TOGETHER WITH

People can say what they want about the auto industry, but they can't say it's dull.

The used car tide is waning a bit, but that is part of the cycle. Low tide is the best time to find dope shells, so you know, win-win?

They're looking for more than shells around the industry with new contracts, plants, lithium projects, and... legal threats? (We didn't see that one coming)

Check it all out below. Stay informed, stay connected, and…

Keep Pushing Back, Friends

-Paul, Kyle, Chris & Kristi

First-time reader? Subscribe here!

Read time: 5 mins 48 secs

BUSINESS

Businesses Making Moves

Giphy/20th Century Fox

Used Car Market Downturn

Cox Automotive's Manheim Used Vehicle Value Index: Lowest since April 2021.

Wholesale Prices: Dropped 2.3% from September; 4% YOY decline.

Impacts: Decreased demand, higher borrowing rates.

Borrowing rates nearly doubled since February 2022.

Key Factor: End of UAW strike, return to market normalcy.

In October, the used car market experienced a significant downturn which fell to its lowest point since April 2021. This trend is expected to impact retail prices soon. Factors contributing to this include decreased demand and increased borrowing rates, which have nearly doubled since February 2022, exacerbating consumer affordability issues.

Notably, this marks the largest drawdown in the index's history, potentially leading to a crisis for consumers who purchased cars during the Covid peak.

Louisville Ford Workers Reject Contract

Contract Terms: Immediate 11% raises, growing to 25% over four years.

Local Vote: 55% production workers against, 69% skilled trades in favor.

Discontent: Long-time workers feel under-compensated for past concessions.

Louisville Ford workers, part of UAW Local 862, voted against a proposed contract, diverging from the national trend where about 70% of Ford workers have approved it. The impact of this vote on the national outcome remains unclear.

Hyundai's EV Production Expansion

New Factory: $1.5B EV plant in South Korea.

Capacity: 200,000 cars annually.

Sustainability Focus: Renewable energy, low carbon construction.

Global Expansion: Additional EV plants in the US and Saudi Arabia.

Market Strategy: Commitment to long-term EV market growth.

Hyundai is expanding its EV production capabilities, breaking ground on a new $1.5B EV factory in South Korea marking Hyundai's first new plant in Korea in almost 30 years. With a focus on sustainability, the factory will operate on renewable energy and employ low-carbon construction methods.

Exxon Mobil Enters Lithium Production

New Venture: Drilling operation in Arkansas for EV lithium production.

Land Acquisition: 120,000 acres in the Smackover Formation.

Production Goals: Start by 2027 and support one million EVs annually by 2030.

Strategic Shift: Focus on minerals for energy transition, addressing climate change.

Exxon Mobil is venturing into lithium production for EVs by setting up a drilling operation in Arkansas. It aims to support the manufacture of one million EVs annually by 2030.

Tesla's Cybertruck Resale Restrictions

New Clause: Prohibits resale within the first year without Tesla's consent.

Penalties: Possible lawsuit, fine of $50,000 or more.

Aim: Prevent profiteering from limited initial release.

Exceptions: Under strict conditions, including possible buyback.

Tesla is cracking down on potentially reselling its upcoming Cybertruck by implementing a new clause in its purchase agreement. Buyers are prohibited from selling their Cybertruck within the first year without Tesla's written consent, facing a possible lawsuit and a fine of $50,000 or more if they breach the terms.

TOGETHER WITH CONGRUENT

Story time w/ ASOTU and Congruent

Giphy

ASOTU email team: What do you want to tell our readers?

Congruent creative team: Don’t think about a fluffy little puppy doing that cute pounce thing they do. And definitely don’t smile about it.

ASOTU email team: Too late. Why would you want us to write that?

Congruent creative team: If we can make you do what we want and smile with only words, just imagine what we could do with pictures and videos, too.

ASOTU email team: You should consider doing this for a living.

Congruent creative team: We’ll give it a shot.

DATA & INSIGHT

Market Mechanics

Giphy/NBC

Economic Indicators:

Job Market — While job growth is slowing, the market remains historically tight. Interestingly, wage growth has been outpacing inflation since April.

Consumer Credit — There was an increase of $9.06B in September, a bounce back from the previous month's decline, driven by auto loans, student loans, and credit card debt.

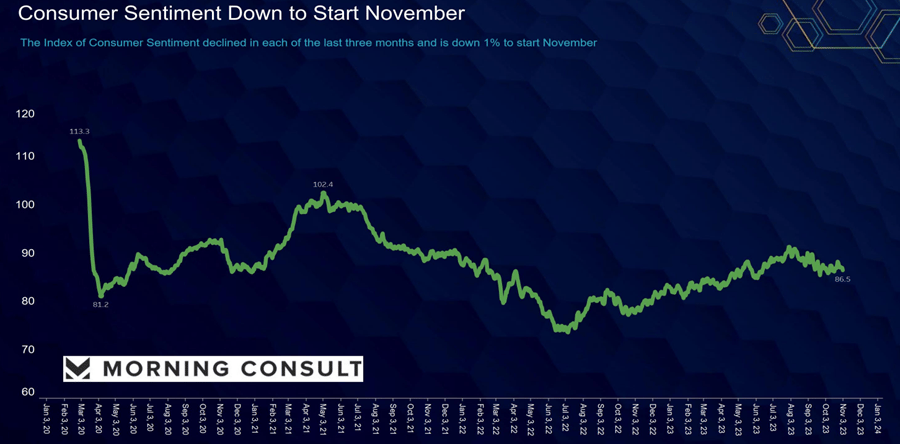

Consumer Sentiment — It's seen a recent drop, influenced by rising interest rates and gasoline prices.

Sales Trends:

New Vehicles — Sales in October increased by 1.5% year-over-year, despite a month-over-month drop of 9.6%.

Inventory:

New Vehicle Supply — Despite strikes, new vehicle inventory began November higher than early October. The US supply of unsold new vehicles climbed to 2.40M units, a 62% increase from the previous year.

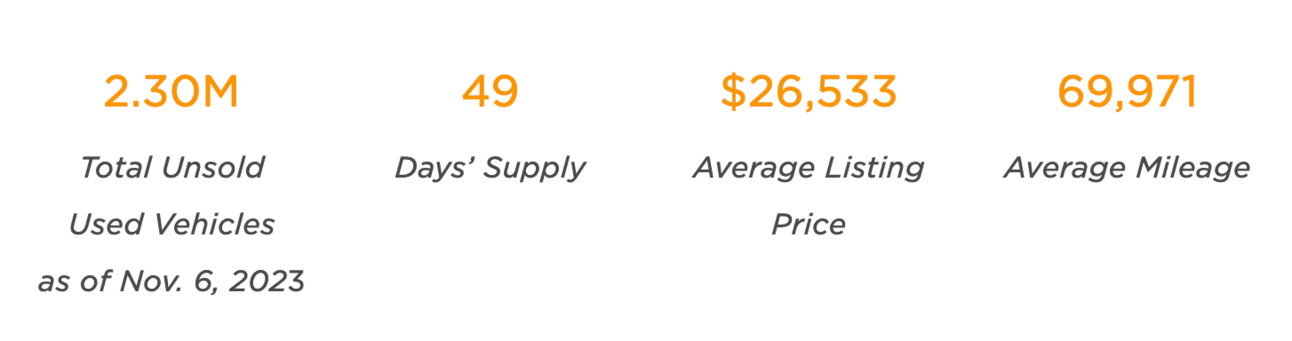

Used Vehicle Supply — Used-vehicle inventory volume at the start of November was slightly higher than in early October but days’ supply remained flat at 49.

Retail Price Trends:

Stabilization — Price changes across categories were minimal, suggesting a leveling-off period. Particularly, vans and minivans saw a decrease of $150, while SUVs and cars dropped by about $100.

Hybrid and EV Prices — These vehicles have seen a marginal decrease, and their prices appear to have bottomed out, down 17.5% from last year.

Affordability:

Balancing Act — Higher interest rates are somewhat counterbalanced by increased sales incentives from manufacturers.

Baby Steps — Auto credit availability improved slightly in October but remains tighter than in previous years.

AROUND THE ASOTU-VERSE

Coming Soon

TODAY, NOVEMBER 14

The ASOTU Wheelhouse Hosted By Daniel Govaer

This week, Daniel and his guests talk about EVs. It is a topic everybody has thoughts about, but nobody can settle on what the data means.

🎧 Listen with us 🎧

THIS WEEK!

Modern Retailing Conference 2023 in Palm Beach, FLOnce again industry leader, Brian Pasch has everybody coming together! Paul and Kyle are in the middle of things taking time to meet all the wonderful folks in attendance.

👋 Don’t hesitate to come say hi! 👋

NOVEMBER 16 @ 2:00 pm EST

ASOTU EDGE 30-Minute Webinar in partnership with Invoca

“Revolutionizing Phone Call Management: Adapting to the Digital Era”

Discover how the automotive industry is revolutionizing phone call management, personalizing marketing through call data, and enhancing customer experiences with cutting-edge tools like Invoca's AI technology. Dive in, decode, and drive success in today's digital age!

☎️ Register now ☎️

NOVEMBER 21 @ 7:00 pm EST

More Than Cars: Episode 1-3 Mashup Premiere

We're mashing up the best of More than Cars’ Episodes 1 and 2 with an exclusive glimpse into Episode 3 before it’s released — just for YOU.

👁️ See it first 👁️

FEBRUARY 1-4, 2024

NADA 2024 in Las Vegas

Lights, camera, actions! Paul and Kyle will be at NADA creating content for exhibitors. Hit us up to let us know what we should see, who we should talk to, and what we should cover while we’re there.

MAY 14-17, 2024

ASOTU CON 2024 in Baltimore

The design team is putting the finishing touches on elements and assets for the event. All participants and collaborators can expect to see the release THIS WEEK!

Podcast

Enjoying our daily email? Then, we expect you’ll dig our daily podcast, too!

The Automotive Troublemaker is a quick look at the day’s business, tech, culture, and of course, automotive news.

Quick Hits

Google’s parent company, Alphabet, dissolved its stake in the stock trading app Robinhood. 🏹

US Secretary of Energy, Jennifer Granholm, says she will clean up “clean energy.” 🧹

Disney’s “The Marvels” was released to an underwhelming box office over the weekend. It is currently the lowest-grossing MCU opening ever. 🎥