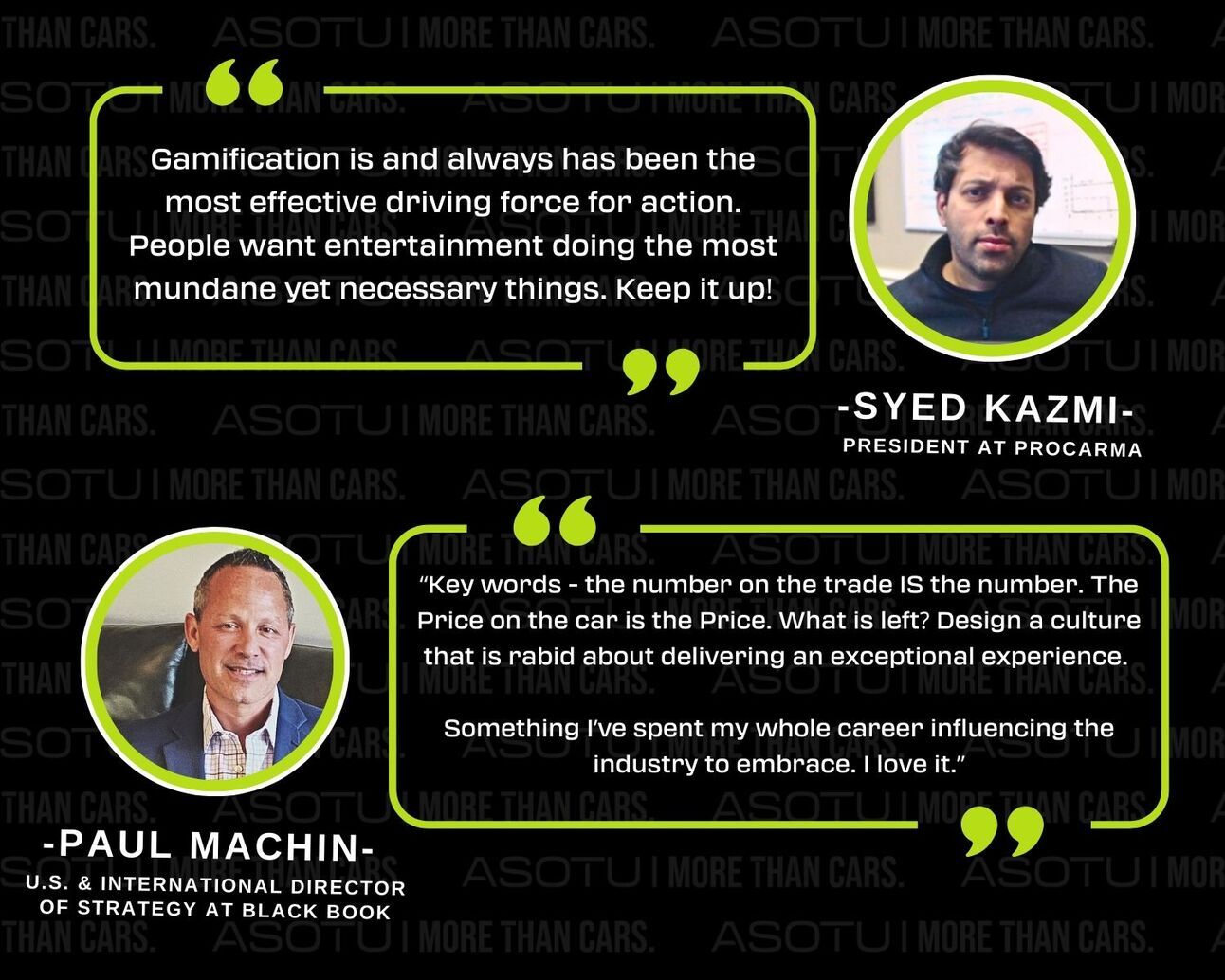

First stop: Some community comments from our visit to a dealership last week.

Keep Pushing Back

-Paul, Kyle, Chris & Kristi

Was this email forwarded to you? Subscribe here!

Reading time: 4 mins 56 secs

AROUND THE ASOTU-VERSE

The Only Thing Missing is You

We visited Rohrman Automotive Group and their “World’s Largest Plinko Board” to investigate claims of tomfoolery, ask about the creative energy behind their marketing ideas, and, of course, play Plinko.

Check it out here, and, like Paul and Syed’s highlighted comments above, let us know what you think!

What is going on at your store that we should check out? Hit reply, and let us know!

BUSINESS

One: NADA Data June Vs. July

Giphy

In the concentric circles of relevancy, stuff happening in your own store is the bullseye, while companies you don’t work for doing stuff in countries you don’t live in is the widest loop.

We try to take a tour from the inside out each day so we can keep our community connected to the present and aware of the future. Who knows what will matter tomorrow, so let’s practice caring well for today, huh?

--

More Data on Sales Recovery from NADA

The automotive market faced a notable downturn in June 2024, largely attributed to a cyberattack on CDK Global. This incident significantly impacted dealers' operations and sales, causing a ripple effect across the industry.

Data from NADA:

SAAR (Seasonally Adjusted Annual Rate):

June 2024: 15.3M units

Year-over-year decline: 4.8%

Month-over-month decline: 4%

Impact of CDK Cyberattack:

Estimated 50,000 unit sales lost

Services restored by early July for most customers

Quarterly Sales:

Q2 2024: 4.075M units

Year-over-year decline: 0.4%

First decline since Q3 2022

This disruption, primarily due to the cyberattack, led to a rare dip in quarterly sales, underscoring the industry's vulnerability to technological threats.

However, CDK's swift restoration of services suggests a positive outlook for July, with expectations of a sales rebound.

Alternative-Fuel Vehicles Gain Market Share

Despite the overall sales slump in June, alternative-fuel vehicles have shown significant growth, reflecting a shift in consumer preferences towards more eco-friendly options.

Market Share Breakdown:

Alternative-Fuel Vehicles: 18.2% of new vehicle sales (first half of 2024)

Hybrid Vehicles:

Market share: 9.1%

Year-over-year increase: 2.3 percentage points

Plug-in Hybrid Vehicles (PHEVs):

Market share: 2.2%

Year-over-year increase: 0.5 percentage points

Battery Electric Vehicles (BEVs):

Market share: 6.9%

Year-over-year decline: 0.2 percentage points

Sales Growth:

Hybrid Vehicles: +35.6% year-over-year

PHEVs: +35.7% year-over-year

BEVs: -0.2% year-over-year

The rise in hybrid and plug-in hybrid vehicle sales highlights a growing consumer interest in fuel-efficient and environmentally friendly options.

However, the slight decline in BEV sales indicates a need for further market adaptation and infrastructure improvements to support all-electric vehicles.

Inventory Levels and Future Sales Forecast

As the industry navigates the June sales dip, inventory levels and future sales forecasts provide a clearer picture of the market trajectory.

Inventory Status:

End of June 2024:

2.82M units

Increase from May 2024: 3.4%

Highest since November 2020: 2.88M units

Forecast:

Stable inventory throughout summer.

Potential rise to 3M units by December.

Sales Forecast for 2024:

Expected Increase: 2%-3% from 2023

Total Sales Target: 15.9M units

The inventory levels at the end of June, reaching the highest point since November 2020, suggest that the market is recovering.

NADA's forecast of a 2%- 3% increase in new light-vehicle sales for 2024 underscores the industry's resilience and adaptability to challenges.

TOGETHER WITH UPSTART

Better Financing Solutions for Independent Dealerships

In a tightening credit environment, many independent dealerships face challenges in securing affordable financing for consumers.

CARite, one of Orlando's leading independent dealers, has found success with Upstart, which has financed 39% of CARite’s deals in the last three months and helped the dealership achieve a 30% higher back-end profit on average.

"Credit has been tighter than I’ve ever seen it. With AI lending, you get competitive rates and instant approvals, reducing frustration for customers and salespeople,” said Alex Balk, CARite’s General Manager.

Click here to learn how to offer the best financing options to your customers.

BUSINESS

Two: Stallantis, Lucid, Hyundai, Toyota, Jeep, and The Globe

Giphy

Stellantis Goes Wide, Lucid Goes Far, Hyundai Finds its Sweet Spot, Toyota Goes Six Feet Under

Some major players are making moves to stay ahead. Stellantis is expanding its hybrid lineup, Lucid Motors is breaking records with EV deliveries, Hyundai is thriving in the US EV market, and Toyota is bidding farewell to the V-8 engine in its Land Cruiser. Here are some deets:

Stellantis Expands Hybrid Vehicle Line

Plans to offer 36 hybrid models in Europe by 2026.

Nine brands, including Fiat, Peugeot, Jeep, and Alfa Romeo.

European hybrid sales rose 41% in the first half of 2024.

Lucid Motors Surges with Record Q2 Deliveries

Delivered 2,394 EVs in Q2 2024, a 22% increase from Q1.

Production reached 2,110 EVs, with the Gravity SUV launching later this year.

The stock surged 9% due to improved production and price cuts.

Hyundai Finds its Sweet Spot

Hyundai's EV sales are up 15% year-over-year in Q2 2024.

IONIQ 5 and IONIQ 6 set new sales records.

The new Kona Electric highlights Hyundai's competitive pricing and efficiency.

Toyota Discontinues V-8 Engine in Land Cruiser

Ending the V-8 option for the Land Cruiser 70 Series in Australia.

4.5-liter turbodiesel V-8 ceases production by September 2024.

Land Cruiser continues with a 2.8-liter turbodiesel engine and five-speed manual gearbox.

Global Plug-In Car Sales Surge: 1.3 Million Units in May 2024

The EV market continues to grow, with global plug-in car sales hitting 1.32M units in May 2024. This surge reflects a significant shift towards electrification, with plug-in vehicles capturing a 20% market share, up from 16% the previous year.

How Many Plugs Are We Talking About?:

May 2024: 1.32M units

Market share: 20% (up from 16% in May 2023)

BEV Vs. PHEV:

All electric accounted for 66% of total plug-in registrations (approximately 860,000 units sold)

Plug-in hybrids experienced a 37% year-over-year growth. (approximately 450,000 units sold)

Region by Region:

China: Over 60% of global plug-in sales, 33% year-over-year growth

US and Canada: 18% year-over-year growth

Europe: 10% year-over-year decline

Other Markets: Significant increases in Mexico, Chile, Malaysia, Brazil, and Russia

Specific Models of Note:

Tesla Model Y: Best-selling plug-in model with 89,120 units

BYD Song: 63,371 units

BYD Qin Plus: 49,294 units

Who's Winning?

BYD: 314,760 units

Tesla: 140,683 units

BMW: 45,615 units

Jeep Owners Furious Over Corrosion Issues

Jeep JL Wrangler and JT Gladiator owners report significant corrosion on aluminum door hinges and panels. They face delays and inconsistent responses from Jeep, sparking widespread dissatisfaction.

--

Remember when Jeep commercials were king of making wild claims about their performance?

Now what? “Jeep: we fixed the rust thing”?

What a time to be alive.

Quick Hits

A NASA crew has emerged from 378 days living in a simulated Mars colony. 🚀

Temp jobs are dropping, indicating a possible slowdown in job growth. 🧑🏭

A Gladiator 2 trailer is out. Looks pretty cool. ⚔

History

1962: The three-point seat belt is patented. 🦺

1965: The Rolling Stones get their first number one single on the U.S. Billboard Charts with "I Can't Get No Satisfaction.” 🎸

1972: The Honda Civic debuts. 🚙

Thanks for reading, friend! May your expectations be clear and your efforts be blessed!